(Bloomberg) — Stocks headed toward their best week in 2024, with a handful of economic data over the past few days doing little to alter bets the Federal Reserve will cut rates in September.

Most Read from Bloomberg

Equities extended their advance into a seventh straight session, with the S&P 500 on track for its best performance in such a span since October 2022. Just a week ahead of Jerome Powell’s speech in Jackson Hole, Wyoming, traders hope the Fed Chair will set expectations for the next policy gathering. While officials have successfully brought down inflation, the labor market is still a wild card.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

“We look for Powell to signal that given recent progress, the Fed is likely to ease policy next month — without fully committing to the size of the rate cut,” according to TD Securities’ strategists. “We expect a 25 basis-point reduction.”

The stock market halted a streak of four weeks of losses that had been fueled partially by concern the Fed wouldn’t reduce borrowing costs fast enough to prevent a deeper slowdown in the world’s largest economy.

While recent data have indicated that a 25-basis point cut in September seems more probable than a bigger reduction, given the Fed’s increasing emphasis on the labor market, the next jobs report will be crucial in determining the final decision, according to Fawad Razaqzada at City Index and Forex.com.

The S&P 500 hovered near 5,550. Most megacaps gained, with Tesla Inc. leading the charge. Applied Materials Inc. sank after a sales forecast that disappointed investors looking for a bigger payoff from artificial-intelligence spending. Wall Street’s “fear gauge” – the VIX – dropped below 15.

Treasury 10-year yields fell two basis points to 3.89%. The dollar dropped. Gold hit $2,500, bolstered by hopes that the Fed is edging closer to cutting rates.

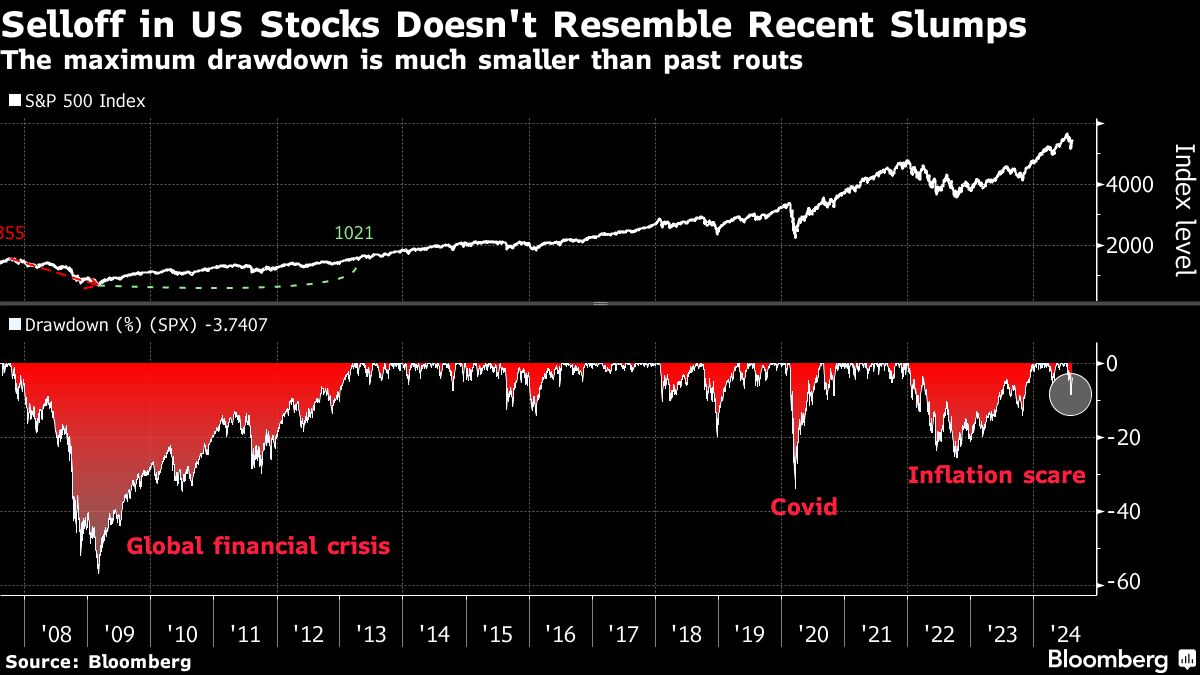

With US equities on the rebound, this summer’s selloff is looking more like a pause in the bull market than the beginning of its end.

Of course, traders have struggled to forecast where the economy is headed — and the recession fears that helped drive the recent pullback could resurface again just as quickly as they faded. On top of that, the US elections and geopolitical tensions are adding other elements of uncertainty.

But beneath the surface, there are some reassuring signals. Among them: The selloff hit a relatively small slice of the market, with nowhere near the breadth of the routs set off by the Feds rate hikes, the pandemic and other pivotal events. And while valuations are at risk of another recalibration if the economy does wind up sputtering, the S&P 500 during the recent retreat held above a threshold that — to technical analysts, at least — telegraphs investors’ continued confidence.

“The week was essentially a ‘one way’ week, harshly punishing pessimistic outlooks,” said Florian Ielpo at Lombard Odier Investment Managers. “Nonetheless, the economic data still comes with contradictions. Significant uncertainties persist, warranting caution against excessive optimism.”

Fed Chair Powell will speak next Friday at the Kansas City Fed’s Jackson Hole Economic Policy Symposium.

With the central bank on the cusp of lowering interest rates from a more than two-decade high, Powell’s comments will be closely parsed for any hints on how the Fed chief is viewing the economy in the wake of a weaker-than-expected jobs report and further easing in inflation.

“The main message in Powell’s speech will likely be that monetary policy overall has worked as intended, and the current level of rates is restrictive,” said Anna Wong at Bloomberg Economics. “He may say the balance of risk between the Fed’s mandates – employment and inflation – is about even. We expect him to signal a rate cut is coming, but not to indicate whether it will be 25 basis points or 50 bps. That will depend on the August jobs report.”

Five Big Questions for the Fed at Jackson Hole: Bill Dudley

At Bank of America Corp., Ralf Preusser says the next few weeks will likely determine whether the Fed ends up cutting by 50-75 basis points this year or more aggressively.

“We maintain a bullish bias in US rates, and would see a Jackson Hole-induced selloff as an opportunity to buy,” he noted.

Corporate Highlights:

-

Mastercard Inc. is cutting 3% of staff worldwide, according to a spokesperson for the payments network.

-

Boeing Co. Chief Executive Officer Kelly Ortberg met with union representatives during his first week on the job and said he’s “committed to reset” the relationship the company’s relationship with workers as the US planemaker heads into crucial labor negotiations next month.

-

Texas Instruments Inc. is set to receive $1.6 billion in Chips Act grants and $3 billion in loans, the Biden administration announced Friday, marking the latest major award from a program designed to boost American semiconductor manufacturing.

-

Rivian Automotive Inc. has paused production of the electric commercial van it makes for Amazon.com Inc. due to a parts shortage in the latest supply chain snafu for the EV maker.

-

Bayer AG shares jumped following a significant win for the German company in the long-running cancer litigation over its Roundup weedkiller.

-

A combination Covid-flu vaccination developed by Pfizer Inc. and BioNTech SE missed on one of its goals in a final-stage trial, a setback for the companies as they search for lucrative new uses of a technology that succeeded in the pandemic.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.3% as of 1:47 p.m. New York time

-

The Nasdaq 100 rose 0.3%

-

The Dow Jones Industrial Average rose 0.3%

-

The MSCI World Index rose 0.6%

-

Bloomberg Magnificent 7 Total Return Index rose 0.5%

-

The Russell 2000 Index rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.4%

-

The euro rose 0.4% to $1.1012

-

The British pound rose 0.6% to $1.2929

-

The Japanese yen rose 1% to 147.77 per dollar

Cryptocurrencies

-

Bitcoin rose 3.9% to $58,905.5

-

Ether rose 1.7% to $2,592.76

Bonds

-

The yield on 10-year Treasuries declined two basis points to 3.89%

-

Germany’s 10-year yield declined two basis points to 2.25%

-

Britain’s 10-year yield was little changed at 3.93%

Commodities

-

West Texas Intermediate crude fell 2% to $76.56 a barrel

-

Spot gold rose 1.6% to $2,496.34 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Viljoen and Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel