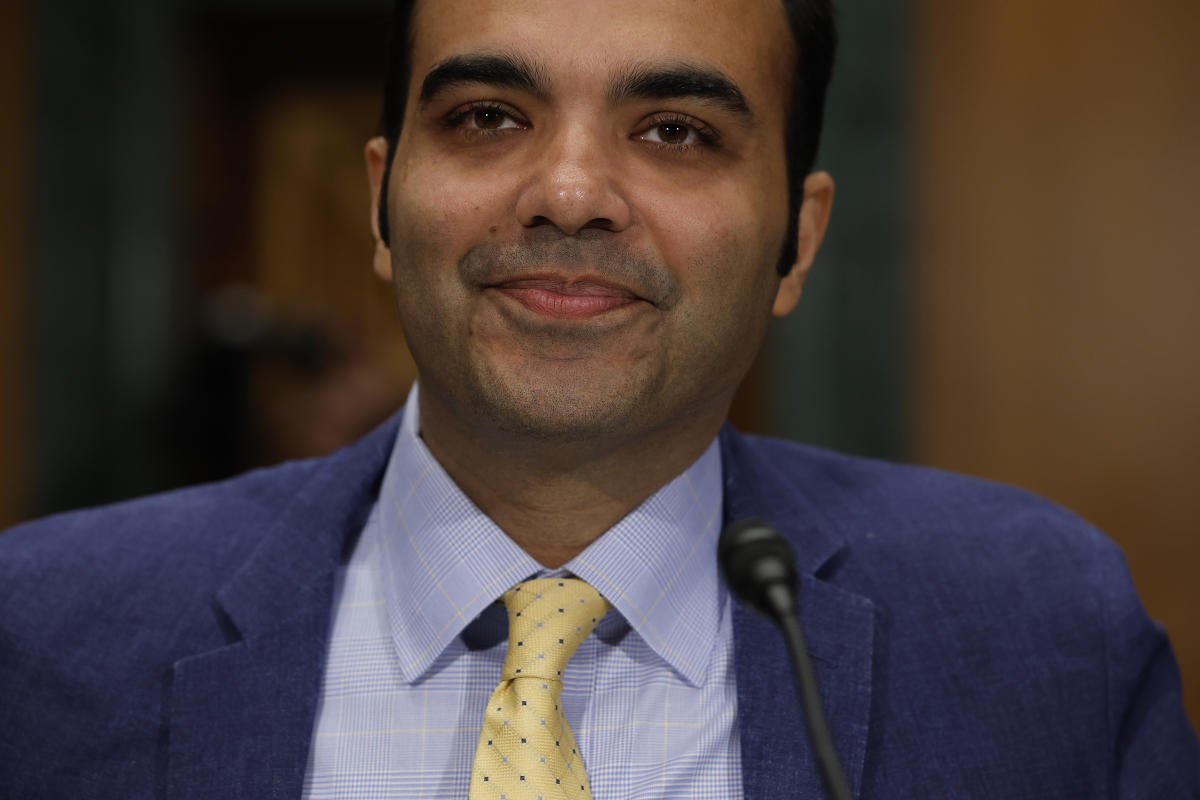

Rohit Chopra may not have much time left as director of the Consumer Financial Protection Bureau, with Donald Trump preparing to assume the presidency. But the regulator has been making the most of his likely final months on the job, telling Congress recently he didn’t think there was any reason for the agency to act like a “dead fish.”

This week, the CFPB took a flurry of small actions involving the credit card industry. Among the actions: It warned companies that devaluing customers’ points might be illegal and released a study knocking retail credit cards for offering particularly high interest rates. It also debuted a new credit card comparison tool using data the agency collects that, in theory, could offer an alternative to commercial sites that it argues often rely on kickbacks or affiliate marketing.

In an interview on Thursday, Chopra told Yahoo Finance that the credit card industry has a growing price-gouging problem and shared some of his thoughts on regulations that may be needed to curb it — even if it may be a while before another Democrat has a chance to implement them. Below is a transcript of the interview, which has been edited for length and clarity.

Weissmann: I want to take a step back. In general, how would you describe the way the credit card industry is currently treating consumers? Is its whole business model fundamentally problematic or are there just a bunch of discrete issues that need better regulation, in your view?

Chopra: I think the most noteworthy shift in recent years has been what many would consider price gouging. Very importantly, we have seen a shift in the margins on credit card interest rates. In other words, when you look at the cost of funds for big credit card issuers, and you look at other factors like consumer credit profiles, we’re seeing much fatter margins. And in some ways credit cards have been more expensive than at any time in recent history.

So just to put a finer point on it: Even when you consider [the Fed’s] interest rate hikes, those credit card interest rates went well beyond that. The net result is that as consumers were walking down the aisle and wondering why things like diapers were so expensive when they were swiping those purchases with a credit card, they were once again getting hit with high prices.

Read more: How do credit card companies make money?

Weissmann: What is your theory about why those margins have gotten so much fatter? What’s allowing them to engage in “price gouging,” as you put it?

Chopra: There’s a whole host of reasons and we’ve looked at many of them. Some of them range from real in-the-weeds type practices, like how they’ve changed their credit reporting to obscure to their competitors who their most profitable customers are, to things that are much more in the open. And one of those things is the major role that rewards cards have now played in the market.

You now see that rewards cards are not just being marketed to higher-income, prime borrowers. You’re seeing it penetrate across the marketplace. Consumers are really looking at choosing a credit card based on the rewards. That’s created a market environment where the interest rate itself is less salient, and the interest rates that people are paying often wipe out way more than the value of the rewards.

We’ve looked at this also from other angles, including how so many non-financial companies have essentially turned into credit card companies. We have department stores out there that are largely staying afloat because they’re churning credit cards.

Weissmann: You guys put out this credit card comparison tool. When I went online and tried it out, what struck me initially is that you can’t compare rewards very well on it, which is what most credit card shoppers — like you said — are interested in. What it does make easy is comparing the APR. I’m curious, was that intentional? Was that a way of signaling people should care more about interest rates? Or was it a limitation of the data?

Chopra: So here is what I would say about the tool. As you can tell, it’s not so fancy. But what we’re really trying to do is make the data public. Based on what we’ve done the past few years, we’re ordering companies to require data and then allowing people to visualize it with the goal that third-party comparison sites will also make use of this data. And it’s going to be updated periodically.

But you’re right that the way consumers are looking at it now, it’s mostly based on rewards, and I’m really concerned that the structure of credit cards today creates a financial incentive for credit card companies to push consumers into a treadmill of debt. Because when you’re signing up for a credit card, it’s typically a time when you feel you can pay off your balance month to month, and that means the interest rate is a lot less salient. You’re then focused on the sign-up bonus for the rewards, which is very natural. And what we find is that when people start paying interest on credit cards, we are not seeing those credit card issuers fess up to consumers that they can switch to a card with a lower rate.

The fundamental issue is credit card companies profit when people get into debt.

Weissmann: There are obviously a lot of these comparison tools online. Why do you feel like we need another one?

Chopra: We’ve done work and issued policy about rigged comparison sites. We think comparison tools are very important, but when the results are rigged, it ends up steering consumers into cards that may simply be profitable for the comparison website. And manipulated results are something that we’ve been increasing our scrutiny over.

I’ll give one example: You have a lot of airline points websites, not operated by airlines, operated by third parties who are actually making enormous sums of money through commissions and kickbacks from credit card companies. So part of it was again trying to make the data available so that there is some unbiased data set and that there is at least someplace where people can go where it’s not skewed.

Are we expecting tons of eyeballs on this? No, but we have found that making the data public so that it can be used and power other sorts of tools is really important.

Weissmann: You put out a report arguing that retailers are essentially responsible for a disproportionate share of the problems and bad debt in the industry. Do you think retail credit cards need more specific regulations?

Chopra: One of the places that we have heard a lot from is retail workers. I’ve also heard this from flight attendants and others that an increasing amount of their compensation is now tied to whether or not they can push credit cards on customers. When that moves into high-pressure tactics and quotas, that can often be a recipe for what we saw at places like Wells Fargo, that even created fake accounts. So trying to make sure that there isn’t too much pressure or coercion on frontline workers to push these cards, I think, could be something that we continue to do.

Weissmann: Donald Trump talked about imposing a cap on credit card interest rates during his campaign. Do you think that would be an appropriate move?

Chopra: I do think that there’s a growing consensus about the need for interest rate caps. We’ve done research to show that the rates that are being charged by the largest and most dominant credit card issuers are substantially higher than credit card issuers that may not be popular name brands. We’ve also looked at credit unions who are subject to a federal rate cap on their credit cards and many of them have very robust businesses. So I think that’s something that the incoming administration is clearly interested in and I think that’s going to be a place where there’s going to be more bipartisan discussion.

Disclosure: Yahoo Finance, through its personal finance affiliate marketing business, makes money from advertisers and partners, including credit card issuers. Read about our standards and editorial guidelines.

Read more: What credit card users need to know about the Fed’s December rate cut

Jordan Weissmann is a senior reporter at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel