(Bloomberg) — Stocks retreated Thursday and bond yields inched higher, ahead of US inflation data that could show whether the Federal Reserve will opt for a slower pace of interest-rate cuts.

Most Read from Bloomberg

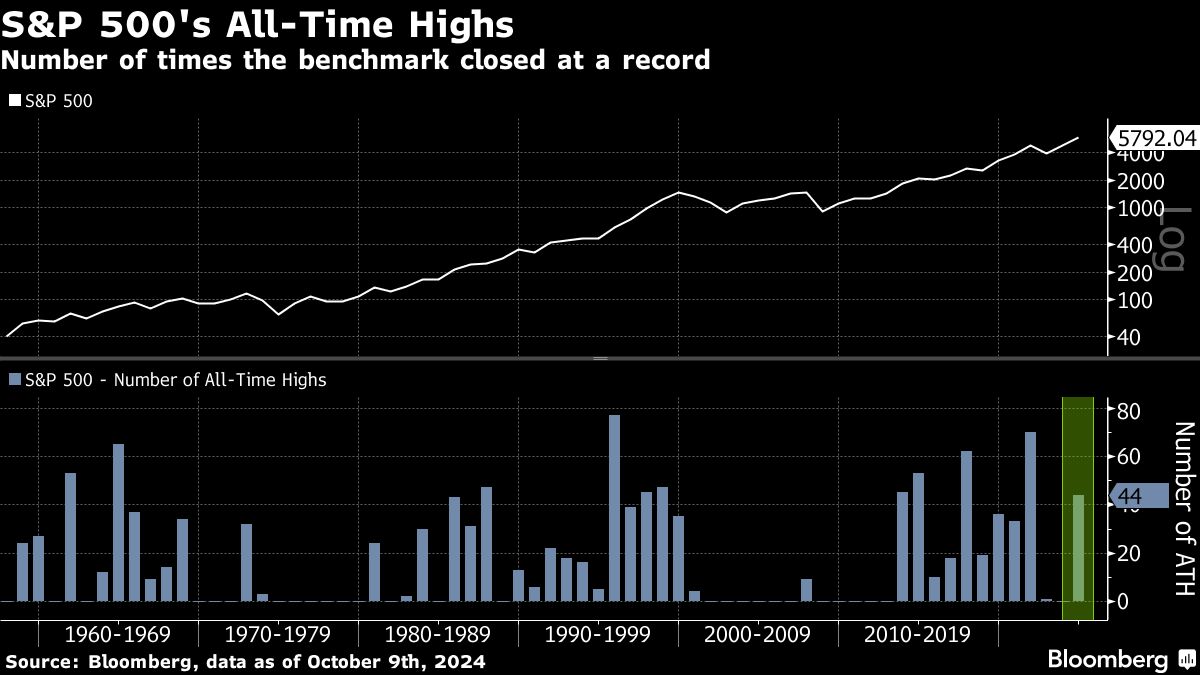

Europe’s Stoxx 600 index and S&P 500 futures slipped about 0.2%, after the main US equity gauge hit its 44th record this year. Ten-year Treasury yields held above 4%, near the highest levels since end-July, while Bloomberg’s dollar index was steady after an eight-day streak of gains, its longest since April 2022.

US consumer price data is expected to show inflation moderated further, supporting the view that the Fed will continue easing policy in the coming months. But a surprisingly strong jobs print for September has forced traders to dial back rate-cut bets, with many expecting a 25 basis points reduction next month.

A strong inflation reading could change the reaction function from the Fed, Bénédicte Lowe, a strategist at BNP Paribas Markets 360 said on Bloomberg TV.

“Given that equities are near all-time high in the US, close to multi-year high in Europe, the risks are more skewed to the downside if we get a pick-up in inflation from here,” Lowe said.

Minutes of the Fed’s September meeting showed a majority of rate-setters had supported a 50-basis-point cut, though some officials had preferred to cut at a more gradual pace.

This week also brings the start of the third-quarter earning season and investors will want to see if profits are robust enough to sustain this year’s roughly 20% rally in the S&P 500. Companies in the index are expected to report a 4.7% increase in quarterly earnings from a year ago, according to data compiled by Bloomberg Intelligence, down from the 7.9% growth projected on July 12.

Delta Air Lines Inc. will report later on Thursday, while JPMorgan Chase & Co. and Wells Fargo & Co. are scheduled for Friday.

Among individual stock movers, 10X Genomics Inc. fell as much as 24% after preliminary revenue of the biological-research equipment maker fell short of expectations. Among the biggest gainers was the supply-chain services provider GXO Logistics Inc., which rose on the news of a potential sale.

In Europe, GSK Plc gained after saying it will pay as much as $2.2 billion to resolve US court cases related to its Zantac medication. Deutsche Telekom AG rose after announcing a share buyback program.

Earlier, Chinese stocks advanced as investors awaited a Saturday press conference by the finance ministry for clues on its fiscal stimulus. Commodity markets were broadly weaker, though oil strengthened above $77 a barrel, on fear that Israeli retaliation against Iran for its recent missile strikes will trigger all-out war in the Middle East.

Key events this week:

-

US CPI, initial jobless claims, Thursday

-

Fed’s John Williams and Thomas Barkin speak, Thursday

-

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

-

US PPI, University of Michigan consumer sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.2% as of 9:45 a.m. London time

-

S&P 500 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The MSCI Asia Pacific Index rose 0.6%

-

The MSCI Emerging Markets Index rose 0.6%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0935

-

The Japanese yen rose 0.1% to 149.11 per dollar

-

The offshore yuan was little changed at 7.0910 per dollar

-

The British pound was little changed at $1.3075

Cryptocurrencies

-

Bitcoin rose 0.8% to $60,857.15

-

Ether rose 1.5% to $2,388.87

Bonds

-

The yield on 10-year Treasuries was little changed at 4.08%

-

Germany’s 10-year yield advanced two basis points to 2.27%

-

Britain’s 10-year yield advanced three basis points to 4.22%

Commodities

-

Brent crude rose 0.7% to $77.15 a barrel

-

Spot gold rose 0.3% to $2,615.76 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Abhishek Vishnoi, Masaki Kondo and Catherine Bosley.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel