(Bloomberg) — Stocks climbed and bond yields tumbled after Federal Reserve Chair Jerome Powell reinforced expectations that the central bank will slash interest rates in September — while leaving the door open for more cuts.

Most Read from Bloomberg

Almost every major groups in the S&P 500 advanced, with the gauge approaching its all-time highs. Treasuries climbed across the US curve, with the two-year yield breaking below 4%. The dollar retreated against all of its major peers.

Powell said the “time has come” for the Fed to cut rates, affirming expectations that officials will begin lowering borrowing costs next month and making clear his intention to prevent further cooling in the labor market. The Fed chief also acknowledged recent progress on inflation, which has resumed moderating in recent months after stalling earlier in the year.

The S&P 500 rose 0.6%. Treasury 10-year yields declined four basis points to 3.81%. The dollar fell 0.8%. Swap traders held steady in their pricing for the total rate cuts they foresee through the end of 2024, at about 98 basis points. Odds also remained steady for a quarter-point cut in September.

Wall Street’s Reaction to Powell:

Powell’s Jackson Hole speech delivers bullish-dovish, promising to do everything the Fed can to ensure that the labor market remains strong as it makes further progress bringing inflation back to target.

The Fed chair said the economy “continues to grow at a solid pace.” This should provide some reassurance against recession concerns.

His discussion is consistent with a base case of a string of 25bp moves. But while he did not explicitly reference the “size” of cuts, “pace” incorporates the possibility of moving faster than 25bp per meeting.

In the context of the pledge to do whatever the Fed can to maintain a strong labor market as it makes further progress on inflation, we read Powell as confirming the Fed is open to 50s if incoming data suggests this may be required to get ahead of a deteriorating balance of risks on the employment side.

With inflation seemingly under control, signs of further cooling in labor market conditions could entice the Fed to move at a “less” measured pace.

The ‘Powell pivot’ is here, as the Fed has now firmly turned dovish. He said ‘the time has come for policy to adjust’ and that was all the market wanted to hear, as cuts are now coming in September and we will likely see multiple over the coming months. What changed? Inflation was the big worry for the longest time, but that is no longer an issue, as he sees a path to 2% inflation coming. A weakening labor market is now firmly in his sights and cuts will likely help to stabilize there.

Powell has rung the bell for the start of the cutting cycle. The Federal Reserve now has strong confidence about inflation’s path forward – it is time to shift to the other side of the dual mandate, and labor market risks now have their full attention.

Powell has not pre-committed to a 50 basis-point cut – the magnitude of the September move will be determined by the August jobs report. But make no mistake, if the labor market shows signs of further cooling, the Fed will cut with conviction.

Here comes the punchbowl. Jerome Powell came out swinging today with a litany of dovish signals. He drove the point home with a clear call for adjusting policy.

This keeps a tailwind at the market’s back into year-end, making it harder to expect a retest of this month’s lows.

The market should be happy with this speech because it wasn’t hawkish in any way, gave the green light for 25 bps rate cuts, and left the door open for even larger cuts if that becomes necessary (e.g. in the event the economy or labor market softens materially).

While many are rushing to call a soft landing, we remain cautious. We have been pleasantly surprised that the economy has remained as resilient as it has and we hope for everyone’s sake that the labor market holds up and recession can be pushed off until 2025 or even later. But it is important at this time to take a balanced approach to investing and neither plan for an imminent recession, nor chase risk and get complacent just because the Fed will be lowering interest rates in less than a month.

-

Ted Rossman at Bankrate:

The main theme of Powell’s speech was that inflation continues to fade, and while fighting inflation has been the Fed’s primary objective over the past couple of years, now it’s time to put more attention on the other side of the Fed’s dual mandate – maximum employment.

Rate cuts are coming, almost certainly to begin next month, although the pace and depth of these cuts in the months and years to come remains uncertain.

The main reason behind this increased clarity is the current situation in the US job market. As long as it continues to cool, the Fed appears ready to respond with rate cuts. This is another strong statement from the Fed.

For now, reasons for the Fed to cut by 50 basis points look scarce: the rhythm of cuts at the moment look poised to be progressive as there is no feeling of emergency in the speech. Powell nonetheless mentioned how decisions were to be made before year-end, showing commitment to cut rates in 2024.

Market expectations were largely baked into the recent speech, particularly the anticipated September rate cut. While the speech did not entirely rule out the possibility of a significant rate cut, it largely met expectations, offering few surprises. This is likely to provide some stability to markets broadly, though it might not be enough to propel equities to new highs in a matter of days. For a significant rally, with the support from the Fed, a decent upcoming job report would be needed.

-

Bret Kenwell at eToro:

Fed Chair Powell delivered the one item that investors were looking for in his Jackson Hole remarks today — clarity on rate cuts.

When it comes to timing, it’s nearly impossible for the Fed to thread the needle. They will either appear to cut rates too early and risk a reflationary response or will seemingly cut too late and risk a breakdown in the labor market. This is the reality of being data-dependent.

Some investors may have hoped for clarity as it pertains to the size of rate cuts, but that was always going to be a long shot. Ultimately, Chair Powell delivered what the market was craving, which was certainty regarding the Fed’s monetary policy moving forward, opening the door to the first rate cut in more than four years.

While a September rate cut is essentially a done deal at this point, the more important question is whether this will be a one and done rate cut, or if it will be the beginning of a more substantial cutting cycle, and that will be determined by the economic data over the next two to three months. The market is pricing in multiple rate cuts over the next 12 months, although we remind investors that the market has a history of being too optimistic about rate cuts.

We have now seen more evidence than ever that a soft landing has been achieved. While there has been a slowing of economic data, that’s very different from a recession.

The stock market has staged a dramatic rebound since the August 5 low, confirming that the August selloff was a garden variety correction. September is a historically volatile month for stocks, so it’s likely that we see a return of volatility in September. For investors who missed the brief window in early August to add to their stock positions, we would be buyers on any dips throughout September.

There was little to guide us on the path of policy beyond the next meeting, although the dovish tone today suggests that our forecast of 25 bp cuts at each meeting is perhaps the least we can expect.

We continue to think that temporary factors pushed up the unemployment rate in July, which leaves scope for it to stabilize or even drop back in August, and should mean that the Fed remains comfortable with a 25 bp cut. If the unemployment rate instead rises further, then the Fed would likely respond with a 50 bp cut at the 17th-18th September policy meeting.

Missing from Powell’s speech is the word “gradual.” Unlike some of the speakers yesterday, Powell is not removing the optionality of doing large moves as policy adjusts. The balance of risks as we have argued for a while has now changed. There is a higher risk of rising unemployment than rising inflation. The risk of recession is now receding because the Fed is seeking to support labor market. The strike price on the fabled Powell Put is now rising.

Powell more dovish than anticipated. Focus on labor. Powell was clear that now is the time to lower rates, although he did not specify numbers. What he did not say was that it was time to move to 50 basis points. Again Powell was dovish, but we think markets will have trouble sustaining the gains. Equities love it. Again we are not going to get in the way of equities until September.

In other words, any aggressive rate-cutting cycle from here, rather than methodical and measured, will be because the economy and labor market deteriorates. Either way, with 100 bps of cuts priced in through year end followed by another 100 bps priced in through next August, nothing here should be a market surprise, though we see the initial stock market reaction is excitement.

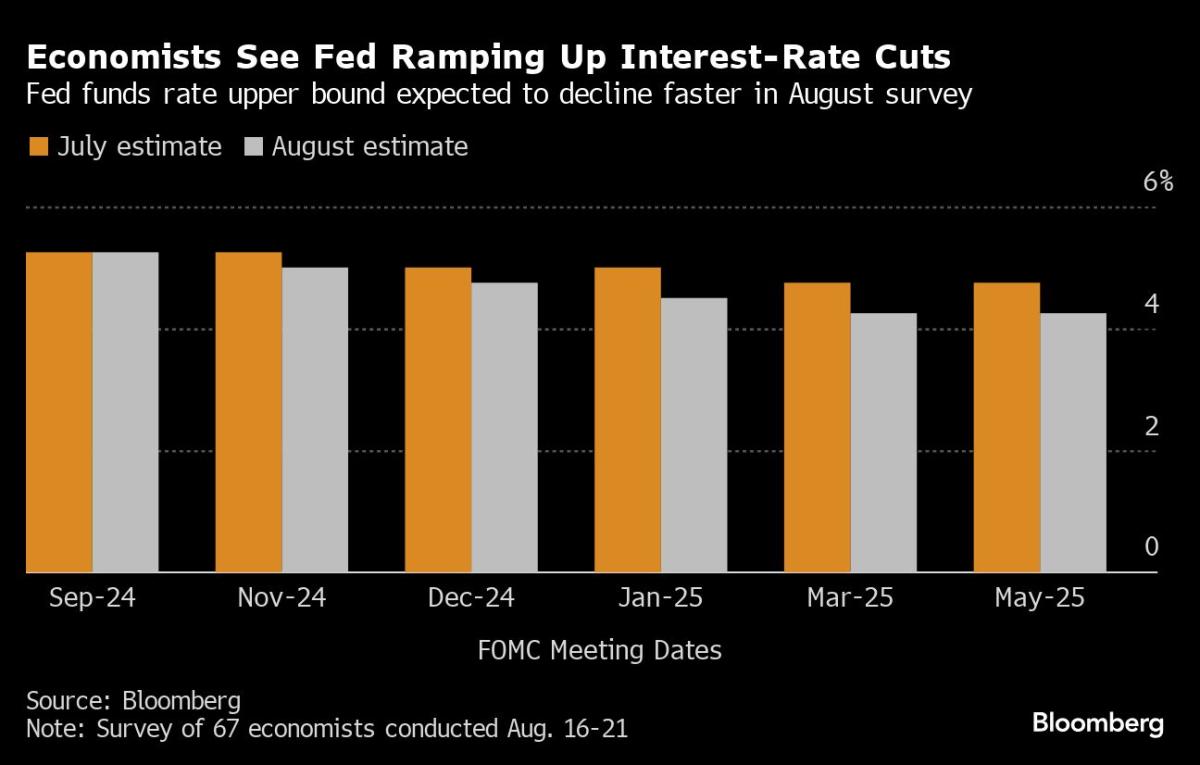

A labor market softening more so than previously thought should spur faster and steeper interest-rate cuts by the Fed, according to the latest Bloomberg monthly survey of economists.

That should leave the federal funds rate 75 basis points lower by the end of this year from its current level — the July survey only saw 50 basis points of easing — followed by a quicker pace of reductions into 2026.

While have their eyes peeled on Powell’s speech at the Jackson Hole symposium, to Morgan Stanley’s Michael Wilson, the jobs data in early September will be of even bigger importance.

“It’s about the labor data, period — that’s what’s going to dictate what the Fed does, they’ve said that,” Wilson, the bank’s chief US equity strategist, said in an interview with Bloomberg Television. “And that’s what the market is going to trade off of.”

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.6% as of 12:02 p.m. New York time

-

The Nasdaq 100 rose 0.6%

-

The Dow Jones Industrial Average rose 0.7%

-

The Stoxx Europe 600 rose 0.5%

-

The MSCI World Index rose 0.8%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.8%

-

The euro rose 0.6% to $1.1178

-

The British pound rose 0.8% to $1.3198

-

The Japanese yen rose 1% to 144.83 per dollar

Cryptocurrencies

-

Bitcoin rose 1.3% to $61,462.16

-

Ether rose 1.6% to $2,667.79

Bonds

-

The yield on 10-year Treasuries declined four basis points to 3.81%

-

Germany’s 10-year yield declined two basis points to 2.22%

-

Britain’s 10-year yield declined five basis points to 3.91%

Commodities

-

West Texas Intermediate crude rose 2.5% to $74.82 a barrel

-

Spot gold rose 1% to $2,508.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alex Nicholson, Robert Brand and Lynn Thomasson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel