(Bloomberg) — Stock futures rose and bond yields fell after the latest inflation reading did little to alter Wall Street’s bets the Federal Reserve will be able to cut interest rates in September.

Most Read from Bloomberg

Equities climbed in early New York trading after data showed the Fed’s preferred measure of underlying US inflation rose at a tame pace in June and consumer spending remained healthy — encouraging signs for officials looking to cool inflation without knocking down the economy. Treasury yields saw mild declines across the US curve and the dollar fluctuated.

“The Fed can still set the table at the July meeting and serve the first cut in September,” said Tim McDonough at Key Wealth. “Today’s PCE reading wasn’t exactly what the Fed was looking for after this month’s CPI surprise, but doesn’t change the narrative for a September rate cut based on data-dependency.”

The Fed is likely to signal next week its plans to cut rates in September, according to economists surveyed by Bloomberg News. Nearly three-quarters of respondents say the US central bank will use the July 30-31 gathering to set the stage for a quarter-point cut. The survey of 47 economists was conducted July 22-24.

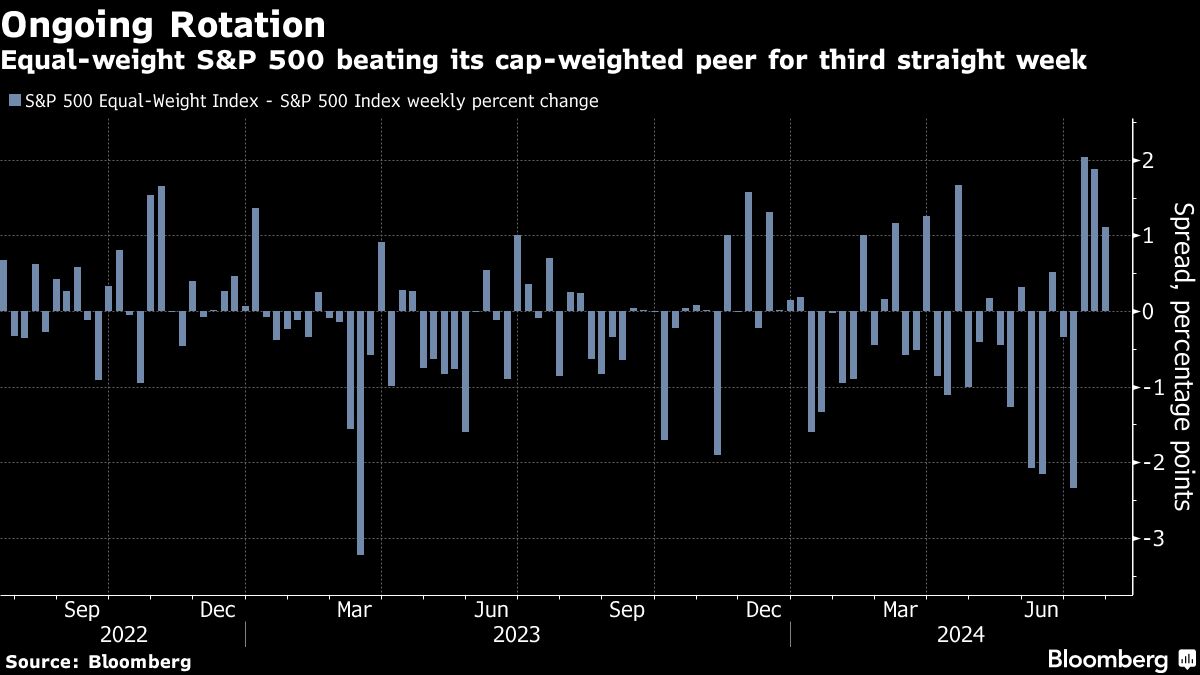

S&P 500 futures rose 0.7%, with tech leading gains after this week’s selloff. Still, Nasdaq 100 contracts continued to underperform those on the Russell 2000 of small caps. Treasury 10-year yields declined three basis points to 4.22%

The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 0.2% from May. From a year ago, it rose 2.6%. Inflation-adjusted consumer spending rose 0.2%, while May’s increase was revised higher.

“It’s been a good week for the Fed,” said Chris Larkin at E*Trade from Morgan Stanley. “The economy appears to be on solid ground, and PCE inflation essentially remained steady. But a rate cut next week remains a longshot.”

While the Fed has the data to cut rates next week, the market has already fully priced in two cuts this year already so it really doesn’t matter, according to Peter Boockvar at The Boock Report.

“The bottom line from here is whether we are going to see a rate tweaking cycle or a real rate-cutting cycle.”

To David Russell at TradeStation, the PCE number gives more evidence that we’re on the downward slope in terms of inflation.

“Investors can now focus on the big earnings next week and worry less about prices and rates because it seems the tide has finally turned,” he noted.

The rally in the biggest US technology stocks is at risk of fading further if the US economy continues to cool, according to Bank of America Corp.’s Michael Hartnett.

The strategist — who is bullish on bonds for the second half of 2024 — has said signs of an economic slowdown would fuel a rotation into stocks that have lagged behind the pricey tech mega-caps this year.

In a note on Friday, Hartnett said recent data suggested the global economy was “ill,” and that “we are one bad payroll away” from big tech stocks losing their dominance.

Corporate Highlights:

-

3M Co. raised its full-year profit forecast in a sign of progress as its new chief executive officer looks to reinvigorate the iconic manufacturer after a lengthy period of turmoil.

-

McDonald’s Corp.’s new $5 meal deal has led to a modest increase in US visits and brought back some low-income diners — the first signs that the burger chain’s strategy to appear more affordable is paying off.

-

Bristol Myers Squibb Co. raised its 2024 profit forecast after demand for the company’s new medicines helped it beat Wall Street’s second-quarter sales estimates.

-

Apollo Global Management Inc. has agreed to buy International Game Technology Plc’s gaming division and the gambling machines company Everi Holdings Inc. in a $6.3 billion, all-cash deal that will see the two businesses merged.

-

Apple Inc. lost ground in China’s smartphone market in the June quarter after local companies like Huawei Technologies Co. surged ahead.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.7% as of 9:05 a.m. New York time

-

Nasdaq 100 futures rose 0.9%

-

Futures on the Dow Jones Industrial Average rose 0.6%

-

The Stoxx Europe 600 rose 0.6%

-

The MSCI World Index was little changed

-

E-Mini Russ 2000 Sep24 rose 1.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1% to $1.0862

-

The British pound rose 0.1% to $1.2869

-

The Japanese yen was little changed at 154.00 per dollar

Cryptocurrencies

-

Bitcoin rose 3.1% to $67,291.46

-

Ether rose 2.7% to $3,238.42

Bonds

-

The yield on 10-year Treasuries declined three basis points to 4.22%

-

Germany’s 10-year yield was little changed at 2.42%

-

Britain’s 10-year yield declined three basis points to 4.10%

Commodities

-

West Texas Intermediate crude fell 0.7% to $77.77 a barrel

-

Spot gold rose 0.5% to $2,376.08 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel