Super Micro Computer (NASDAQ: SMCI) has been a hot buy this year, but lately, the stock has been nosediving. In just six months, it has fallen by 27%. Its year-to-date return is still impressive at 90%, but it’s clear that investors appear to be growing concerned with the stock potentially hitting a peak.

The company, also known as Supermicro, experienced a lot of growth due to artificial intelligence (AI) as businesses upgrade their servers and IT infrastructure. Supermicro hasn’t been generating just double-digit growth; its top line more than doubled last quarter. However, revenue growth alone may not be enough of a catalyst to rally the stock much higher. Although Supermicro is coming off another strong period of growth, there’s a more concerning number that investors may want to pay attention to: its gross profit.

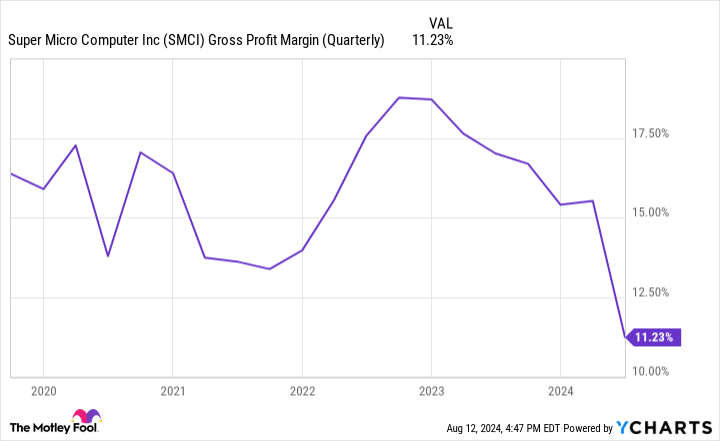

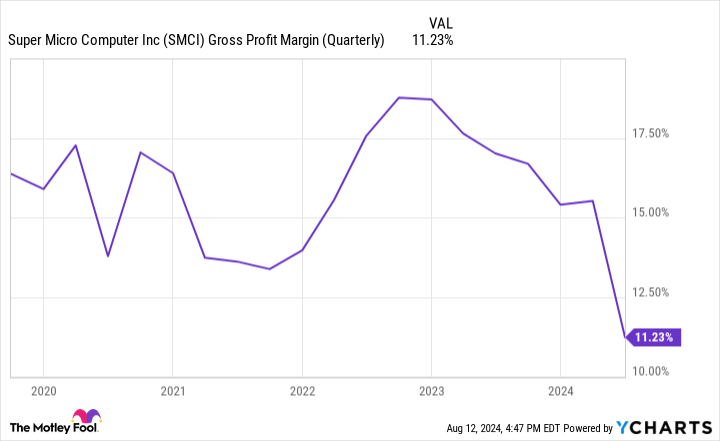

Supermicro’s margins have been shrinking

Sales growth is great, but it isn’t all that important if a company’s cost of revenue is high. The higher those costs are, the less gross profit there is that’s flowing through to cover overhead and operating costs. If margins aren’t good, it may not necessarily result in better earnings numbers. That’s ultimately a key reason why investors are bullish on fast-growing companies — the assumption is that they will generate stronger profits, which improves their earnings multiples and can ultimately lead to a higher valuation for the stock.

But last quarter, which ended in June, Supermicro’s gross margin, which was already low at 17% a year ago, fell even lower to just 11%. That means that for every $1 Supermicro generates in revenue, it’s incurring $0.89 in costs. This is before marketing and promotional expenses and before paying administrative staff; these are direct costs related to revenue.

This isn’t a new problem for Supermicro

Supermicro’s business hasn’t typically generated high margins to begin with. Normally, they’ve been around 15%. But this past quarter they dipped to a new low.

Now, whether a company generates 11% margins or 15% margins may not make a whole lot of difference to investors, but it is something to keep an eye on nonetheless. What can be problematic is if its overhead and other costs start to creep up — last quarter, Supermicro’s operating expenses were less than 5% of sales. If that percentage increases, that will exacerbate the issue related to the company’s thin margins. And if demand also starts to slow down, things could quickly go from bad to worse.

Supermicro’s revenue for the period grew by 143% to $5.3 billion, but its gross profit increased by 60% to $596.3 million, and its operating income of $343.4 million rose by 51%. Those are still impressive numbers, but the danger is that inevitably, Supermicro’s growth rate will slow down. Companies aren’t likely to continue spending feverishly on IT upgrades and servers forever. The AI-related spending frenzy could slow next year, especially if a recession takes place. And that could have a disastrous effect on the company’s bottom line due to its problematic margins.

Is Supermicro stock a good buy?

Supermicro’s valuation isn’t all that expensive despite its relatively thin margins. Based on analyst estimates, it’s trading at 15 times its future profits. That’s not high when you consider that the average tech stock is trading at a forward price-to-earnings multiple of 29.

The stock still appears to be a good buy, as Supermicro’s margins have historically never been that high. Companies can make low margins work provided their other costs remain low, which is the case with Supermicro. At its current valuation, the AI stock still looks to be one of the better options out there for investors, especially with business remaining strong.

Even if its growth rate slows, at a decent valuation, Supermicro stock comes with a good margin of safety which could justify hanging on to it even despite potential headwinds in the near future. There is some risk here, but may not be enough to deter investors from what’s proving to be a top AI stock.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $723,545!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer’s Sales Growth Is Incredible, but This Could Be a Problem for the Stock was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel