(Bloomberg) — Stock futures rebounded after a better-than-estimated economic report helped ease fears the Federal Reserve would need to rush to cut rates to prevent a recession.

Most Read from Bloomberg

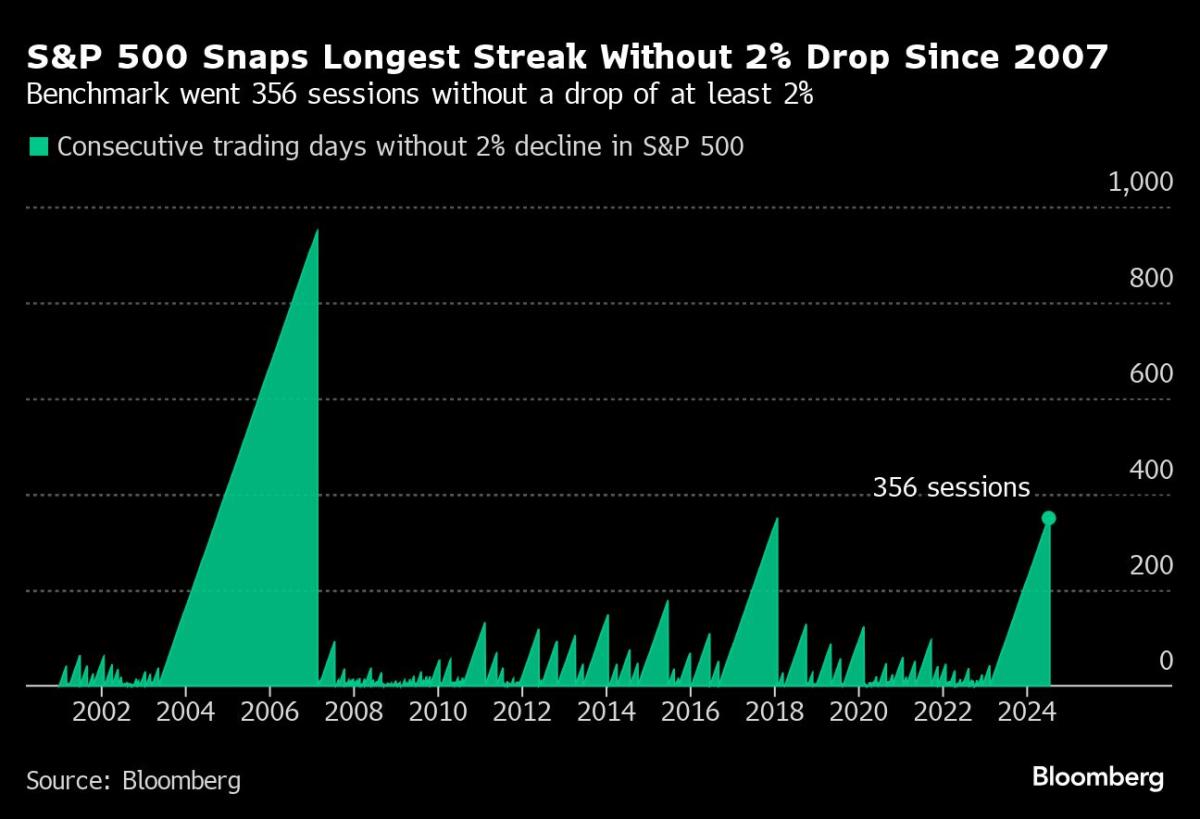

S&P 500 contracts were little changed after the US equity benchmark’s worst rout since December 2022. Treasuries trimmed an earlier rally. Gross domestic product increased at a 2.8% annualized rate after rising 1.4% in the previous period, the government’s initial estimate showed. The economy’s main growth engine — personal spending — rose 2.3%, also more than forecast.

“See you in September,” said Neil Dutta at Renaissance Macro Research. “The data today will reinforce the notion that the Fed has the benefit of time. In the Fed’s mind, there is no need to rush with private domestic demand growing at a solid pace over the second quarter. July remains a set up meeting.”

S&P 500 futures erased losses. International Business Machines Corp. climbed amid a jump in bookings for its artificial-intelligence business. American Airlines Group Inc. sank after slashing its earnings outlook for this quarter.

Treasury 10-year yields declined six basis points to 4.22%. The dollar fluctuated.

Corporate Highlights:

Royal Caribbean Cruises Ltd. became the first cruise operator to reinstate dividends as record demand put it on firmer financial footing.

Chipotle Mexican Grill Inc.’s limited-time offers and speedy service helped it beat sales expectations, and the burrito chain says efforts to ensure generous serving sizes will keep them coming back.

New York Community Bancorp’s Flagstar Bank unit agreed to sell its residential mortgage-servicing business to Mr. Cooper Group Inc. for about $1.4 billion.

AbbVie Inc. lifted its 2024 profit projection as its top-selling anti-inflammatory drugs made up for the gradual decline of Humira, the blockbuster autoimmune treatment that has defined the company for more than a decade.

Universal Music Group NV tumbled after its subscription and streaming revenue growth disappointed investors.

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 8:51 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 fell 1.2%

The MSCI World Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0846

The British pound fell 0.3% to $1.2865

The Japanese yen rose 0.3% to 153.39 per dollar

Cryptocurrencies

Bitcoin fell 3.1% to $64,004.84

Ether fell 6.8% to $3,147.48

Bonds

The yield on 10-year Treasuries declined six basis points to 4.23%

Germany’s 10-year yield declined three basis points to 2.41%

Britain’s 10-year yield declined four basis points to 4.12%

Commodities

West Texas Intermediate crude fell 1.4% to $76.49 a barrel

Spot gold fell 1.2% to $2,368.84 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel