Over the past few years, it’s become clear that the technology sector has been a key driver of market growth. Innovations, especially in generative AI, are rapidly enhancing software capabilities, offering the potential for greater productivity and adaptability in digital tools.

Yet, while software plays a vital role, none of this progress could happen without the hardware driving it. This underscores compelling investment opportunities in tech companies that provide the server hardware necessary for running AI applications.

In this context, Vijay Rakesh, a 5-star analyst at Mizuho, has shifted his focus to the AI space, specifically focusing on server hardware.

“Generative AI is igniting growth and disruption across multiple markets, pushing the frontiers of innovation and productivity. AI servers comprise the infrastructure enabling the AI revolution,” Rakesh opined. “The AI server market is projected to be a ~$406B market by 2027E, growing at a ~54% CAGR driven by CSPs (Hyperscale and Tier 2) and Enterprise demand. We see GenAI growing exponentially, supporting secular growth in the AI server market.”

Not all AI stocks are created equal, however, and some present better investment prospects than others. Rakesh highlights two key players in this space, Super Micro Computer (NASDAQ:SMCI) and Dell Technologies (NYSE:DELL), and offers insight into which stands out as a must-buy AI stock. Let’s dive into both, using the latest data from TipRanks alongside insights from Mizuho’s report.

Super Micro Computer

We’ll start with a look at Super Micro Computer, a high-tech firm from Silicon Valley that specializes in developing and producing the hardware behind high-performance computing and high-end server stacks. In addition, Super Micro provides management software and memory storage systems for a wide range of enterprise-scale applications, including AI, cloud computing, data centers, edge computing, and 5G networking.

This company has been in business for more than thirty years and has established itself as a go-to for high-end computing needs. Super Micro has in-house expertise to handle the design and building of complex server stacks and high-performance computers and can install these systems at all scales. The company has product lines available for custom builds, to meet customers’ idiosyncratic needs, or off-the-shelf, and can even handle unique or unusual design requests. Super Micro supports its product offerings with a large-scale manufacturing footprint, capable of producing some 5,000 AI, HPC, and liquid cooling rack solutions every month.

From the customer’s perspective, particularly from those customers in the AI field, the key point here is the ability of Super Micro’s products – the servers, the high-performance computers, the advanced memory storage – to meet the needs of today’s cutting-edge technology.

On the financial side, Super Micro generated $5.3 billion in revenues in its last reported quarter, fiscal 4Q24. This was up an impressive 143% from the prior year period, and beat the forecast by $10 million. The company’s Q4 EPS, $6.25 by non-GAAP measures, missed the estimates, however, by $1.56 per share. The company attributed the miss to a combination of lower gross margins and higher operating expenses in the quarter.

We should note here that SMCI shares are down sharply from their recent peak, hit in March of this year. Since then, not helped by a damning short seller report and a 10-K filing delay, the stock has fallen by 61%, although it still shows a year-to-date gain of approximately 63%. Meanwhile, company management has authorized a stock split, of 10-to-1, to take effect on October 1 this year.

For Mizuho’s Rakesh, the key point here is that the AI hardware segment is growing more crowded, and Super Micro is facing increasing competition with a consequent loss of market share. He writes of the company, “We acknowledge SMCI as a consensus AI leader (AI Server ~70% of revs), but increasing competition, share loss (SMCI market share in AI servers is down from ~80-100% in 2022-23 to 40-50% in 2024E), and continued competition from DELL and other peers is pressuring pricing and margins. We estimate the current 10-K delays a ~10% share headwind, and we don’t foresee a delisting of shares as the delays are tied to internal process controls, we still see share loss and margin pressure as key valuation drivers and justify a 17% discount to its historical average ~12x.”

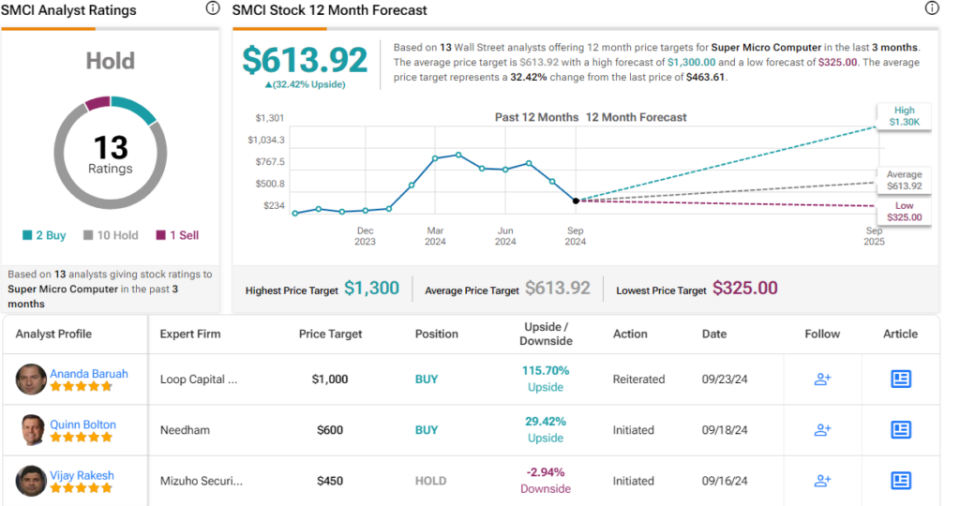

Rakesh follows up those comments with a Neutral (Hold) rating on the stock, along with a $450 price target that suggests the stock will remain relatively flat over the coming year. (To watch Rakesh’s track record, click here)

Overall, SMCI gets a Hold consensus from the Street, based on 13 reviews that include 2 Buys, 10 Holds, and 1 Sell. That said, shares are priced at $463.61, and the $613.92 average target price implies an upside potential of 32.5% in the next 12 months. (See SMCI stock forecast)

Dell Technologies

Next up is Dell Technologies, a well-known name from the personal computing world. Dell built its reputation building PCs and laptops for the direct-to-customer market, and continues to hold a strong position in that market, as a maker and supplier of PCs, laptops, monitors, and gaming peripherals. The company has roots in the 1980s; its modern incarnation dates to 2016, when it acquired the enterprise software and memory storage firm EMC in a transaction valued at approximately $67 billion.

Since then, Dell has expanded its business footprint, and now offers customers a range of hardware products to support networking and AI functions. These include high-end server stacks and advanced memory storage, which are in demand from AI developers, data centers, and other tech businesses that depend on high-performance computing architecture. Dell has taken its expertise at building computer systems – honed through its long experience in the personal computing segment – and applied it to cutting-edge enterprise scale applications.

Looking at the AI world specifically, Dell can offer its customers solutions to fit desktop workstations, data centers, and even cloud-based computing. The company’s computing solutions and hardware can support generative AI applications, including content creation, coding, personal digital assistants, design tools – the list is as long as the imagination of AI developers.

Dell’s last financial report covered fiscal 2Q25, and the company beat the forecasts at both the top and bottom lines. Dell’s quarterly revenue was up more than 9% year-over-year, to reach $25 billion, and beat the forecast by $910 million. The firm’s earnings, reported as a non-GAAP EPS of $1.89, was 18 cents per share better than had been expected.

Prominent among Dell’s revenue drivers were the Infrastructure Solutions Group, which saw a 38% year-over-year increase, to $11.6 billion, and the Networking segment, which was up 80% to $7.7 billion. Both of these figures were segment records for the company.

Checking in again with Vijay Rakesh, we find the analyst upbeat about Dell, noting that the company has built a solid AI hardware business without skimping on its existing retail PC business. Rakesh says of Dell, “We see DELL well positioned in the AI server race with a strong NVDA partnership and aggressively gaining share with pricing, but still diversified with PC, conventional servers, services and storage solutions. We note an Enterprise storage refresh and a potential 2025 Win11 corporate PC refresh cycle is a tailwind, as well as with AI PCs, which could help drive both consumer and corporate upgrades.”

Looking ahead, the analyst outlines plenty of reasons to expect continued strong performance, writing, “We see potential for $9+ EPS for DELL by F26E (~$10+ EPS in F27/C2026) as it continues to take market share in AI servers, maintains a strong position in compute server and see PCs return to growth after F24 saw weaker EPS, mainly due to revenues down ~14% y/ y, offsetting stronger margins.”

In Rakesh’s view, Dell gets an Outperform (Buy) rating, and he complements that with a $135 price target pointing toward a gain of 15% on the one-year horizon.

Dell’s 17 recent analyst reviews include 14 to Buy and 3 to Hold, for a Strong Buy consensus rating. The shares are trading for $117.31 and their average target price of $144.63 suggests an upside of 23% or more by this time next year. (See DELL stock forecast)

Laying out these stocks’ data side by side, it’s clear that for this top analyst, Dell Technologies is the superior AI hardware stock for investors to buy.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel