On June 26, restaurant company Chipotle Mexican Grill (NYSE: CMG) did a 50-for-1 stock split — one of the largest splits investors have ever seen. Anyone who owned just two shares of the company before now owns 100, thanks to this highly publicized event.

However, Chipotle stock is down about 11% from the all-time high that it reached back in June, with much of the drop happening after the stock split. In fact, it’s the largest pullback for Chipotle stock in almost a year.

I have reason to believe that some Chipotle shareholders bought the stock entirely because of the stock split. A 2023 study published by the Journal of Risk and Financial Management found that a stock’s trading volume usually increases with a stock-split announcement. And the trading volume generally goes up enough after a split that it’s reasonable to assume that there are more shareholders after the split than there were before.

Therefore, I believe some investors own Chipotle stock because it just did a huge 50-for-1 split. And these investors are likely upset to already be down sharply.

Why isn’t Chipotle stock surging after the split?

The true value of a company isn’t found in its stock price, but rather in its market capitalization. Each share represents a small, fractional ownership piece of the business. The market cap adds up the price of all the shares outstanding to arrive at the entire worth of the company.

Let’s assume that two different stocks both traded at $10 per share. If the first company had 1 million shares and the second company had 1 billion shares, the former would have a market cap of only $10 million whereas the other would have a market cap of $10 billion. In other words, the stock prices would be the same. But one company would be worth 1,000 times more than the other because it would have 1,000 times as many shares.

When Chipotle split its stock, it instantly had 50 times as many shares as before. But it didn’t do anything to create shareholder value nor was any value lost. This is because the stock price was also instantly about 1/50th what is was before. In other words, it was all a wash from a market-cap value perspective.

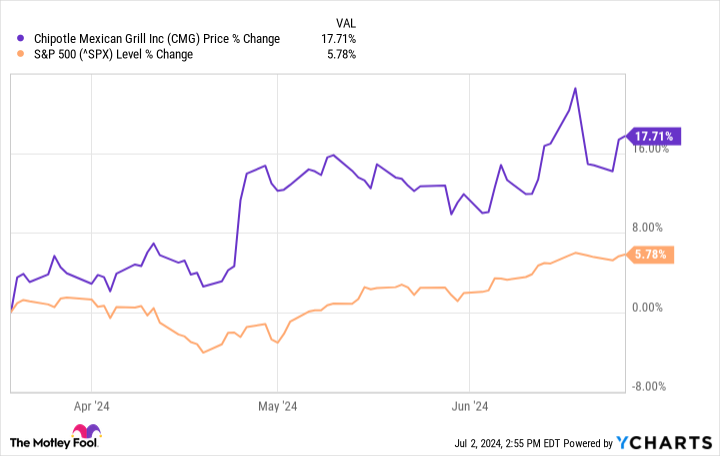

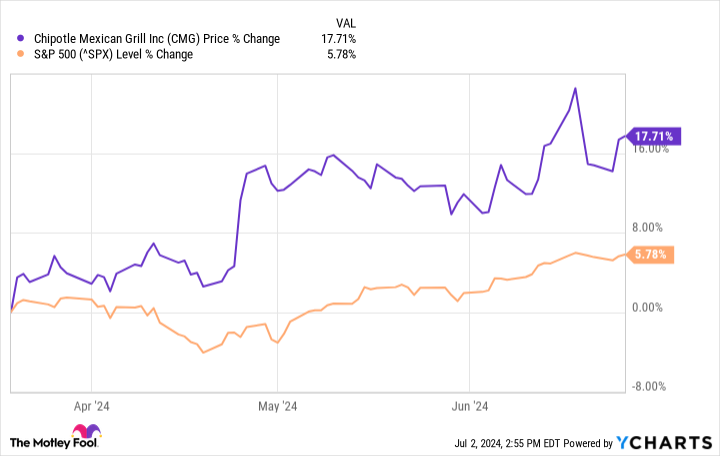

It may not have created any shareholder value with the stock split but Chipotle did create plenty of buzz. From the time the split was announced through when the split actually happened, Chipotle stock outperformed the S&P 500 by a wide margin — investors were clearly excited.

Now that Chipotle’s stock split is in the past, excitement is ebbing, which has led to the lower stock price.

What to do now

Don’t misunderstand: It was never a foregone conclusion that Chipotle stock would rise with the announcement of the split and then fall afterward. Investor sentiment can drive stock prices in any direction over the short term and sentiment is intrinsically unpredictable.

The actionable takeaway from all of this for investors is that there are things that can drive a stock’s price over the short term. But sometimes these are things that don’t actually create value, such as with stock splits. Therefore, these aren’t things that should demand any focus.

Rather, investors in Chipotle (and other stocks) should develop an investment thesis — a pithy explanation of how a company can create value in coming years. While an investment thesis plays out, market sentiment will rise and fall, creating volatility with a stock price. But those who calmly hold through the volatility can be rewarded with big gains.

Over the long term, weightier matters such as revenue growth and profit margin improvements have a much greater impact on a stock’s price than a split. And because this is true, long-term investors need to focus on those things.

For Chipotle shareholders who only bought shares because of the stock split, I’d say that you have more research to do before deciding whether this is a stock that you want to own for the long term. But allow me to give you a head start by explaining why the company can at least increase its revenue.

Chipotle owns all of its U.S. restaurants and it had almost 3,500 as of the end of its first quarter of 2024. However, in coming years, it plans to open hundreds of additional locations. Because these will also be owned by the company, it’s likely that the company’s revenue will meaningfully grow. And revenue growth is one of the most important things for a winning stock.

For Chipotle shareholders who do have an investment thesis that’s unrelated from the stock split, be encouraged that nothing has fundamentally changed with the business. The stock is just down as sentiment adjusts like it always does.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,525!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,621!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $366,492!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of July 2, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

The Stock Split Is Over for Chipotle Mexican Grill and Shares Have Quickly Dropped More Than 10%. What It Means for Investors. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel