(Bloomberg) — Stocks churned as Nvidia Corp.’s results failed to revive the artificial-intelligence-rally that has powered the bull market.

Most Read from Bloomberg

Equities came well off session highs, with tech shares leading losses. The chipmaker at the heart of the AI boom erased earlier gains as its good-but-not-great numbers underwhelmed investors. The dollar rose as President Donald Trump said 25% tariffs on Canada and Mexico are on track to go into place on March 4, adding he would impose an additional 10% tax on Chinese imports.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

All the uneasiness around the actual impact of those potential tariffs on things like trade, the economy, inflation and even geopolitics kept Wall Street traders on their toes. And there was no major relief from Thursday’s big batch of economic data — which was mixed at best.

For starters, data showed the US economy advanced at a healthy pace and inflation was more stubborn than initially estimated at the end of 2024. Gross domestic product increased at an unrevised 2.3% annualized pace in the fourth quarter. The primary growth engine — consumer spending — advanced at a 4.2% pace.

“Investors want lower rates from the Fed, but they don’t want to get there by seeing a notable deterioration in the underlying economy,” said Bret Kenwell at eToro. “At the very least, if the economy is going to slow, investors will want to see inflation slow down too.”

The S&P 500 wavered. The Nasdaq 100 lost 0.6%. The Dow Jones Industrial Average gained 0.6%.

The yield on 10-year Treasuries advanced three basis points to 4.29%. The Bloomberg Dollar Spot Index rose 0.5%.

To Jim Baird at Plante Moran Financial Advisors, the GDP report reaffirms, with some additional refinement, what was already understood: The economy closed out 2024 on with solid momentum, with consumers playing a particularly important role in driving the economy in the final months of the year.

Meantime, the Federal Reserve’s preferred metric — the personal consumption expenditures price index excluding food and energy — climbed 2.7%, faster than the 2.5% initially reported. That was driven mainly by services costs. Monthly figures on Friday are forecast to show the first decline in inflation-adjusted personal spending in a year after a robust holiday-shopping season.

“Indications that price pressures may be catching a second wind even before the potential impact of additional tariffs should send a cautionary message about the near-term inflation outlook,” said Baird.

Separate data on Thursday showed US jobless claims rose to the highest this year, amid an increase in job-cuts announcements at corporations and federal agencies.

Initial claims increased by 22,000 to 242,000 in the week ended Feb. 22, matching the highest level since October, according to Labor Department data released Thursday. The median forecast in a Bloomberg survey of economists called for 221,000 applications.

“Today’s jobless claims surprise will dial up anticipation for next week’s employment data, but it remains to be seen whether the increase is just an outlier or the beginning of a trend,” said Chris Larkin at E*Trade from Morgan Stanley. “Despite recent concerns about the strength of the US consumer, most numbers continue to point to a US economy that may have softened, but is still on solid ground.”

Corporate Highlights:

-

Amazon.com Inc.’s cloud unit has built its first quantum-computing chip, joining a growing roster of technology companies showing off futuristic hardware.

-

EBay Inc. projected sales for the current quarter that missed analysts’ estimates, guidance that Chief Executive Officer Jamie Iannone attributed to soft demand in Germany and the UK.

-

Salesforce Inc. gave a fiscal-year revenue forecast that fell short of estimates, dimming optimism that the company’s new artificial intelligence product would spur faster sales growth.

-

Walgreens Boots Alliance Inc. rose after a report that a potential take-private deal from Sycamore Partners would lead to a breakup of the drugstore chain.

-

Paramount Global, the parent of CBS and MTV, reported fourth-quarter sales and profit that fell short of analysts’ expectations, as gains in streaming failed to offset declines in traditional TV.

-

Peanut butter and jelly maker JM Smucker Co. gave full-year guidance that was more optimistic than Wall Street anticipated, despite missing sales forecasts on supply chain issues.

-

Snowflake Inc. projected better-than-expected revenue growth for the fiscal year, sending an optimistic signal about the adoption of its recently launched products for artificial intelligence.

-

Royal Bank of Canada beat estimates on higher results in its capital-markets and wealth-management divisions as both units benefited from strong markets.

-

Toronto-Dominion Bank beat estimates on better-than-expected wealth-management and capital-markets results, capping off an earnings season that saw all of Canada’s big banks benefit from higher trading activity.

-

Canadian Imperial Bank of Commerce came ahead of analyst expectations with gains across all segments, particularly with strength in the capital markets business.

-

Elliott Investment Management is ramping up pressure on BP Plc after its new strategy fell short of the activist investor’s expectations, people with knowledge of the matter said.

Key events this week:

-

Japan Tokyo CPI, industrial production, retail sales, Friday

-

US PCE inflation, income and spending, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 was little changed as of 10:15 a.m. New York time

-

The Nasdaq 100 fell 0.6%

-

The Dow Jones Industrial Average rose 0.6%

-

The Stoxx Europe 600 fell 0.7%

-

The MSCI World Index fell 0.3%

-

Bloomberg Magnificent 7 Total Return Index fell 0.7%

-

The Russell 2000 Index fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.5%

-

The euro fell 0.7% to $1.0415

-

The British pound fell 0.4% to $1.2631

-

The Japanese yen fell 0.5% to 149.85 per dollar

Cryptocurrencies

-

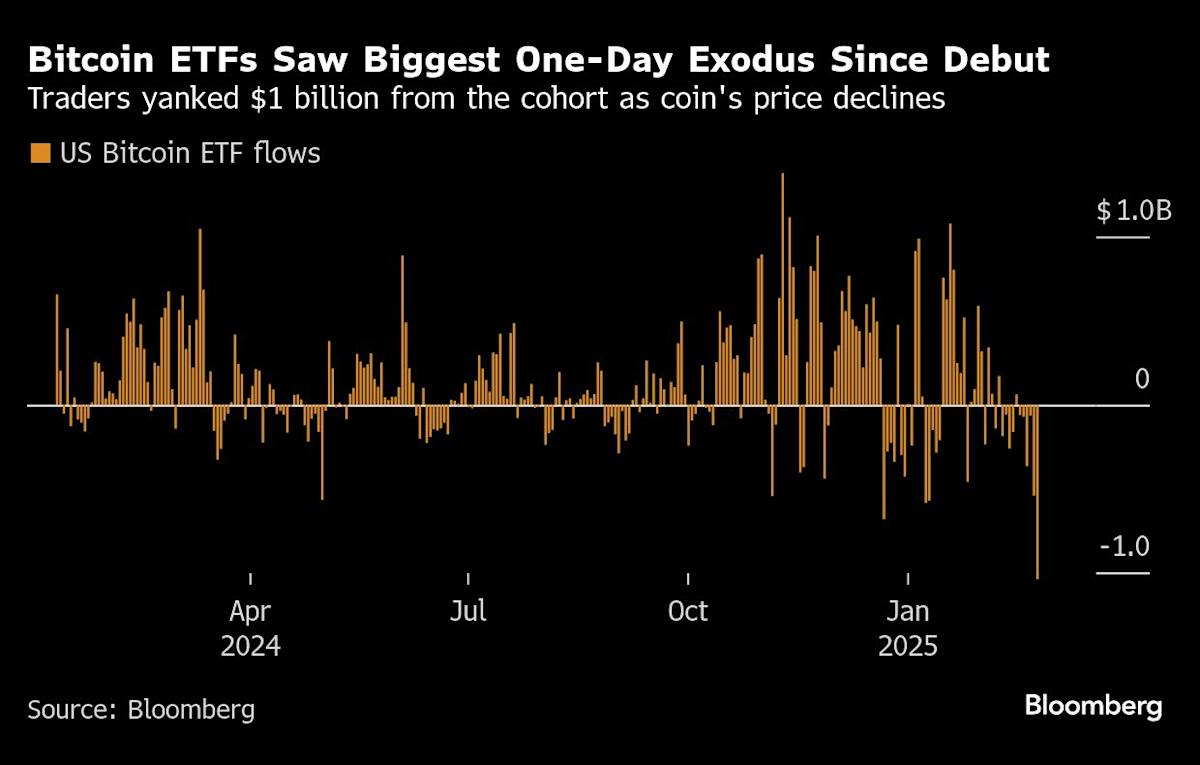

Bitcoin rose 1% to $85,281.35

-

Ether fell 0.9% to $2,319.66

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.29%

-

Germany’s 10-year yield was little changed at 2.43%

-

Britain’s 10-year yield advanced two basis points to 4.53%

Commodities

-

West Texas Intermediate crude rose 1.9% to $69.89 a barrel

-

Spot gold fell 1.4% to $2,875.14 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Margaryta Kirakosian, John Viljoen and Divya Patil.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel