(Bloomberg) — Stocks rebounded on Friday as traders awaited key US inflation data for clues on the timing of interest-rate cuts amid fears of a sharper-than-expected economic slowdown.

Most Read from Bloomberg

Futures on the S&P 500 added 0.7% while those on the Nasdaq 100 were up more than 1%. Europe’s Stoxx 600 benchmark rose 0.5%, while Treasuries and the dollar were little changed.

Stocks are clawing back losses after the exodus from technology giants morphed into a broader risk-off retreat this week. Traders are now awaiting monthly PCE statistics, the last big data point before next week’s Federal Reserve meeting.

In European corporate reports, Mercedes-Benz Group AG’s earnings plummeted 19% in the second quarter as sales of its passenger electric vehicles dropped sharply and demand in China weakened. Meanwhile, Eni SpA increased its full-year profit guidance.

In US markets, the velocity of the tech correction has rattled traders. It took about 20 trading days in 2023 to produce an 8% drop in the Nasdaq index compared with just 10 this time round.

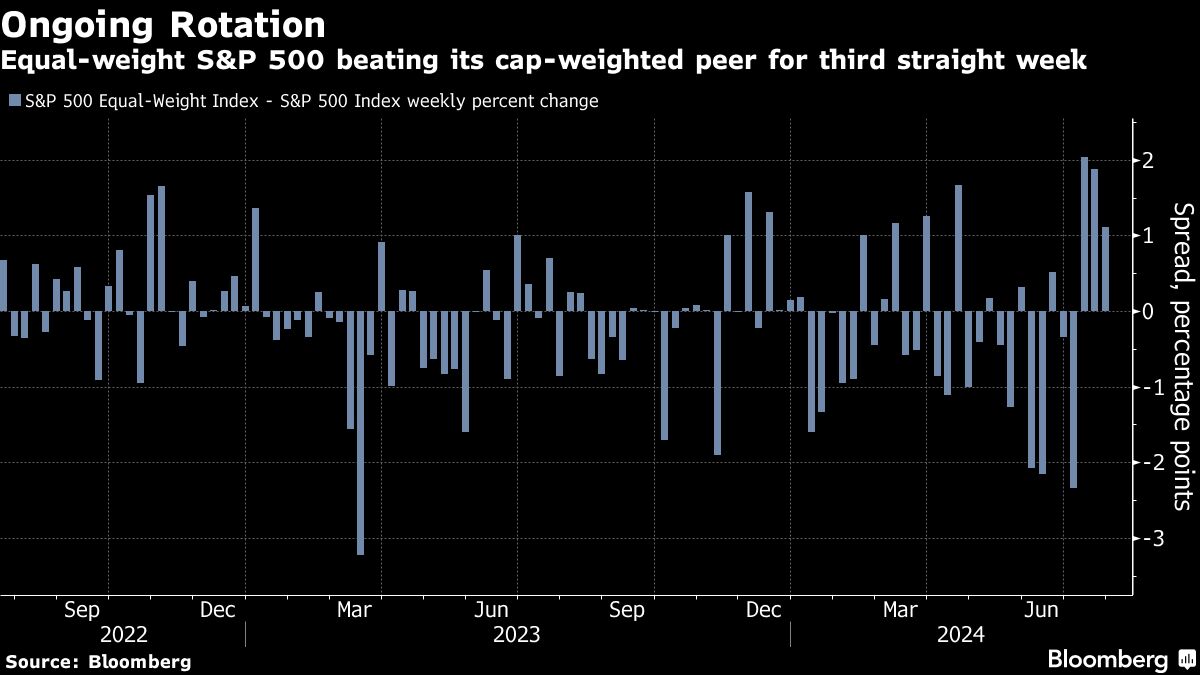

Small caps, meanwhile, have outperformed in a further sign investors are preparing for rate cuts that will support the broader economy.

PCE Gauge

Friday’s data are expected to show spending and income both grew at a solid clip, even as core PCE inflation — the Federal Reserve’s preferred price gauge — slowed to near its 2% target on a three-month annualized basis, Bloomberg Economics predict.

A soft landing for the US economy could slip away if noisy data delay a rate cut beyond September, according to Bloomberg Opinion columnist Mohamed A. El-Erian.

“We certainly think there is a danger that the Fed is reacting slowly,” given the low US savings rate, said Nick Rees, a foreign-exchange analyst at Monex Europe.

Still, “we doubt today’s data will change many minds on the FOMC. We don’t think the Fed has seen enough yet to cut rates next week,” he said.

Corporate Highlights:

-

Apple Inc. lost ground in China’s smartphone market in the June quarter after local companies like Huawei Technologies Co. surged ahead. IPhone shipments there slid 3.1% during the period, compared with an 11% year-on-year rise among Android-powered competitors, according to market tracker IDC.

-

Amundi SA posted second-quarter inflows that surpassed analysts’ estimates and helped lift its assets under management to €2.16 trillion ($2.3 trillion), a record high.

-

Mercedes-Benz Group AG’s earnings plummeted 19% in the second quarter as sales of its passenger electric vehicles dropped sharply and demand in China weakened.

-

Eni SpA’s second-quarter profit was better than expected after a strong performance at its upstream business, prompting the company to revise up its guidance for the year.

-

BASF SE’s earnings declined slightly in the second quarter after prices fell across its chemicals business.

-

NatWest Group Plc boosted its forecast for full-year revenue after net interest income dropped less than analysts expected in the second quarter, a sign that the lending giant is still reaping some benefits from stubbornly high interest rates.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.7% as of 6:11 a.m. New York time

-

Nasdaq 100 futures rose 1%

-

Futures on the Dow Jones Industrial Average rose 0.5%

-

The Stoxx Europe 600 rose 0.4%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0852

-

The British pound rose 0.1% to $1.2864

-

The Japanese yen fell 0.2% to 154.29 per dollar

Cryptocurrencies

-

Bitcoin rose 3.1% to $67,268.13

-

Ether rose 3% to $3,247.68

Bonds

-

The yield on 10-year Treasuries was little changed at 4.24%

-

Germany’s 10-year yield advanced two basis points to 2.44%

-

Britain’s 10-year yield was little changed at 4.13%

Commodities

-

West Texas Intermediate crude fell 0.5% to $77.87 a barrel

-

Spot gold rose 0.4% to $2,373.52 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Cheng, Zhu Lin, Winnie Zhu, Richard Henderson and Chiranjivi Chakraborty.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel