(Bloomberg) — US and European equity futures fell after Jerome Powell indicated the Federal Reserve was in no rush to cut interest rates.

Most Read from Bloomberg

Contracts for the Euro Stoxx 50 Index were down 0.7%, while those for the S&P 500 extended losses after the benchmark closed 0.6% lower in the US. The moves contrast gains in Asia, where MSCI’s regional index headed for its first gain this week following signs of resilience in China’s economy.

A gauge of the dollar was set to rise more than 1.4% for the week despite edging lower on Friday. The greenback has rallied in the wake of Donald Trump’s election win, and the latest boost came from Chair Powell’s comments that the Fed may take its time easing policy. More clarity on the Fed’s path could emerge later Friday as the US releases retail sales data and a host of Fed officials are set to speak.

“Admittedly the US dollar is pricing in a lot of Trump policy without timing or implementation detail, meaning it’s more about embracing a sweeping ‘narrative’,” said Richard Franulovich, head of FX strategy at Westpac Banking Corp. in Sydney. “Markets risk over-egging this story. The rise in the US dollar and US yields is creating fresh restraint, tariffs might be imposed via Congressional legislation which can have a moderating impact, and the first-order hit could fall more on profit margins than final prices.”

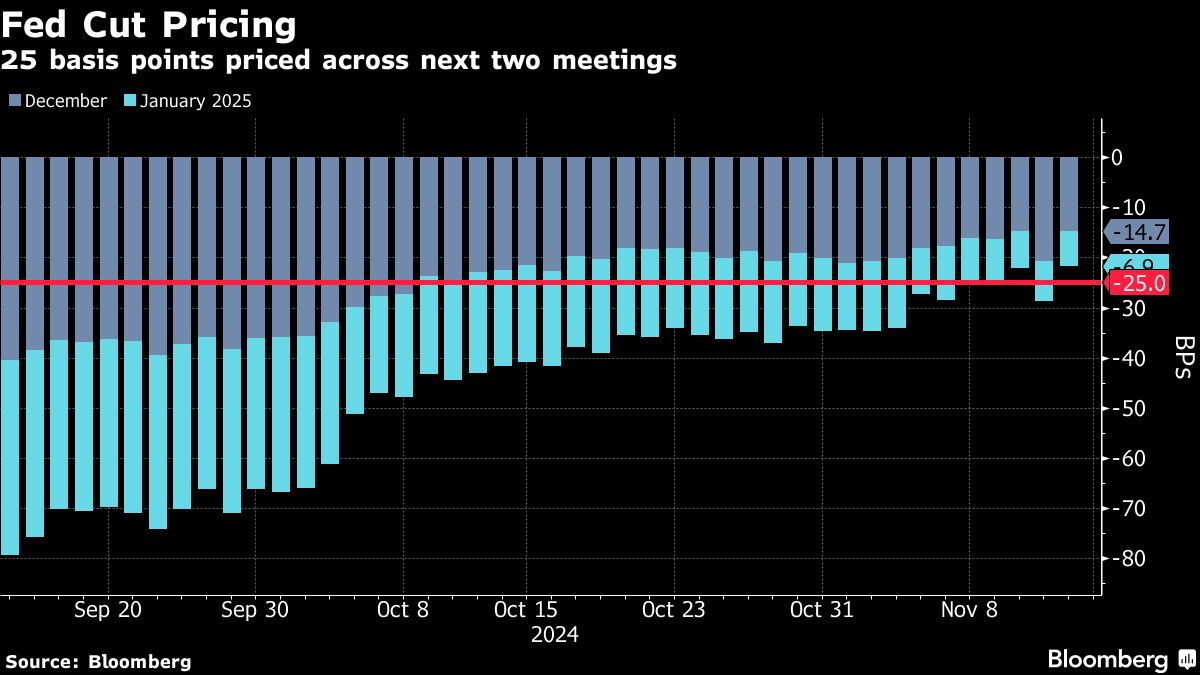

US two-year yields steadied after surging in the previous session as traders pared back their expectations for an interest-rate cut in December. The yen reversed its losses after Japan’s Finance Minister Katsunobu Kato said authorities are monitoring the forex market.

In Asia, a closely-watched monthly activity report from China showed retail sales expanded at the strongest pace in eight months and property prices fell at a slower pace. The CSI 300 Index, a benchmark for onshore shares, fell despite the upbeat data. Focus is also on Alibaba Group Holding Ltd.’s earnings later Friday after another Chinese consumption bellwether JD.com Inc posted a moderate expansion in revenue.

China’s retail sales were “pretty good,” and a result of the central bank’s stimulus policy in late September, according to Jason Chan, senior investment strategist for Bank of East Asia. ““Fiscal stimulus is on the way, probably more details would be announced in December.”

A gauge of emerging markets equities was on pace for its worst week since June 2022, while a separate index of emerging markets currencies came close to erasing its gains for the year.

In commodities, oil headed for a weekly drop, weighed down by the impact of a stronger dollar and concerns the global market will flip to a glut next year. Gold held near a two-month low.

Resilient Economy

Data released Thursday in the US showed producer prices exceeded consensus forecasts. Jobless claims were below expectations and touched the lowest level since May.

Several policymakers have urged a cautious approach to further rate cuts in comments this week, in light of a strong economy, lingering inflation concerns and broad uncertainty. Their comments come at a time when the equity market is showing signs of fatigue following a post-election surge that spurred calls for a pause, with several measures highlighting “stretched” trader optimism.

In the US, automakers like Tesla Inc. and Rivian Automotive Inc. slumped as Reuters reported Trump plans to eliminate the $7,500 consumer tax credit for electric-vehicle purchases. Walt Disney Co. jumped on a profit beat.

Key events this week:

-

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.5% as of 6:43 a.m. London time

-

S&P/ASX 200 futures rose 0.8%

-

Japan’s Topix rose 0.4%

-

Hong Kong’s Hang Seng rose 0.2%

-

The Shanghai Composite fell 1%

-

Euro Stoxx 50 futures fell 0.6%

-

Nasdaq 100 futures fell 0.7%

-

Australia’s S&P/ASX 200 rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.2% to $1.0548

-

The Japanese yen was little changed at 156.20 per dollar

-

The offshore yuan rose 0.2% to 7.2380 per dollar

-

The Australian dollar rose 0.1% to $0.6462

-

The British pound rose 0.1% to $1.2681

Cryptocurrencies

-

Bitcoin fell 0.6% to $87,710.2

-

Ether fell 2.3% to $3,048.39

Bonds

Commodities

-

West Texas Intermediate crude fell 1.2% to $67.90 a barrel

-

Spot gold fell 0.1% to $2,561.55 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu and Matthew Burgess.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel