As global markets navigate through volatility driven by growth concerns and technical factors, investors are increasingly seeking stability in their portfolios. With major indexes experiencing significant swings, dividend stocks offer a reliable income stream and potential for long-term growth. In the current market environment, a good dividend stock typically combines a strong balance sheet with consistent earnings and a history of stable or growing dividends. These characteristics can provide both income and resilience against market fluctuations.

Top 10 Dividend Stocks

|

Name |

Dividend Yield |

Dividend Rating |

|

Tsubakimoto Chain (TSE:6371) |

4.15% |

★★★★★★ |

|

Allianz (XTRA:ALV) |

5.39% |

★★★★★★ |

|

Guaranty Trust Holding (NGSE:GTCO) |

6.97% |

★★★★★★ |

|

Huntington Bancshares (NasdaqGS:HBAN) |

4.56% |

★★★★★★ |

|

Premier Financial (NasdaqGS:PFC) |

5.39% |

★★★★★★ |

|

HUAYU Automotive Systems (SHSE:600741) |

5.10% |

★★★★★★ |

|

FALCO HOLDINGS (TSE:4671) |

6.86% |

★★★★★★ |

|

James Latham (AIM:LTHM) |

5.67% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.64% |

★★★★★★ |

|

E J Holdings (TSE:2153) |

3.95% |

★★★★★★ |

Click here to see the full list of 2087 stocks from our Top Dividend Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Dividend Rating: ★★★★☆☆

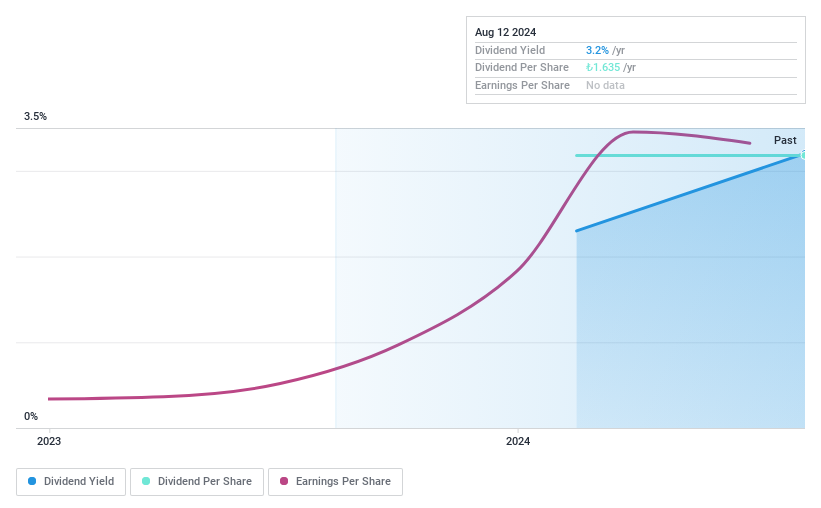

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi offers savings finance for purchasing houses and cars in Turkey, with a market cap of TRY9.19 billion.

Operations: Katilimevim Tasarruf Finansman Anonim Sirketi generates revenue primarily through its consumer financial services segment, amounting to TRY2.47 billion.

Dividend Yield: 3.2%

Katilimevim Tasarruf Finansman Anonim Sirketi recently reported a significant increase in six-month net income to TRY 732.22 million from TRY 115.19 million a year ago, though second-quarter earnings declined to TRY 26 million from TRY 81.11 million. The company has just started paying dividends, with a low payout ratio of 21.5% and cash payout ratio of 18.1%, indicating strong coverage by earnings and cash flows despite its highly volatile share price over the past three months.

Simply Wall St Dividend Rating: ★★★★☆☆

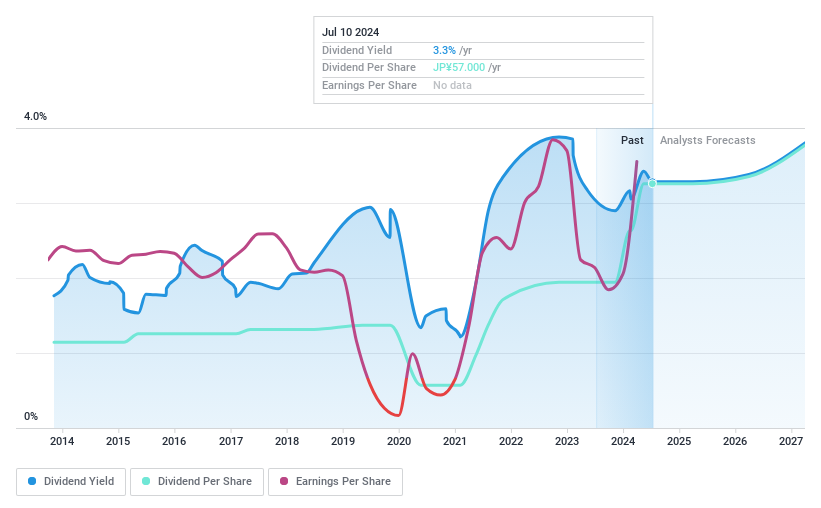

Overview: NHK Spring Co., Ltd. operates in Japan, offering products for the automobile, data communications, and industry and lifestyle sectors with a market cap of ¥338.56 billion.

Operations: NHK Spring Co., Ltd. generates revenue from several segments including Precision Parts (¥96.70 million), Seating Products (¥324.40 million), Suspension Springs (¥173.03 million), and DDS Business (¥67.20 million).

Dividend Yield: 3.6%

NHK Spring’s dividends are well covered by earnings and cash flows, with payout ratios of 24.2% and 37.3%, respectively. However, the dividend yield (3.62%) is below the top quartile of JP market payers (3.89%). Despite an unstable dividend history over the past decade, recent guidance revisions have increased dividends to JPY 63 per share for FY2025 due to strong earnings performance and a weaker yen exchange rate boosting profits.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. develops, manufactures, and sells gases, welding and cutting machines, and related products for industries processing steel plates, aluminum, and stainless steel with a market cap of ¥23.13 billion.

Operations: Koike Sanso Kogyo Co., Ltd.’s revenue segments include the development, manufacturing, and sale of various gases, welding and cutting machines, and related products for both domestic and international markets.

Dividend Yield: 3.6%

Koike Sanso Kogyo Ltd.’s dividends are covered by earnings and cash flows, with payout ratios of 26% and 27.1%, respectively. Despite a volatile dividend track record over the past decade, recent earnings growth of 54% suggests improved stability. The stock trades at a significant discount to its estimated fair value, yet its dividend yield (3.64%) remains below the top quartile of JP market payers (3.89%).

Make It Happen

-

Explore the 2087 names from our Top Dividend Stocks screener here.

-

Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

-

Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IBSE:KTLEV TSE:5991 and TSE:6137.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel