(Bloomberg) — Super Micro Computer Inc. could face an early repayment on up to $1.725 billion of its bonds should its accounting woes result in it being booted off the Nasdaq stock exchange.

Most Read from Bloomberg

Holders of Super Micro’s $1.725 billion March 2029 convertible notes have the option of getting their money back early if the company is delisted, according to the bond’s documentation.

A delisting — seen as a real possibility after Super Micro missed an August deadline to file its annual financial report and its auditor resigned — would constitute a spectacular fall from grace for a company which is a major beneficiary of demand for high-powered servers and other hardware to power artificial intelligence.

Super Micro declined to comment for this article. Chief Financial Officer David Weigand told analysts on a call Tuesday that the company has “long-term and good relationships” with banks regarding its debt. “As necessary, we’ll file extensions or get waivers — we’re not concerned about the company’s ability to access the capital markets,” he said.

The possibility of a delisting rose after its auditor Ernst & Young LLP resigned, citing concerns about governance and transparency. The company said Tuesday it is working on a compliance plan, which could push the deadline to submit audited financials to February 2025.

For more: Super Micro Could Face Delisting, S&P 500 Removal Amid Auditor Woes

Shares of the San Jose, California-based company have slid 81% since a March peak, wiping out roughly $53 billion in market value.

Underscoring earlier enthusiasm for the company, the bonds sold in February were with a 0% coupon, meaning the company pays no interest. It’s a throwback to the pandemic-era tech craze when a host of highly-hyped companies such as Peloton Interactive Inc. and Snap Inc. sold similar interest-free notes.

The documentation under which the Super Micro bonds were sold states that there would a cancellation and payment of the bonds assuming the shares are delisted from Nasdaq and are not immediately re-listed, re-traded or re-quoted.

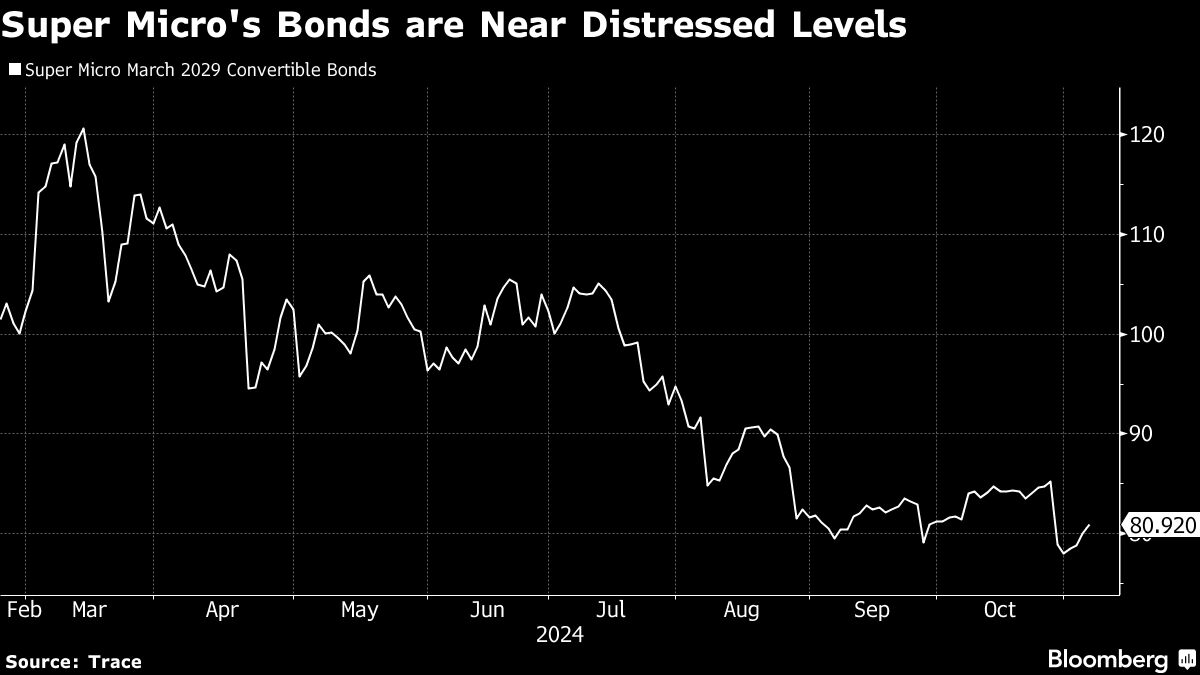

Super Micro bonds were quoted around 81 cents on the dollar on Wednesday, just above the 80 mark that investors consider constitutes “distress.”

The company had about $2.1 billion in cash or equivalents at the end of September, it said Tuesday. That increased cash pile gives it more options if it needs to reset debt agreements, wrote Matt Bryson, an analyst at Wedbush. Still, the potential for this massive sum of debt to come due early is “certainly a risk,” Bryson said in an interview.

Super Micro has been re-working some of its other debt. Last week, it prepaid and terminated a $500 million term loan facility inked in July with Bank of America Corp. It also adjusted a loan with Cathay Bank to extend a deadline to deliver audited financials till the end of the year, which added a rule that Super Micro must keep $150 million of unrestricted cash on hand.

In recent high profile examples of delistings impacting convertible bonds, several Russian companies such as social network firm VK Co. Ltd. and search engine Yandex NV faced a debt restructuring after their listings in London and New York were frozen as part of Western sanctions on Russia.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel