(Bloomberg) — Stocks settled into a holding pattern Thursday ahead of US inflation data that may provide clues on the Federal Reserve’s policy path.

Most Read from Bloomberg

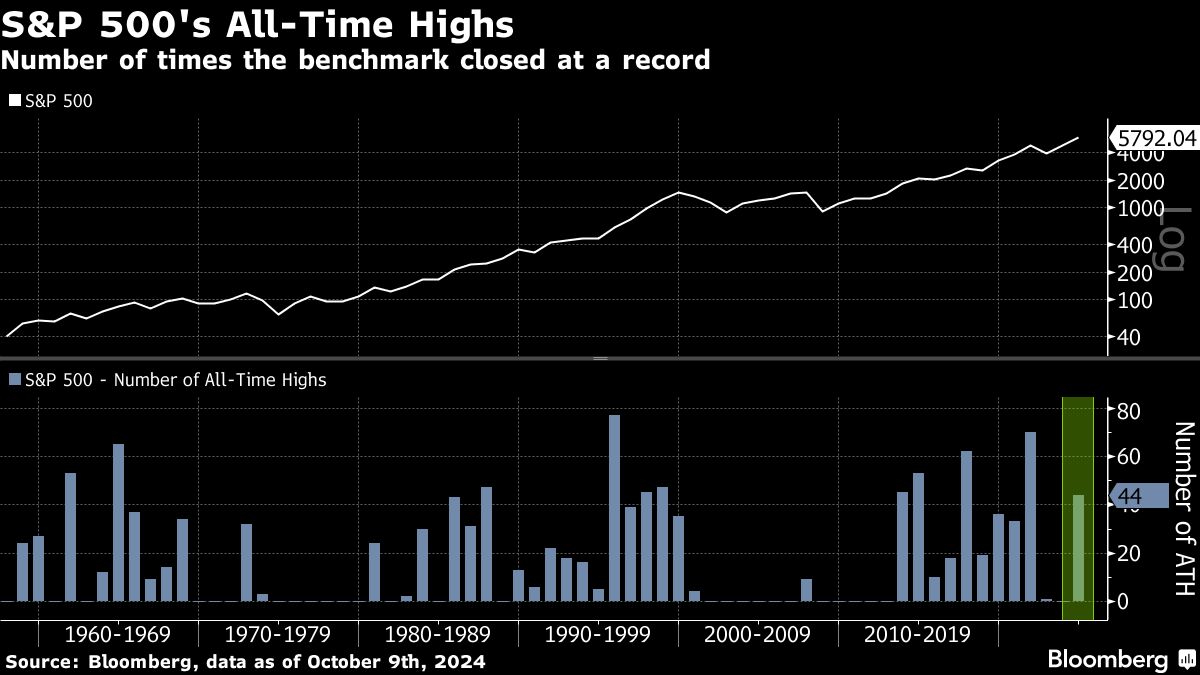

The Stoxx 600 index and S&P 500 futures traded flat, after the main US equity gauge hit its 44th record this year led by the big tech the previous session. Treasuries were steady, while oil gained as traders watched for an Israeli response to Iran’s missile attack. The Bloomberg Dollar Spot Index and the euro were little changed.

US consumer price data is expected to show inflation further moderating, supporting the Fed’s anticipated easing in the coming months. But in the wake of surprisingly strong job growth for September reported last Friday, the gradual slowdown in price pressures suggests policymakers will opt for a smaller interest-rate cut when they meet next meet month — or even not cut at all.

Minutes of the last policy meeting showed a majority of FOMC minutes supported a 50-basis-point cut, though there was a preference among some officials to cut rates at a more gradual pace.

Meanwhile, Chinese stocks jumped after the release of details on stimulus measures, with China’s central bank setting up a swap facility to provide liquidity to institutional investors to buy stocks. Investors in China will look to a press conference by the finance ministry on Saturday for clues on its fiscal stimulus.

“After a few days of heavy profit taking, we expect the offshore market to move on to the second phase of the rally, which features slower gains, higher volatility but with the basics – earnings and valuations – back in focus,” said Richard Tang, China Strategist and Head of Research Hong Kong at Julius Baer Group Ltd.

In France, Prime Minister Michel Barnier’s government will present budget details to his cabinet on Thursday evening in Paris. It’s expected to be an initial course of shock therapy to tackle swelling deficits, aiming to reassure skeptical bond investors and navigate forceful opposition in a fractured parliament.

READ: Hedge Funds Sold Record Chinese Stocks on Tuesday, Goldman Says

Crude edged higher after a two-day decline, with Brent trading near $77 a barrel. The market remains on edge about Israel’s intentions to launch a retaliatory strike against Tehran, which has sparked fears about an all-out war. Iran has warned it’s ready to launch thousands of missiles if needed.

President Joe Biden has discouraged an attack on Iranian oil infrastructure, and spoke with Israeli Prime Minister Benjamin Netanyahu on Wednesday for the first time in over a month.

Key events this week:

-

US CPI, initial jobless claims, Thursday

-

Fed’s John Williams and Thomas Barkin speak, Thursday

-

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

-

US PPI, University of Michigan consumer sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.1% as of 8:13 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 0.6%

-

The MSCI Emerging Markets Index rose 0.6%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0938

-

The Japanese yen rose 0.2% to 149.06 per dollar

-

The offshore yuan rose 0.1% to 7.0825 per dollar

-

The British pound was little changed at $1.3078

Cryptocurrencies

-

Bitcoin rose 1.1% to $61,076.07

-

Ether rose 2.1% to $2,404.57

Bonds

-

The yield on 10-year Treasuries was little changed at 4.07%

-

Germany’s 10-year yield advanced one basis point to 2.27%

-

Britain’s 10-year yield advanced two basis points to 4.20%

Commodities

-

Brent crude rose 0.4% to $76.91 a barrel

-

Spot gold rose 0.2% to $2,611.90 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Abhishek Vishnoi and Masaki Kondo.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel