(Bloomberg) — Bond traders ceased fully pricing in a Federal Reserve interest-rate cut before July after gauges of service-sector activity and job openings were stronger than expected.

Most Read from Bloomberg

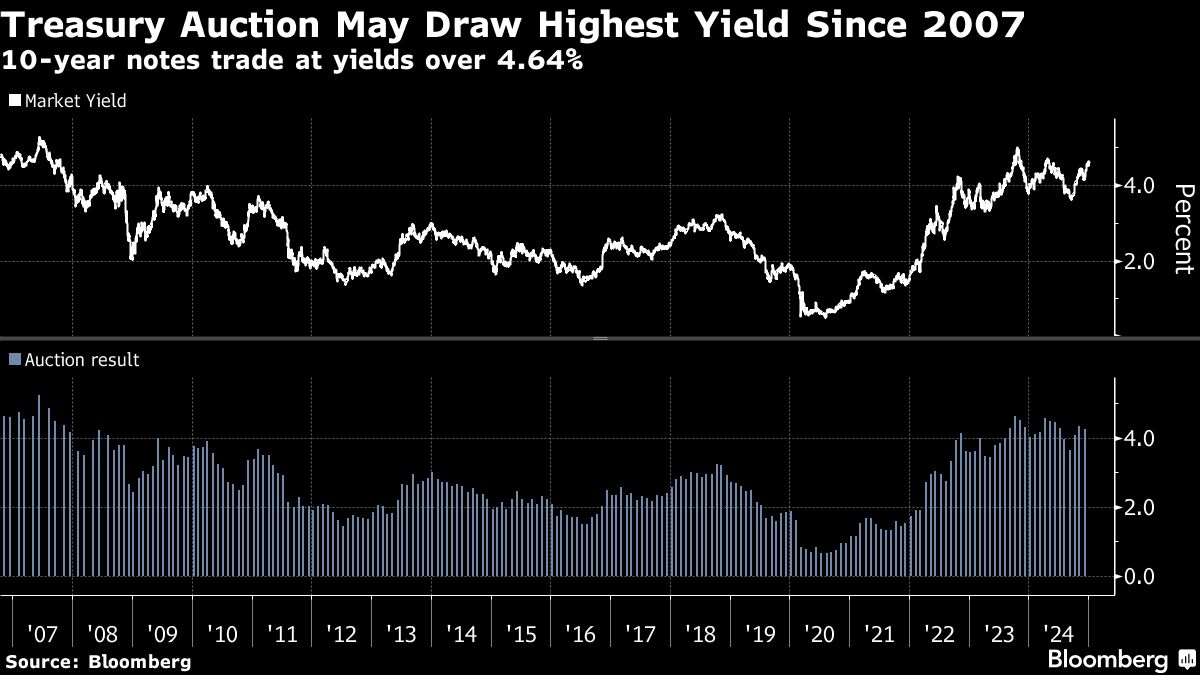

The latest collapse in expectations for additional Fed easing this year lifted Treasury yields ahead of an auction of 10-year notes that was already poised to draw the highest one in 17 years. Yields across maturities increased by at least two basis points, with the 30-year’s rising more than five basis points to the highest level in more than a year.

The data “reinforced the market’s view on a strong US economy and rates are not restrictive,” said Tracy Chen, a portfolio manager at Brandywine Global Investment Management.

Traders who as recently as late September were fully pricing in another Fed rate cut by March scrapped wagers there will be one until the second half of the year.

With critical December employment data to be released Friday, November JOLTS job openings unexpectedly increased while the December ISM services index rose more than anticipated, and a related gauge of prices paid by businesses jumped to the highest level since 2023.

“There’s still concern about elevated inflation risks that has created more of a term premium, there’s concern about these budget deficits needing to be financed, and there’s been a shift from last year that’s leading to more of a focus now on a soft landing — or no landing — as opposed to a hard landing,” said Michael Cloherty, head of US rates strategy at UBS Securities.

The 10-year note’s yield approached 4.69%, the highest level since May, while the 30-year bond’s exceeded 4.91% for the first time in more than a year.

While the yield on 10-year notes hit as much as 5% in late 2023, the current yield of 4.64% — if it holds through the 1 p.m. sale — would be the highest for newly auctioned securities since August 2007. In the post-pandemic period, 10-year auctions drew yields under 1%.

A 30-year bond auction on Wednesday stands to draw the highest yield since 2007 as well.

The 10-year yield has climbed from under 4.2% a month ago amid signs of economic resilience and sticky inflation after three Federal Reserve interest-rate cuts last year, as well as projected growth in borrowing needs. It’s part of a global trend that drove UK 30-year yields to the highest level since 1998 on Tuesday.

The US 10-year auction is a reopening, meaning it creates more of a 10-year note that came into existence in November and has a fixed interest rate of 4.25%. The highest fixed interest rate for 10-year notes in recent years was 4.5%.

Still, the auction result will be noteworthy because it suggests that the next new 10-year note — which will debut in February — could wind up with the highest fixed rate in nearly two decades.

–With assistance from Kristine Aquino.

(Adds economic data releases and updates yield levels.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel