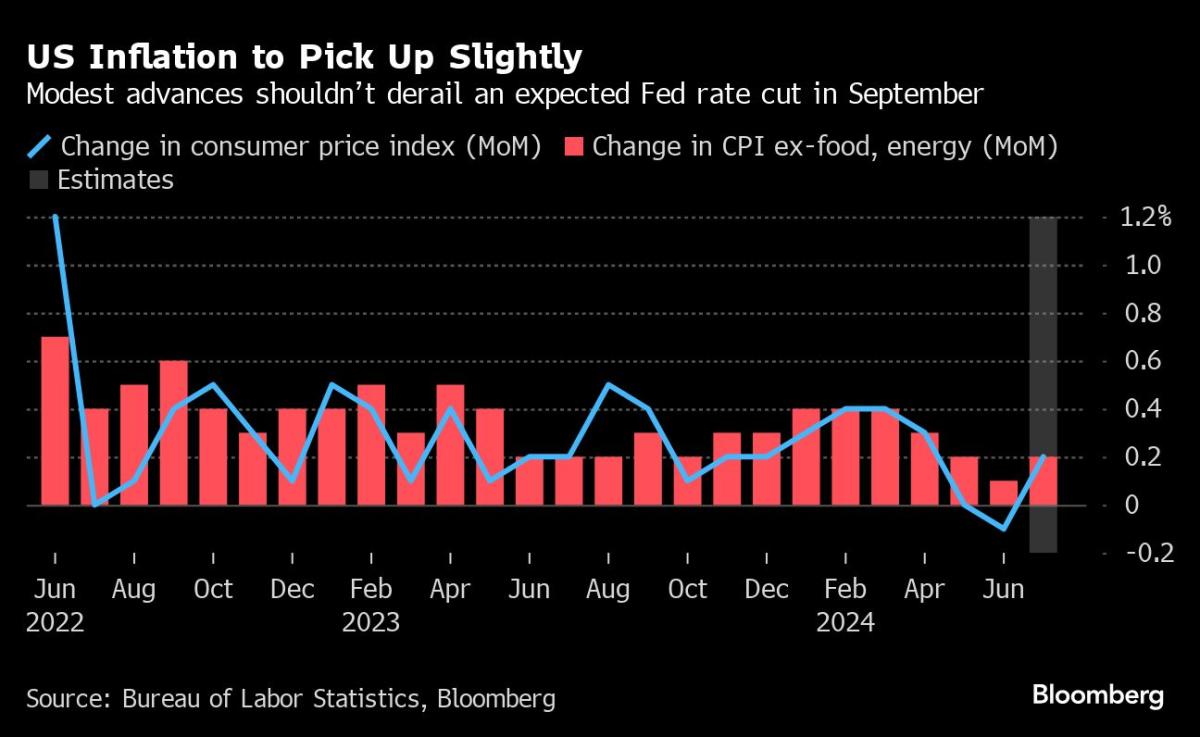

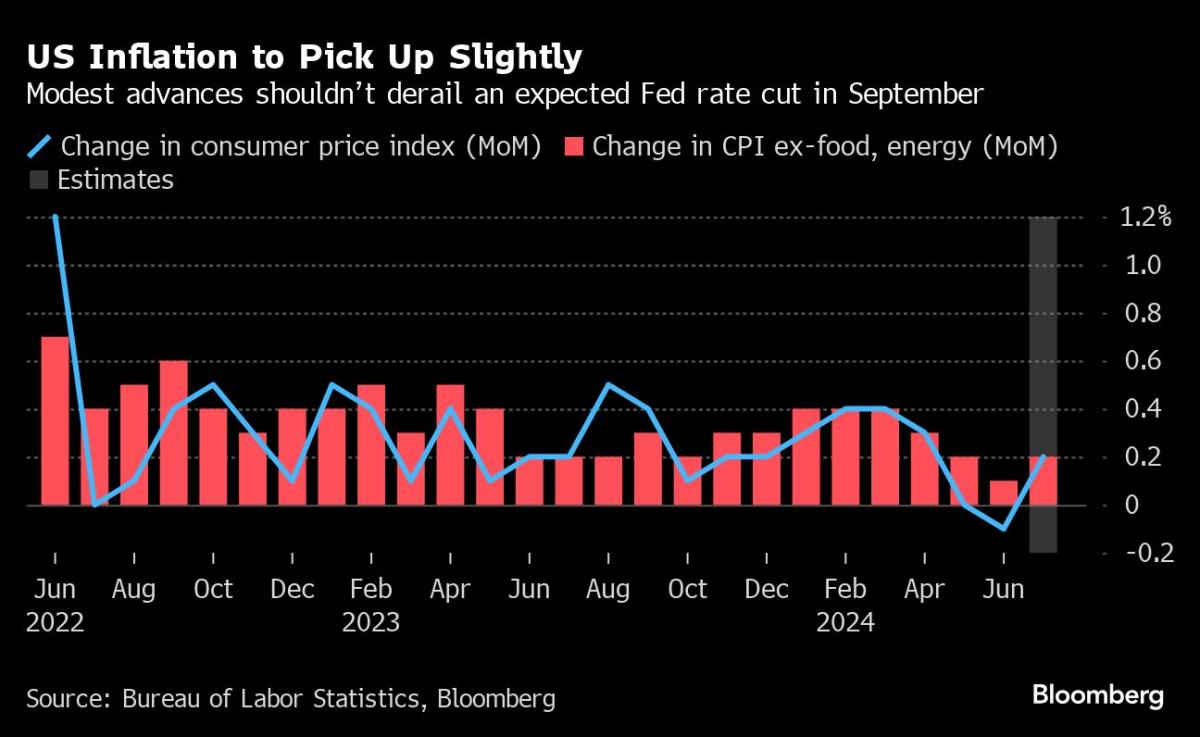

(Bloomberg) — Stocks rallied and bond yields fell after the latest US inflation reading reinforced speculation the Federal Reserve will be able to deploy its widely anticipated interest-rate cut in September.

Most Read from Bloomberg

Just 24 hours ahead of the consumer inflation report, data showed the producer price index rose less than forecast. Categories in the PPI report used to calculate the Fed’s preferred inflation measure — the personal consumption expenditures price index — were generally tame. The S&P 500 climbed 1.7%, led by gains in the world’s largest technology companies. Treasuries rose across the curve, with the move driven by shorter maturities. The dollar fell.

“Markets searching for stability got more evidence of cooling inflation,” said Chris Larkin at E*Trade from Morgan Stanley. “The lower-than-expected reading will probably be welcomed by a stock market attempting to bounce from its biggest pullback of the year.”

The easing of price pressures has bolstered confidence US officials can start lowering borrowing costs while refocusing on the labor market, which is showing greater signs of slowing. Fed Bank of Atlanta President Raphael Bostic said he’s looking for “a little more data” before supporting a reduction in rates, while reiterating he’ll likely be ready to cut “by the end of the year.”

To Ian Lyngen at BMO Capital Markets, there isn’t anything in Tuesday’s data suggesting the Fed will have any hesitation cutting rates next month.

“That said, tomorrow’s consumer inflation update is far more relevant to near-term policy expectations,” he noted.

A survey conducted by 22V Research showed 52% of investors expect the reaction to Wednesday’s consumer price index to be “risk-on.” However, the percentage of respondents expecting a “recession” has stayed elevated.

The S&P 500 saw its biggest four-day rally this year. The Nasdaq 100 climbed 2.5%. The Russell 2000 of smaller firms rose 1.6%. Nvidia Corp. led gains in megacaps. Starbucks Corp. surged by a record 25% after ousting its chief and picking Chipotle Mexican Grill Inc.’s Brian Niccol as its next leader. Wall Street’s favorite volatility gauge — the VIX — tumbled to around 18.

Treasury 10-year yields fell six basis points to 3.85%. Swap traders priced in a nearly 40 basis-point Fed cut in September and a total rate reduction of roughly 105 basis points for 2024. Oil halted a five-day surge.

“Disinflationary data is being celebrated by investors — not for its signaling of a slowing economy here in the US — but to solidify improving liquidity conditions ahead via the much anticipated rate cuts starting presumably in September,” according to Dan Wantrobski at Janney Montgomery Scott.

Interestingly enough, the disinflationary data that triggered the “great rotation” last month is not having the same effect after the latest PPI. Big tech is outperforming small caps on Tuesday as evidenced by the exchange-traded funds tracking the Nasdaq 100 (QQQ) and the Russell 2000 (IWN).

While conditions remain “oversold enough” to capitalize on a favorable CPI print on Wednesday, Wantrobski says he hasn’t seen any signals that negate or cancel the “correction cycle” which began in earnest around Aug. 1.

“Continue to expect a very bumpy ride over the short run, in our opinion,” he concluded.

The volatility in global financial markets hasn’t derailed investor optimism around US technology behemoths or expectations of a soft economic landing, according to a global survey by Bank of America Corp.

While the poll, conducted from Aug. 2 to Aug. 8 and covering the height of last week’s turmoil, showed a defensive rotation into bonds and cash and out of equities, long bets on the “Magnificent Seven” megacaps remained the most crowded trade — albeit less so after the selloff.

“Core optimism on soft landing and US large cap growth stocks is unbowed,” strategist Michael Hartnett wrote. It’s “just that investors now think the Fed needs to cut harder to guarantee no recession.”

Tech stocks had been at the forefront of the recent rout in global financial markets amid worries about high valuations at a time when the US economy has shown some signs of cooling.

At Citigroup Inc., Chris Montagu said US technology stocks remain under “significant pressure” as investor positioning continues extended on the bullish side despite the past month’s selloff.

“On any negative economic data, there will be significant pressure on these long positions,” Montagu wrote. “That, in turn, could amplify any down moves from here in the near term.”

BofA clients were net buyers of US equities for the first time in more than a month last week, snapping up shares during the rout and subsequent recovery. Institutional investors led net purchases of $5.8 billion in US stocks as hedge funds and retail investors offloaded shares, Jill Carey Hall said.

At a sector level, technology and communications services recorded the largest inflows for the week and on cumulative year-to-date basis, she said.

“Our client flows have tended to weaken in the fall months,” Carey Hall noted, adding she expects continued equity volatility heading into the US election.

Chances of a full-fledged stock market rout are low, even though poor seasonality and a murky growth outlook are likely to limit US equity gains through the rest of the quarter, according to Morgan Stanley’s Mike Wilson.

“I find it hard to believe we’re going to break out back toward the highs,” he said Tuesday in an interview with Bloomberg Television. “I also don’t think we’re going to completely break down in a way that would argue that we’re entering a new bear market.”

“While stocks seem to have stabilized, I do believe there is nervousness in the air, which is likely to lead to higher volatility and the potential for outsized reactions to data and developments,” said Kristina Hooper at Invesco.

To Chris Zaccarelli at Independent Advisor Alliance, this is a “pivotal week” for data following on the heels of the “mini-panic” in the beginning of August.

“If tomorrow’s CPI report comes in lower than expected, like this morning’s PPI report did, then the Fed truly has a green light to cut rates by 50 basis points at their next meeting if they deem it necessary to quickly get back to neutral in the face of a looming slowdown in the economy, he noted.

In the wake the market maelstrom that briefly sparked fear across Wall Street last week, financial markets are flashing a higher probability of an oncoming recession.

It still remains an outside chance. But models from Goldman Sachs Group Inc. and JPMorgan Chase & Co. show that the market-implied odds of an economic downturn has risen materially, judging by signals in the US bond market and to a lesser extent the performance of stocks that are acutely sensitive to the ebbs and flows of the business cycle.

The producer price index for final demand increased 0.1% from a month earlier. The median forecast in a Bloomberg survey of economists called for a 0.2% gain. Compared with a year ago, the PPI rose 2.2%. Excluding the volatile food and energy categories, it was unchanged in July from the prior month — the tamest reading in four months.

“The runway is clear for the Fed to cut rates in September,” said Jamie Cox at Harris Financial Group. “If data like this persists, the Fed will have plenty of room to cut rates further this year.”

At Evercore, Krishna Guha said there’s “nothing threatening” in the latest PPI data.

“The larger point here is that we are past the point at which a few basis points here or there on month-over-month inflation will have any material bearing on Fed policy and the rate outlook, which at this juncture will be driven overwhelmingly by the labor market data,” Guha said.

David Russell at TradeStation says PPI data gave gives further evidence that the tide has turned on inflation, especially in services.

“This process could continue or accelerate in coming months as weakness in China weighs on commodity prices. Jerome Powell has a lot to feel good about going into Jackson Hole,” he said.

The Fed Bank of Kansas City’s Economic Policy Symposium in Jackson Hole, Wyoming will be held Aug. 22-24.

Corporate Highlights:

-

Home Depot Inc. lowered its forecast of a key sales metric for the year on expectations that consumers will continue to hold back spending in the coming months.

-

Boeing Co.’s commercial aircraft deliveries are showing signs of stabilizing, with deliveries in July mirroring those in the same month a year earlier.

-

Paramount Global began laying off staff Tuesday after the entertainment company said last week it planned to slash 15% of its US-based workforce, amounting to roughly 2,000 positions.

-

General Motors Co. has been laying off staff in China and will soon meet with local partner SAIC to plan a larger structural overhaul of its operations there, a recognition the Detroit automaker is unlikely to see its sales return to 2017 peak levels.

-

Baxter International Inc. said it will sell its kidney-care unit to the Carlyle Group private equity firm for $3.8 billion, part of the health care company’s efforts to streamline and pay down debt.

-

Avon Products Inc., owner of the beauty brand known for its door-to-door saleswomen, filed for bankruptcy after facing a wave of lawsuits alleging talc in its products caused cancer.

-

Illumina Inc.’s plan to increase sales through easier DNA sequencing and improved data analysis failed to excite investors, with targets short of earlier growth rates.

-

Kroger Co. and Albertsons Cos. have spent more than $800 million on fees to lawyers, bankers and advisers for their proposed merger, underscoring the high costs of trying to complete the largest ever tie-up between two US grocery chains.

Key events this week:

-

Eurozone GDP, industrial production, Wednesday

-

US CPI, Wednesday

-

China home prices, retail sales, industrial production, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 1.7% as of 4 p.m. New York time

-

The Nasdaq 100 rose 2.5%

-

The Dow Jones Industrial Average rose 1%

-

The MSCI World Index rose 1.7%

-

Bloomberg Magnificent 7 Total Return Index rose 3.1%

-

The Russell 2000 Index rose 1.6%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.4%

-

The euro rose 0.6% to $1.0996

-

The British pound rose 0.8% to $1.2866

-

The Japanese yen rose 0.2% to 146.85 per dollar

Cryptocurrencies

-

Bitcoin rose 3.4% to $60,850.63

-

Ether rose 1.2% to $2,712.82

Bonds

-

The yield on 10-year Treasuries declined six basis points to 3.85%

-

Germany’s 10-year yield declined four basis points to 2.19%

-

Britain’s 10-year yield declined three basis points to 3.89%

Commodities

-

West Texas Intermediate crude fell 1.9% to $78.51 a barrel

-

Spot gold fell 0.2% to $2,467.08 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel