(Bloomberg) — Stocks lost traction following a furious post-election rally that spurred calls for a pause amid signs of buyer fatigue.

Most Read from Bloomberg

Equities fell from near all-time highs, with the S&P 500 pushing away from technically overbought levels. That’s after a surge that drove the benchmark gauge up 25% this year. Several measures highlight “stretched” trader optimism, including the latest figures from the American Association of Individual Investors, which showed a spike in bullish sentiment.

“The stock market is showing signs that it’s getting ‘tired’,” said Matt Maley at Miller Tabak + Co. “It wouldn’t surprise us at all if it saw a bit of a pullback over the very short-term or at least a further breather.”

In the run-up to Jerome Powell’s speech on Thursday, traders waded through economic data. US producer prices picked up, fueled in part by gains in portfolio management and other categories that feed into the Federal Reserve’s preferred inflation gauge. Applications for unemployment benefits fell to the lowest level since May.

“The question we have is whether Powell’s dovishness will reset the tone for higher long rates. On that question alone, we say ‘no for now’,” noted Andrew Brenner at NatAlliance Securities. “But he will continue to support Fed easing in the near term, and even that will have a limited effect.”

The S&P 500 dropped 0.3% to around 5,970. The Nasdaq 100 slipped 0.3%. The Dow Jones Industrial Average lost 0.2%. Automakers like Tesla Inc. and Rivian Automotive Inc. slumped as Reuters reported President-elect Donald Trump plans to eliminate the $7,500 consumer tax credit for electric-vehicle purchases. Walt Disney Co. jumped on a profit beat.

Treasury 10-year yields slid three basis points to 4.42%. The Bloomberg Dollar Spot Index wavered.

Equities lost steam after a strong post-election rally that reflected optimism that Trump’s agenda would support corporate growth.

To Jose Torres at Interactive Brokers, while the stock rally has been ferocious, investors see few reasons to sell before the shift in Washington control, which is widely viewed as positive for risk assets and the economy.

Investors seem reluctant to sell just yet, but caution is warranted, according to Fawad Razaqzada at City Index and Forex.com. The S&P 500 is clearly overbought by several metrics, signaling that a correction or consolidation may be due, he noted.

“Although a full-fledged selloff appears unlikely without the index first breaking multiple support levels, current conditions suggest a modest pullback may be in order for the S&P 500,” Razaqzada added. “For seasoned traders, a short-term pullback could offer buying opportunities, though a clear trend reversal signal has yet to emerge.”

The S&P 500 may reach 6,100 before year-end amid enthusiasm over the Republican sweep of the White House and Congress, but pushing beyond that level may be challenging in the near term, according to Mike Wilson at Morgan Stanley.

The market may be pressured by any backup in benchmark borrowing rates, or expectations of less aggressive monetary easing by the Fed, Wilson said in an interview to Bloomberg Television, adding that pullbacks will probably be seen as buying opportunities.

The US equity benchmark is likely to grind higher into year-end — with a market melt-up possible, but not a base case, according to UBS Group AG strategists including Maxwell Grinacoff.

With Commodity Trading Advisor funds already positioned max long, marginal upside from option dealer short gamma positioning and the Trump re-election well priced, a market grind higher is a more likely scenario, they noted.

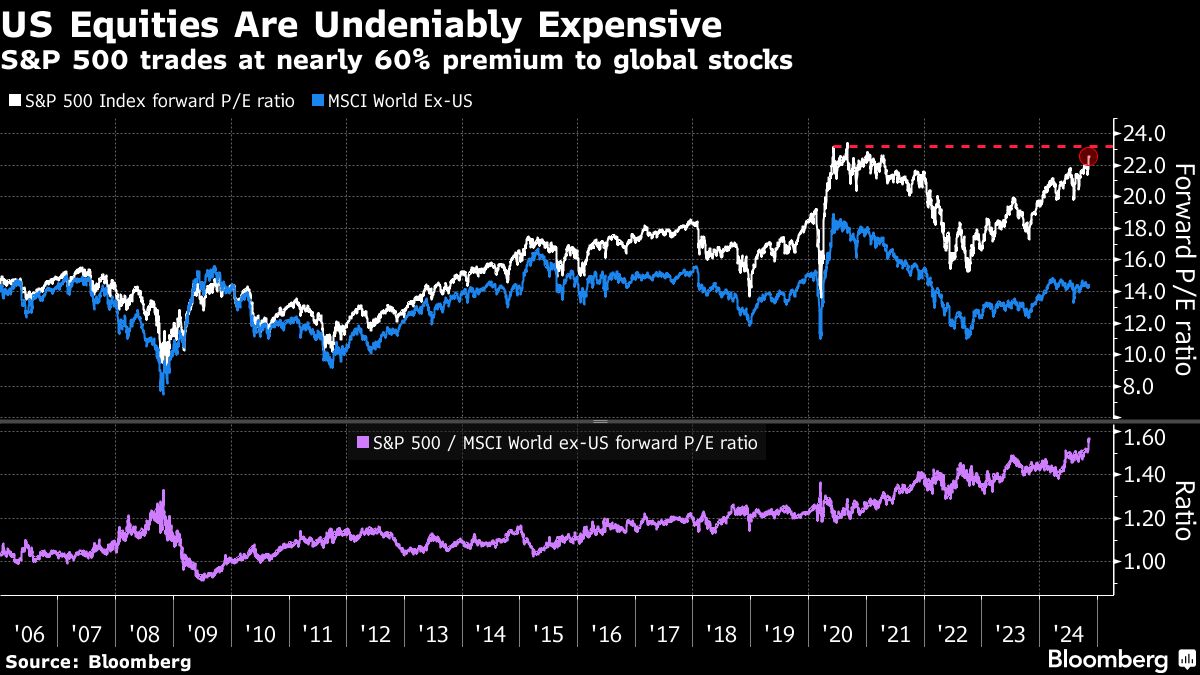

Societe Generale SA strategists including Andrew Lapthorne see US equities as “undeniably expensive” but say valuation conversations “are increasingly rare.” The US represents about 74% of the MSCI World market cap, also a record high. “This is almost entirely down to the valuation premium, without which the US would be closer to 50% of MSCI World.”

While the stock market has mostly ignored the recent move higher in bond yields as economic growth holds up, it’s still something worth keeping an eye on.

Higher odds of a December Fed cut increase the chances that an already firm economy will strengthen further, according to Dennis DeBusschere at 22V Research. Economic data needs to stay consistent with growth of around 2.5% (or lower) for 10-year yields to stay where they are, he added.

“Our call is 10-year yields remain around current levels, but growth above 2.5% will lead to higher yields and a potential break above 4.55%,” DeBusschere noted. “That level of yield would be a headwind for small caps, debt risk names, and other riskier factors as it happens.”

In fact, while Trump’s victory in the US election propelled the Russell 2000 of smaller firms back toward levels last seen three years ago, an overhang from interest rates remain a hurdle.

Morgan Stanley’s Wilson this week said a key risk for small caps present now that was not in 2016 is the market’s negative correlation to rates, while it was positive eight years ago when Trump first captured the White House. The Russell 2000 rose 60% during Trump’s first term, though still trailing the S&P 500 and the Nasdaq 100 indexes.

“In other words, in today’s later-cycle environment, these cohorts’ adverse sensitivity to rising rates is greater than it was in that period,” he warned clients in a note. “Should rates see more upside post the election, these cohorts could be held back from a relative performance standpoint.”

The potential for renewed inflation is being considered, though even hotter US data is unlikely to derail the risk-on mood since there’s another inflation print in December ahead of the next Fed meeting, according to JPMorgan Chase & Co.’s Andrew Tyler.

Several policymakers have urged a cautious approach to further interest-rate cuts in comments this week, in light of a strong economy, lingering inflation concerns and broad uncertainty.

Fed Bank of Richmond President Tom Barkin said the central bank has made “great progress,” but emphasized officials can’t declare victory. Fed Governor Adriana Kugler said policymakers must keep their focus on both the central bank’s inflation and employment goals.

Corporate Highlights:

-

Hims & Hers Health Inc. sank after Amazon.com Inc. said it would start marketing drugs to fight hair loss, an important component of the telehealth company’s business.

-

Meta Platforms Inc. was hit with a €798 million ($841 million) fine by European Union regulators by tying its Facebook Marketplace service to its sprawling social network, the US tech giant’s first ever penalty for EU antitrust violations.

-

ASML Holding NV, the Dutch maker of advanced chip-making machines that are critical to global supply chains, reaffirmed its long-term revenue outlook as it bets on an artificial intelligence-driven boom in semiconductor demand.

-

Ford Motor Co. agreed to a $165 million civil penalty to settle allegations the company failed to recall cars with defective rearview cameras in a timely manner, the second largest fine ever levied by the National Highway Traffic Safety Administration.

-

Merck & Co. licensed an experimental cancer antibody from a closely held Chinese company in a deal worth $588 million upfront, plus as much as $2.7 billion in milestone payments.

-

General Mills Inc., known for cereal brands such as Cheerios, made its fifth acquisition in the pet food sector since 2018 by buying the North American unit of Whitebridge Pet Brands in a deal valued at $1.45 billion.

-

Capri Holdings Ltd and Tapestry Inc. scrapped their $8.5 billion plan to merge after a court order froze the proposed combination of the US fashion companies due to antitrust regulators’ objections.

-

JD.com Inc.’s quarterly revenue rose 5.1%, a moderate expansion that suggests Chinese consumers are only cautiously spending again as Beijing tries to revitalize the economy.

Key events this week:

-

China retail sales, industrial production, Friday

-

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.3% as of 2:32 p.m. New York time

-

The Nasdaq 100 fell 0.3%

-

The Dow Jones Industrial Average fell 0.2%

-

The MSCI World Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.0550

-

The British pound fell 0.1% to $1.2689

-

The Japanese yen fell 0.3% to 155.92 per dollar

Cryptocurrencies

-

Bitcoin rose 1% to $89,526.85

-

Ether fell 0.5% to $3,140.33

Bonds

-

The yield on 10-year Treasuries declined three basis points to 4.42%

-

Germany’s 10-year yield declined five basis points to 2.34%

-

Britain’s 10-year yield declined four basis points to 4.48%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel