(Bloomberg) — Stocks rose after the latest economic data showed the economy is holding up, while still leaving the door open for the Federal Reserve to cut rates a few times this year.

Most Read from Bloomberg

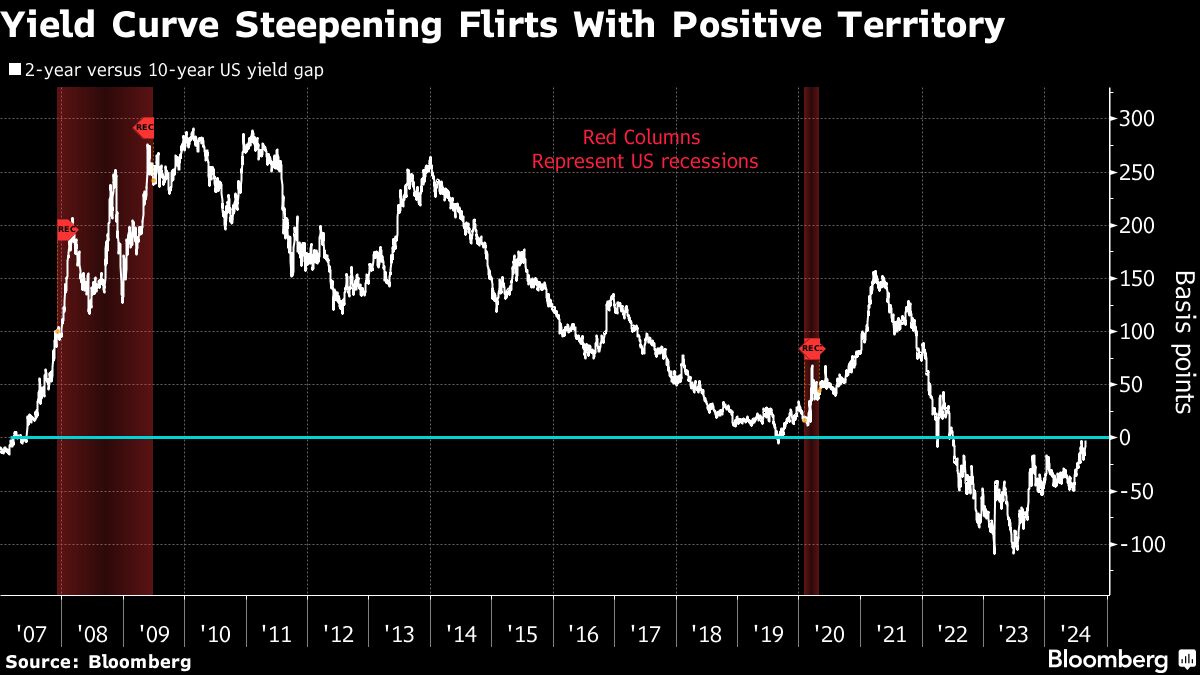

The S&P 500 trimmed this week’s losses and was on track to notch a fourth consecutive monthly advance. Treasuries barely budged, with the market poised for its longest run of monthly gains since 2021. Swap traders continued to project about 100 basis points of Fed reductions before the year is over. That implies the potential for a jumbo-sized cut, but not necessarily in September.

US consumer sentiment improved for the first time in five months as slower inflation and prospects for Fed rate cuts helped lift expectations about personal finances. The Fed’s preferred measure of underlying US inflation — the core personal consumption expenditures price index — rose at a mild pace.

“This week’s numbers dispel worries about a recession and inflation,” said David Russell at TradeStation. “Goldilocks could be here as Jerome Powell prepares to turn the page.”

Fed Chair Jerome Powell said last week the time has come for the central bank to cut its key policy rate, affirming expectations that officials will begin lowering borrowing costs next month and making clear his intention to prevent further jobs cooling.

The S&P 500 rose 0.3%, while the tech-heavy Nasdaq 100 added 0.5%. Treasury 10-year yields were little changed at 3.86%. The dollar fluctuated, while heading toward its worst month this year.

Oil fell sharply after a report that OPEC+ plans to proceed with previously announced output hikes in the fourth quarter.

To Chris Low at FHN Financial, Friday’s report was no surprise after recent “benign” inflation readings. These are “Fed-friendly numbers,” supportive of the start of policy easing next month, he noted.

“July PCE checked the box for the Fed, providing further support for a 25-basis point cut in September,” said Tim McDonough at Key Wealth. “All eyes will now be on the August jobs report as the Fed shifts its focus from inflation to the labor market.”

“No surprises from PCE,” said Chris Larkin at E*Trade from Morgan Stanley. “Inflation still looks contained, and that’s good news for the economy and for investors looking ahead to lower interest rates. The markets will now be focusing on next week’s jobs data to gauge whether the economy is cooling at an acceptable level, or risking a more significant slowdown.”

Friday’s report supports the view that it’s time to begin unwinding the restrictiveness of monetary policy. That’s despite the fact that the data also showed inflation-adjusted consumer spending accelerated from the prior month.

“Today’s PCE report, showing a mild increase in core personal consumption inflation, shouldn’t change the Fed’s ‘direction of travel,’ as Powell called it last week,” said Gary Pzegeo at CIBC Private Wealth US. “But this data does not support the case for those calling for more aggressive Fed cuts. At this point, the Fed will need to see another month of material weakness in labor data to support a super-sized cut.”

Interest-rate swaps show traders see a 20% probability the Fed lowers its key rates by a half-point at the next policy meeting in September, compared to about a 24% chance prior to the data report. For the remainder of 2024, the contracts imply a total of 97 basis points worth of easing.

Like the Fed, investors’ focus seems to be shifting from inflation to the labor market, and soon all eyes will be on Friday’s monthly jobs report, said Bret Kenwell at eToro.

“Last month’s jobs report was a big miss, causing widespread worry that the Fed was too late to cut rates,” he noted. “Another big miss could increase speculation of a 50 basis-point cut vs. the current expectation of a 25 basis-point cut.”

Weakening inflation gives the Fed plenty of room to begin cutting rates, while still resilient household spending is the recipe for a soft landing, according to David Alcaly at Lazard Asset Management.

“There’s a lot of focus right now on the pace of rate cuts in the short term, but we believe it ultimately will matter more how deep the rate cutting cycle goes over time,” he noted.

US government bonds returned 1.5% in August through Thursday, set for a fourth month of gains, according to the Bloomberg US Treasury Total Return Index. The gauge has been rallying since the end of April, extending this year’s gain to almost 3%, as investors have grown more confident in the case for lower borrowing costs.

“The markets are now awaiting next week’s job market figures, which should determine whether the Fed opens the rate cut ball with a 50 or 25 basis point cut – the difference between an emergency cut and a normalization cut,” said Florian Ielpo at Lombard Odier Investment Managers.

Stock markets are likely to benefit again from good economic data, which is needed for the rally to broaden out further beyond the tech sector, according to Barclays Plc strategists.

The team led by Emmanuel Cau says the monthly US jobs data next week will be the bellwether for confirming or refuting recession worries.

“If it is a bad print, no doubt equities would react badly given their level after the rebound,” they wrote. On the other hand, a better-than-expected figure would “help assuage those recession fears in the short run, and likely be good for equities.”

Cash funds recorded inflows of about $24.5 billion in the week through Aug. 28, a fourth straight week of additions, according to a note from Bank of America Corp., citing EPFR Global data. About $20.7 billion entered bond funds, while $13.7 billion flowed into stocks, the data showed.

US equities saw a ninth straight week of additions at $5.8 billion.

Investors pursuing widely followed 60/40 strategies should consider swapping out bonds for commodities, according to strategists at Bank of America Corp.

The strategy usually involves investing 60% of a portfolio in stocks and 40% in fixed income. But commodities may be a better bet in an environment of prolonged high inflation, the BofA strategy team including Jared Woodard and Michael Hartnett wrote in a note.

“The commodity bull market’s just starting,” the strategists said. The asset class is “a better ‘40’ than bonds in the 2020s.”

Corporate Highlights:

-

Intel Corp. is working with investment bankers to help navigate the most difficult period in its 56-year history, according to people familiar with the matter.

-

The company is discussing various scenarios, including a split of its product-design and manufacturing businesses, as well as which factory projects might potentially be scrapped, said the people, who asked not to be identified because the deliberations are private.

-

-

Dell Technologies Inc. reported better-than-expected revenue due to an increase in the sales of its servers to handle artificial intelligence workloads.

-

Lululemon Athletica Inc. lowered its sales and profit outlook for the year as increased competition and relentless inflation curb demand for its pricey yoga pants.

-

Ulta Beauty Inc. trimmed its sales forecast as more US consumers cut back on makeup and cosmetics in the face of higher prices and elevated borrowing costs.

-

Autodesk Inc. raised its full-year earnings outlook following pressure on the software maker from activist investor Starboard Value LP.

-

Alnylam Pharmaceuticals Inc. plummeted after full results from a trial its drug to treat a progressive and deadly form of heart disease disappointed investors.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.3% as of 11:16 a.m. New York time

-

The Nasdaq 100 rose 0.5%

-

The Dow Jones Industrial Average was little changed

-

The Stoxx Europe 600 rose 0.2%

-

The MSCI World Index rose 0.3%

-

Bloomberg Magnificent 7 Total Return Index rose 0.4%

-

The Russell 2000 Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.1063

-

The British pound fell 0.2% to $1.3138

-

The Japanese yen fell 0.5% to 145.74 per dollar

Cryptocurrencies

-

Bitcoin fell 1.7% to $58,495.59

-

Ether fell 3% to $2,464.14

Bonds

-

The yield on 10-year Treasuries was little changed at 3.86%

-

Germany’s 10-year yield was little changed at 2.28%

-

Britain’s 10-year yield declined one basis point to 4.00%

Commodities

-

West Texas Intermediate crude fell 2.6% to $73.90 a barrel

-

Spot gold fell 0.6% to $2,506.89 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel