(Bloomberg) — A semblance of calm returned to markets as investors looked for bargains after Monday’s dramatic selloff that capped a three-week, $6.4 trillion retreat twin equities globally. Bonds fell.

Most Read from Bloomberg

Futures on the S&P 500 signaled a rebound may be in store after the benchmark sank to the brink of a technical correction on Monday. Nasdaq 100 contracts gained more than 1%. Europe’s Stoxx 600 index rose 0.7% after yesterday’s slump to a five-month low.

Japan’s two key share gauges both jumped more than 9% at the close, after tumbling 12% the day before, while a regional gauge halted a three-day decline.

Traders are catching their breath following a day in which almost every risk asset was sold amid growing concern about a US recession, extreme valuations in the technology sector, and a surging yen that sparked an unwind of carry trades. Concerns of an abrupt downturn were somewhat allayed by numbers Monday showing the US services sector expanded in July, after the worst contraction in four years a month earlier.

“Some normalcy has started to return to the markets,” said Mohit Kumar, chief economist for Europe at Jefferies International Ltd. “We do not think that the US economy or Europe is headed for a hard landing. The violent market moves over the last few sessions, in our view, present a buying opportunity.”

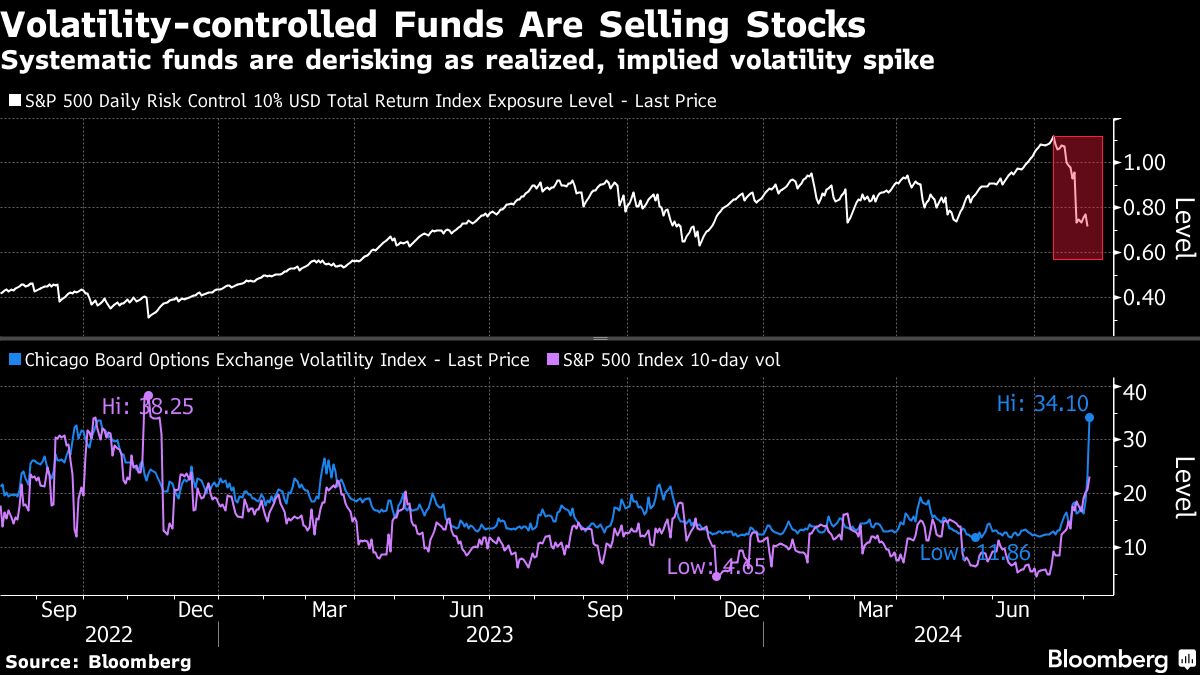

The respite may be temporary, however, depending on the next signals from the US economy and the Federal Reserve’s response. Wall Street’s “fear gauge,” the VIX index, remains at the highest level since 2020 after spiking the most on record yesterday. Traders are rushing to insure their portfolios against an extreme market crash, in an echo of the chaotic period at the start of the pandemic.

“We have cut equity risk overall, seeking a net asset value-stabilizing balance of risk and safety assets until the soft- versus-hard landing verdict is in,” said Michael Kelly, global head of multi-asset at PineBridge Investments. “If we morph into the ‘R’ word, there’s more to go,” he added, referring to a potential recession in the US.

Meanwhile, JPMorgan Chase & Co. warned the recent unwinding in the carry trade has more room to run as the yen remains one of the most undervalued currencies.

“We are not done by any stretch,” Arindam Sandilya, co-head of global FX strategy, said on Bloomberg TV. “The carry trade unwind, at least within the speculative investing community, is somewhere between 50%-60% complete.”

Treasuries Retreat

Treasury yields rose across the curve, with the benchmark 10-year yield climbing five basis points to 3.84%. The yield had fallen as low as 3.67% Monday before being pushed back up by the stronger-than-expected US ISM services report.

“The hotter-than-expected ISM services report slowed the bleeding on Wall Street,” said Matt Simpson, a senior market strategist at City Index Inc. “So we’re not seeing a risk on rally as such, but a healthy correction after an unhealthy selloff, triggered by investors stampeding for a tiny exit.”

Federal Reserve Bank of San Francisco President Mary Daly said the labor market is softening and indicated the US central bank should begin cutting interest rates in coming quarters, but stopped short of concluding the jobs market has begun seriously weakening. The swaps market is pricing in a near 50-basis-point Fed rate cut in September.

Back in Asia, the yen fell as much as 1.5% Tuesday, before paring some of its losses. The currency has still gained about 11% this quarter on expectations of further rates hikes by the Bank of Japan.

The Nikkei 225 futures circuit breaker was triggered before the market opened as Monday’s savage selloff was deemed overdone. A surge in Kospi 200 and Kosdaq 150 futures activated another “sidecar” in South Korea on Tuesday morning, briefly halting buy orders for program trading.

Japan’s auction of 10-year sovereign notes on Tuesday met the weakest investor demand since 2003 by one measure, as expectations of more rate hikes deterred investors. Traders sold the benchmark bond in the secondary market, unwinding a haven trade during the selloff earlier.

In commodities, oil rose from a seven-month low as the halting of production from Libya’s biggest field refocused attention on the Middle East. Bitcoin inched back to briefly top $56,000 after a bout of risk aversion in global markets inflicted steep losses on most major cryptocurrencies.

Key events this week:

-

Eurozone retail sales, Tuesday

-

China trade, forex reserves, Wednesday

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.7% as of 8:02 a.m. London time

-

S&P 500 futures rose 1%

-

Nasdaq 100 futures rose 1.3%

-

Futures on the Dow Jones Industrial Average rose 0.5%

-

The MSCI Asia Pacific Index rose 3.2%

-

The MSCI Emerging Markets Index rose 1.5%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.2% to $1.0935

-

The Japanese yen fell 1.1% to 145.76 per dollar

-

The offshore yuan was little changed at 7.1431 per dollar

-

The British pound fell 0.3% to $1.2740

Cryptocurrencies

-

Bitcoin rose 2.5% to $55,763.01

-

Ether rose 2.9% to $2,509.03

Bonds

-

The yield on 10-year Treasuries advanced seven basis points to 3.86%

-

Germany’s 10-year yield advanced one basis point to 2.20%

-

Britain’s 10-year yield advanced three basis points to 3.89%

Commodities

-

Brent crude rose 0.9% to $77 a barrel

-

Spot gold fell 0.3% to $2,404.27 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Jason Scott and Abhishek Vishnoi.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel