Investors looking for ways to permanently boost their passive income streams would do well to begin their search with the Dow Jones Industrial Average (DJINDICES: ^DJI). This market index comprises 30 well-established companies with a proven ability to generate strong profits in both good economic times and bad.

Nearly all the Dow Jones stocks pay quarterly dividends, but around two-thirds offer yields below 3% at recent prices. If you want a high yield, you’ll have to go all the way to the top.

Right now, Verizon (NYSE: VZ) and Dow (NYSE: DOW) are the highest-yielding stocks in the Dow Jones Industrial Average. With yields of 6.5% and 5.3%, respectively, they could produce market-beating gains for patient investors if they can raise their payouts in the years ahead.

Here’s a look under their hoods to see whether buying the highest-yielding Dow Jones stocks is a smart move for income-seeking investors.

Dow

The company formerly known as Dow Chemical and the Dow Jones index both began in the 19th century. They were founded by unrelated men with the same surname, so the relationship ends there.

While Dow offers a high yield up front, investors should know the company hasn’t raised its dividend since separating from DowDuPont in 2019. Dow’s specialty materials business is highly cyclical, and the current cycle is trending down. First-quarter sales sank by 9% year over year. The company also has a lot of debt to service.

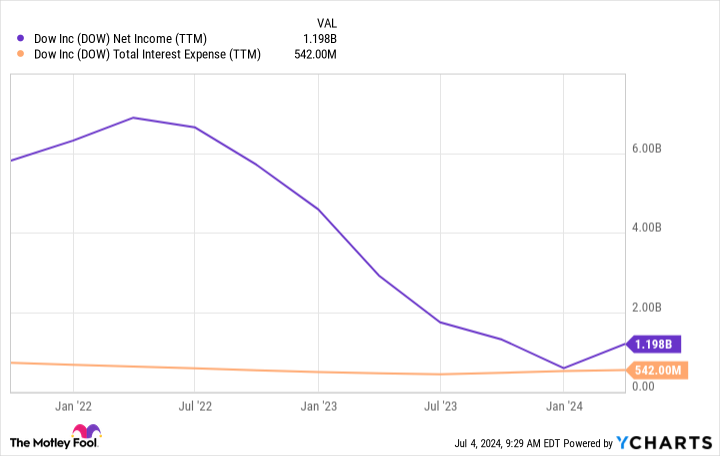

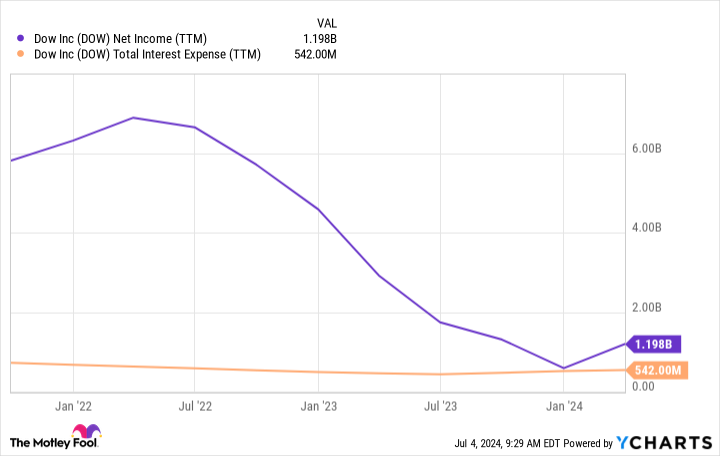

Overall interest expenses reached $542 million over the past 12 months. That’s a heavy debt load for a company that produced just $1.2 billion in net income over the same time frame.

A high debt load and the cyclicality of the chemicals business make committing to a higher dividend payout right now a bad idea. It’s just a matter of time, though, before the advanced materials business cycle hits a new upswing.

Despite unfavorable cyclicality in the materials business, Dow generated a healthy $2.4 billion of free cash flow over the past 12 months. That’s significantly more than it needs to meet its present dividend commitment.

Dow hasn’t raised its dividend but has repurchased enough shares to reduce its outstanding share count by about 5.2% since the 2019 spin-off. Fewer shares will make eventual dividend raises easier to commit to down the road. For income-seeking investors with some time ahead of their expected retirement age, adding some shares of Dow to a portfolio now and holding them long-term makes a lot of sense.

Verizon

Last September, Verizon raised its dividend payout for the 17th year in a row. This is the longest dividend-raising streak among America’s three-way telecommunications oligopoly.

At recent prices, Verizon offers a 6.5% yield, which also makes it the highest-yielding dividend stock in the Dow Jones index.

Verizon recently reported total first-quarter revenue that grew just 0.2% year over year. Despite the apparent stagnation, investors who would like to see their dividends continue increasing probably don’t need to worry.

Verizon reported stagnating first-quarter revenue because fewer customers have been upgrading their phones. It’s been more than five years since I’ve heard of a good reason to upgrade my phone, but sooner or later, it’s going to stop working. With this in mind, it’s just a matter of time before Verizon’s equipment sales find a bottom.

First-quarter wireless service revenue rose 3.3% year over year, and this segment is likely to continue climbing. Customers rarely change their mobile or broadband internet service providers, and options are limited. Remember, Verizon is one of just three American telecom companies with a big 5G network.

Verizon might not have the fastest-growing dividend payout, but its position in America’s telecom oligopoly could make it the most reliable stock in your portfolio.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

The 2 Highest-Yielding Dividend Stocks in the Dow Jones Offer More Than 5%. Is It Time to Buy? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel