The S&P 500 has been setting one new all-time high after another in 2024, but not every stock has participated during the current bull market.

Over the last few years, big tech stocks have been the driving force behind the stock market’s increasing value. That trend accelerated recently as innovations among the biggest companies using artificial intelligence (AI) have pushed their stock prices even higher.

The market expects those innovators to produce massive earnings growth over the next few years, and investors have raised their valuations as a result.

But one indicator suggests the domination of big tech might be about to shift. Investors could find a great investment opportunity from an entirely different group of stocks.

A huge valuation gap that can’t be ignored

One of the most commonly used valuation metrics in investing is the price-to-earnings (P/E) ratio. It tells you how much you’ll pay per dollar of earnings for any given stock. For example, if a company generated $1 in earnings per share over the past year and its share price is $20, it has a P/E ratio of 20.

Since stocks are valued based on expectations for the future, looking at forward P/E can be a better indicator of whether a stock is fairly priced. The forward P/E uses management or analysts’ expectations for earnings over the next year to calculate the ratio, instead of previous earnings.

Looking at stocks as a group and comparing their valuation to historical averages can help determine whether the market as a whole is overvalued or undervalued. And comparing the P/E of one segment of the market to another could help identify investment opportunities.

Currently, the gap between the forward P/E ratios of the large-cap S&P 500 index and the small-cap S&P 600 index is about as wide as it’s been since the start of the century. As of this writing, the S&P 500 has a forward P/E of 21.3, while the S&P 600 sits at just 13.9. The last time the gap topped seven was just ahead of the dot-com recession of 2001, according to Yardeni Research.

I’m not suggesting we’re headed for another recession or a big market downturn in the near future, but it seems increasingly likely the next leg up in the market will be driven by smaller companies.

While the S&P 500 struggled to make any gains in the early 2000s, small caps zoomed higher. And history could be about to repeat itself.

The massive outperformance of small caps

Over the very long run, small caps historically outperform large caps. But that outperformance comes in cycles. Small caps underperform in some periods and then massively outperform in others.

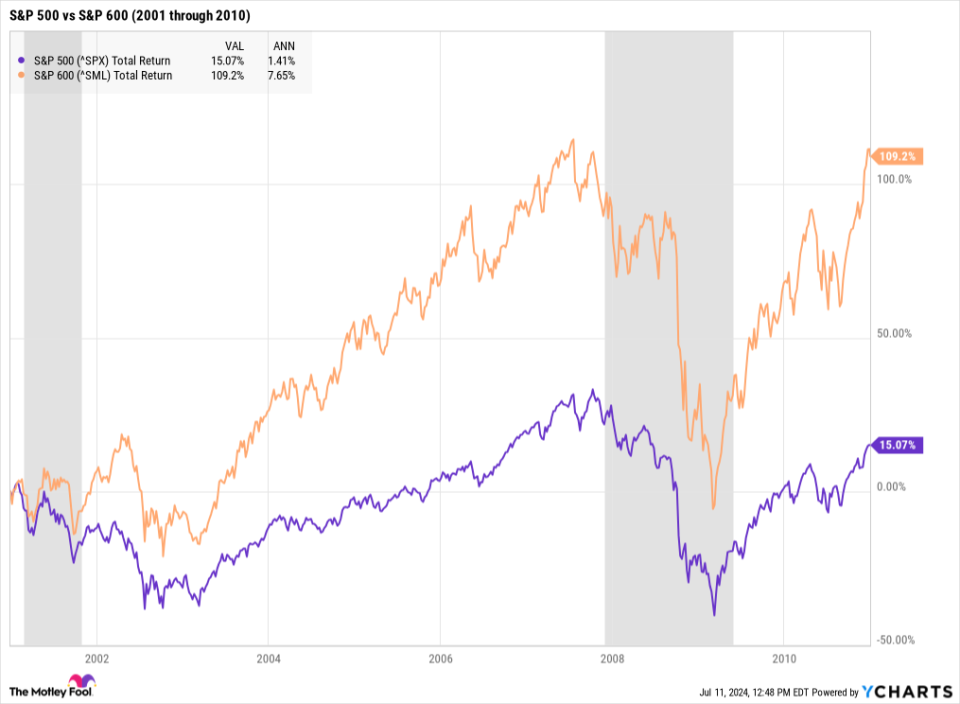

The last time the valuation gap between large-cap and small-cap stocks was this wide, the S&P 600 went on to generate huge returns for investors relative to its large-cap counterpart.

From the start of 2001 through 2005, the S&P 600 produced a total return of 66.7%, or a compound annual growth rate of 10.8%. By comparison, the S&P 500 offered just a 2.8% total return over the same five-year period.

Through 2010, which includes the Great Recession, small caps continued to outperform. The S&P 600 produced a total return of 109.2% vs 15.1% for the S&P 500.

How to invest in today’s market

There are a few reasons small-cap stocks have lagged larger companies in recent history. For one, higher interest rates in the last few years have put pressure on small caps that are heavily reliant on debt for growth.

What’s more, investors will discount future earnings more if they can get a 5% risk-free return from Treasury bonds. That’s a double whammy for small caps. On top of that, recession fears over the last couple of years pushed more investors to favor larger, more stable companies.

But smaller companies could be set to get some relief from high interest rates. The Federal Open Market Committee expects to cut interest rates at least once this year. After a couple of months with better-than-expected inflation data, the market thinks the Fed could cut rates even faster. And recession fears have abated over the past year as well.

That could make it a great time to invest in small-cap stocks. You could research individual companies to find the best opportunities among smaller stocks. These companies aren’t as widely followed — fewer analysts and institutional investors are buying and selling shares — and that means there’s a great opportunity to outperform the overall market.

But the simplest way to buy small caps is to use an index fund. You could buy the SPDR Portfolio S&P 600 Small Cap ETF (NYSEMKT: SPSM). This exchange-traded fund (ETF) does a good job of tightly tracking the benchmark index with an expense ratio of just 0.03%.

Another option is an index fund that tracks the Russell 2000, which is often used as the benchmark for small-cap stocks. It doesn’t have any profitability requirements like the S&P 600 does, so it includes a lot more growth stocks that have yet to become profitable.

While the S&P 600 has historically outperformed the Russell 2000, some big-name billionaires are buying Russell 2000 index funds like the iShares Russell 2000 ETF (NYSEMKT: IWM).

My personal favorite way to invest in small-cap stocks is with the Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV). Technically an active fund, it uses several profitability and valuation criteria to narrow down the small-cap stock universe and weigh investments across 774 stocks. The result is a mostly passive portfolio, which still keeps fees low at just 0.25%.

While there’s still a place for large caps in any portfolio, investors might want to consider using one of the above ETFs to tilt their weighting toward small caps in today’s market.

Should you invest $1,000 in SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF right now?

Before you buy stock in SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Adam Levy has positions in American Century ETF Trust-Avantis U.s. Small Cap Value ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Stock Market Is Doing Something Unseen Since the Year 2000. History Says This Happens Next. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel