(Bloomberg) — Asian stocks fell and European equity futures edged lower as investors weighed whether the artificial-intelligence rally still has room to run. Chinese property stocks jumped before a press briefing on Thursday.

Most Read from Bloomberg

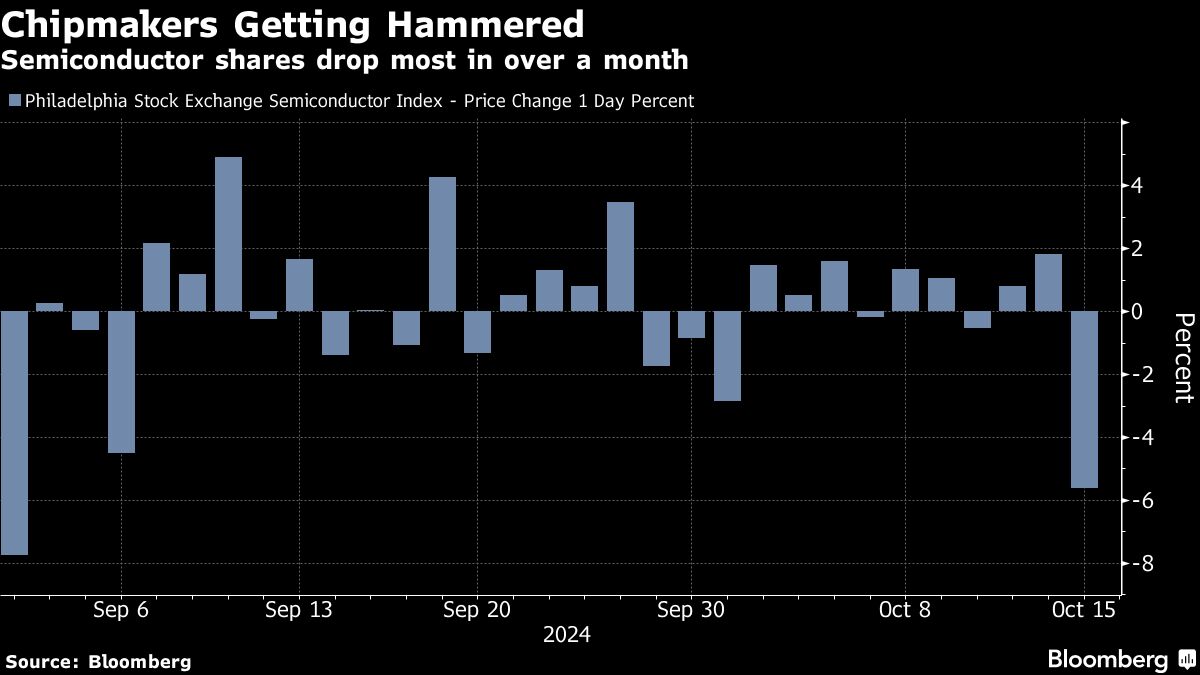

MSCI’s Asia Pacific Index fell for a third day, with chip stocks including SK Hynix Inc. and Samsung Electronics Co. slipping after key equipment supplier ASML Holding NV lowered its guidance for 2025. US stock futures and Treasuries were little changed.

A Bloomberg gauge of China’s property shares surged as much as 8.3% as markets prepared for a joint news conference to be held by government officials including the housing minister and central bank.

Chinese stocks have whipsawed since late September, when a series of stimulus measures by the central bank unleashed a burst of optimism that has begun to unravel. Many investors are still optimistic enough to see if the authorities are willing to deploy greater firepower to bolster the economy.

Any announcements “may only help property stocks for one or two days, but not the overall market,” said Kenny Wen, head of investment strategy at KGI Asia Ltd. “Only the property sector will be benefit” and investors are still waiting for several trillion yuan fiscal package, he said.

The warning from Netherlands-based ASML threw cold water on the mounting rally in chip stocks. ASML’s peers including Tokyo Electron Ltd. and top foundry Taiwan Semiconductor Manufacturing Co. fell during Asian trading hours. In the US, Nvidia Corp. lost 4.7%, signaling a slowdown for some of the biggest bellwethers of the industry.

“The tech-led retreat triggered by the slump in chipmakers not only echoes earlier skepticism over the AI-driven rally but, more broadly, the slowdown in this economy-sensitive industry certainly does not bode well for the global economic outlook,” said Hebe Chen, an analyst at IG Markets.

The pound dropped after UK inflation slipped below the Bank of England’s 2% target for the first time in 3 1/2 years, a fall that sets the stage for a second interest rate cut next month. The pound fell 0.4% after the report to $1.3021, its lowest level in over a month.

Bloomberg’s dollar index was little changed in Asia after climbing to its highest level in about two months in US trading when former President Donald Trump defended proposals to raise tariffs on foreign imports. Atlanta Fed President Raphael Bostic said he expects the US economy to slow this year but to remain robust, adding that the downward path for inflation could see some bumps.

The yen traded at around 149 per dollar after Bank of Japan Board Member Seiji Adachi emphasized the need for taking a gradual approach to raising the benchmark interest rate. New Zealand’s dollar and sovereign bond yields fell after the annual inflation rate slid in the third quarter.

Three of Southeast Asia’s biggest economies will unveil monetary policy decisions later Wednesday. Indonesia and Thailand are expected to keep rates on hold, while a cut is seen in the Philippines.

Oil Gains

Oil climbed as Israel said it would make its own decision on how to attack Iran, keeping open the possibility that energy infrastructure may be targeted. Crude has had a roller-coaster ride this month, with prices buffeted by tensions in the Middle East, as well as China’s efforts to revive growth in the largest importer.

“It looks like dealers simply have their machines tied to oil futures these days,” said Christoph Rieger, head of rates and credit research at Commerzbank AG. “Whether it makes sense to adjust your long-term inflation view on the back of this is a different question.”

In other commodities, iron ore futures advanced to just below $107 a ton in Singapore after swinging between gains and losses. Gold advanced.

Key events this week:

-

Morgan Stanley earnings, Wednesday

-

ECB rate decision, Thursday

-

US retail sales, jobless claims, industrial production, Thursday

-

Fed’s Austan Goolsbee speaks, Thursday

-

China GDP, Friday

-

US housing starts, Friday

-

Fed’s Christopher Waller, Neel Kashkari speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 7:11 a.m. London time

-

Nasdaq 100 futures rose 0.2%

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index fell 0.9%

-

The MSCI Emerging Markets Index fell 0.6%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.0881

-

The Japanese yen was little changed at 149.32 per dollar

-

The offshore yuan was little changed at 7.1303 per dollar

-

The British pound fell 0.4% to $1.3017

Cryptocurrencies

-

Bitcoin rose 1.2% to $67,249.51

-

Ether rose 1.9% to $2,619.69

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.02%

-

Germany’s 10-year yield declined five basis points to 2.22%

-

Britain’s 10-year yield declined eight basis points to 4.16%

Commodities

-

Brent crude rose 0.3% to $74.45 a barrel

-

Spot gold rose 0.3% to $2,670.85 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Kurt Schussler, Yuling Yang, Jake Lloyd-Smith and Zhu Lin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel