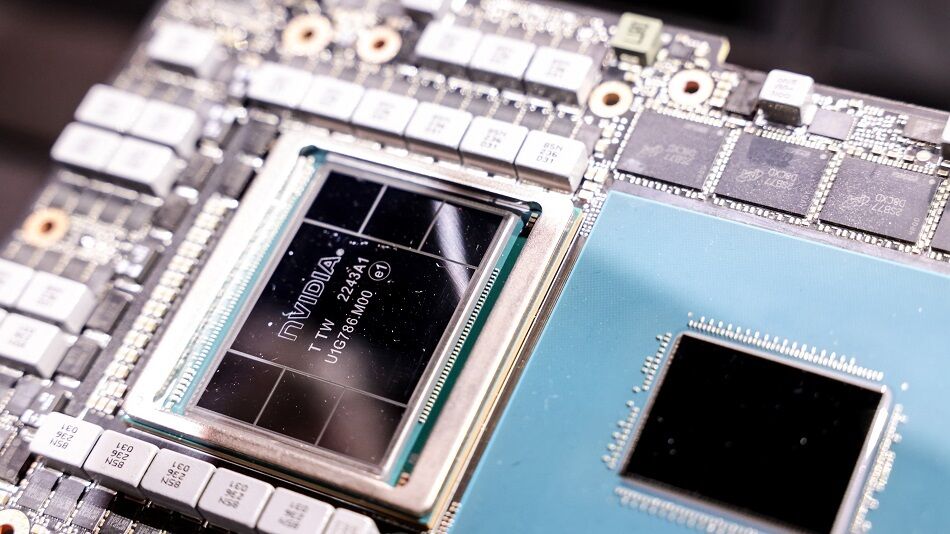

(Bloomberg) — Global equities steadied on Thursday, attempting to recover from Nvidia Corp.’s disappointing sales forecast, as traders turned their focus to the likelihood of interest-rate cuts.

Most Read from Bloomberg

Nvidia shares dropped more than 5% in US premarket trading, after its underwhelming guidance hinted at a cooling in the artificial-intelligence frenzy. However, futures on the Nasdaq 100 and the S&P 500 indexes were little changed, erasing earlier losses. The pan-European Stoxx 600 index rose 0.5%, and chip-linked shares such as ASML Holding NV and ASM International NV rose.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

“One should not forget that all semi companies are not exposed to the AI trend as Nvidia, and some have large exposure to handset, auto or industrials,” said Gaël Combes, head of equities at Banque Syz & Co.

The Nvidia setback also follows a rally that’s lifted the shares more than 150% this year.

With the earnings season officially at an end, the focus should turn back to the macro landscape. Money markets are wagering on 100 basis points worth of rate cuts by year-end but uncertainty remains whether the Federal Reserve will ease policy by a quarter-point next month or deliver a larger 50 basis-point cut. Atlanta Fed President Raphael Bostic said it “may be time to cut,” but he’s still looking for additional data to support lowering rates next month.

The Fed’s preferred inflation gauge may firm up bets on how much and how quickly the central bank will ease policy, with the annual and month-on-month core PCE readings due Friday.

“What investors are looking for now is further confirmation that if economic momentum is weakening, the Federal Reserve are going to ride to the rescue, and provide a series and of substantial cuts,” said Brian O’Reilly, head of market strategy at Mediolanum International Funds.

Treasury 10-year yields slipped about two basis points. In Europe, bond yields slid across the board after data showed Spanish inflation slowing to a one-year low — a retreat that’s likely to be mirrored across the euro area — offering ammunition to those betting on policy easing from the European Central Bank in September.

The dollar was steady and is headed for its biggest monthly decline this year, undermined by the rate-cut expectations.

Key events this week:

-

Eurozone consumer confidence, Thursday

-

US GDP, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

-

Eurozone CPI, unemployment, Friday

-

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.3% as of 8:26 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures fell 0.2%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The MSCI Asia Pacific Index fell 0.1%

-

The MSCI Emerging Markets Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro was little changed at $1.1127

-

The Japanese yen was little changed at 144.68 per dollar

-

The offshore yuan rose 0.3% to 7.1088 per dollar

-

The British pound rose 0.2% to $1.3222

Cryptocurrencies

-

Bitcoin rose 0.4% to $59,571.01

-

Ether rose 0.4% to $2,547.13

Bonds

-

The yield on 10-year Treasuries was little changed at 3.84%

-

Germany’s 10-year yield advanced two basis points to 2.28%

-

Britain’s 10-year yield advanced one basis point to 4.01%

Commodities

-

Brent crude was little changed

-

Spot gold rose 0.5% to $2,517.73 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Abhishek Vishnoi and Winnie Hsu.

(An earlier version corrected the date of PCE report.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel