(Bloomberg) — Stocks and Treasuries fell on Friday as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing.

Most Read from Bloomberg

The rate-sensitive Nasdaq 100 slid 1.9% and the S&P 500 tumbled 1.2%. As of Thursday’s close, the benchmark had ceded roughly one-third of the trough-to-peak gains it notched after the US presidential election, as some of the optimism over corporate growth under Trump fades.

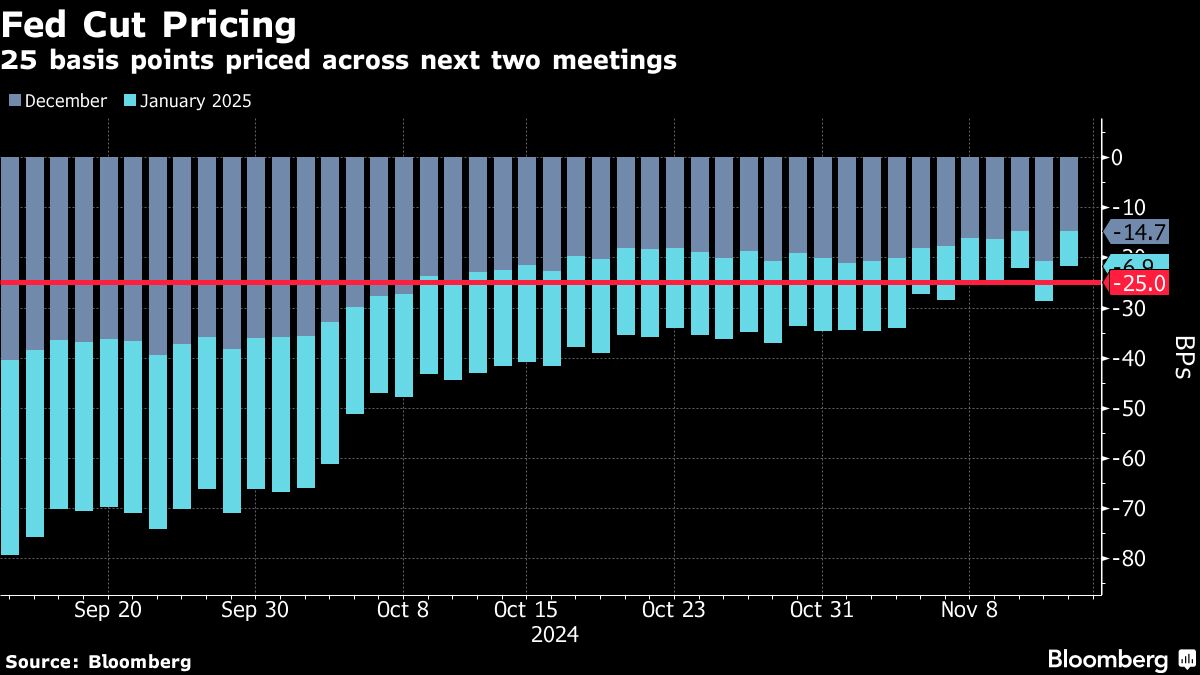

As the initial euphoria about Trump’s pro-business agenda begins to fade, investors are coming to terms with the costs of his fiscal plans and their potential to reignite inflation. Bets on interest rate cuts were pared after Fed Chair Jerome Powell warned the central bank may take its time easing policy. His remarks helped pushed odds on a December quarter-point rate cut to less than 50% from roughly 80% a day earlier.

“It will come at the expense of potentially larger budget deficits, potentially larger debt and there is also the inflation dimension,” said Charles-Henry Monchau, chief investment officer at Banque Syz & Co. “There’s been a realization that there is a price to pay for this.”

Treasury yields jumped after October retail sales came in higher than estimates, boosted by a jump in autos purchases. US government bonds suffered the biggest weekly outflows since January at $3.5 billion according to Bank of America citing EPFR Global data.

Meanwhile, drugmakers Moderna Inc. and Pfizer Inc. came under pressure in New York trading after Trump named a prominent vaccine skeptic Robert F. Kennedy Jr. to a top health-policy role.

The greenback eased off two-year highs but is on track for its seventh straight weekly gain. Another of the so-called Trump trades, Bitcoin also gave up some gains. It hit a record $93,000 level earlier this week on hopes of crypto-friendly policies from the new US administration.

Key events this week:

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 1.2% as of 10:31 a.m. New York time

-

The Nasdaq 100 fell 1.9%

-

The Dow Jones Industrial Average fell 0.7%

-

The Stoxx Europe 600 fell 0.6%

-

The MSCI World Index fell 1%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0535

-

The British pound fell 0.3% to $1.2627

-

The Japanese yen rose 0.7% to 155.18 per dollar

Cryptocurrencies

-

Bitcoin fell 0.2% to $88,058.15

-

Ether fell 3% to $3,026.1

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 4.48%

-

Germany’s 10-year yield advanced two basis points to 2.36%

-

Britain’s 10-year yield advanced one basis point to 4.49%

Commodities

-

West Texas Intermediate crude fell 1% to $67.99 a barrel

-

Spot gold rose 0.1% to $2,567.75 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel