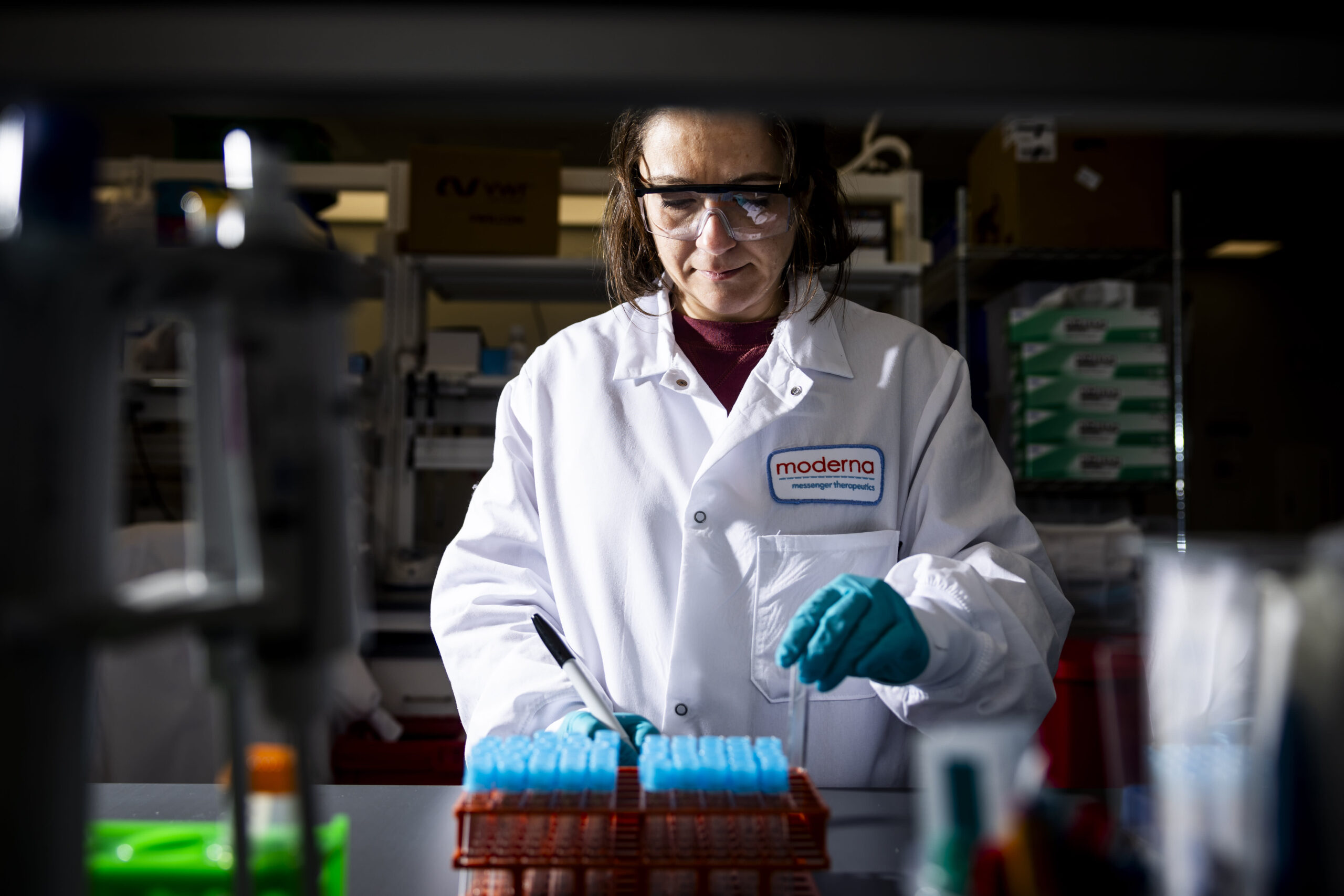

Check out the companies making headlines before the bell: Alaska Air Group — Shares gained 5% after Alaska Air Group raised its third-quarter outlook, citing strong summer demand. The airline guided for per-share earnings in the range of $2.15 and $2.25, greater than prior guidance of $1.40 to $1.60 earnings per share. Moderna — Shares shed more than 6% after the drugmaker announced plans to slash expenses by $1.1 billion by 2027. Moderna also said it anticipates the launch of 10 new products through 2027. Oxford Industries — Shares dropped 10% after the clothing company behind Tommy Bahama posted second-quarter figures that missed expectations. Oxford Industries posted adjusted earnings of $2.77 per share, lower than the FactSet consensus estimate of $3 earnings per share. Revenue of $419.9 million came in below the $438.2 million forecast. Interpublic Group of Companies — The advertising stock slid 2% on the heels of a UBS downgrade to sell from neutral. UBS said investors are not fully pricing in the potential that IPG is losing clients for structural reasons, or that the current strategic initiatives might not fix the company’s issues in a timely manner. U.S. Bancorp — The bank stock rose more than 1% after announcing a dividend hike. U.S. Bancorp also announced a $5 billion stock buyback plan. Kroger — Shares of the supermarket chain were slightly higher ahead Kroger’s fiscal second quarter results this morning. Diageo — Shares popped 1.4% after Bank of America upgraded the alcohol beverage company to buy from neutral, saying the “worst is behind” it. — CNBC’s Alex Harring, Hakyung Kim, Jesse Pound and Samantha Subin contributed reporting

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel