(Bloomberg) — US government bonds fell Thursday after economic data and comments from President Donald Trump failed to provide a fresh catalyst to buy Treasuries at yields near the lowest levels since December.

Most Read from Bloomberg

Already several basis points higher on the day, Treasury yields remained near those levels after upward revisions to price gauges in the fourth-quarter US gross domestic product report and a bigger-than-expected jump in jobless claims. Meanwhile, Trump said tariffs would go into effect March 4 on imports from Mexico, Canada and China.

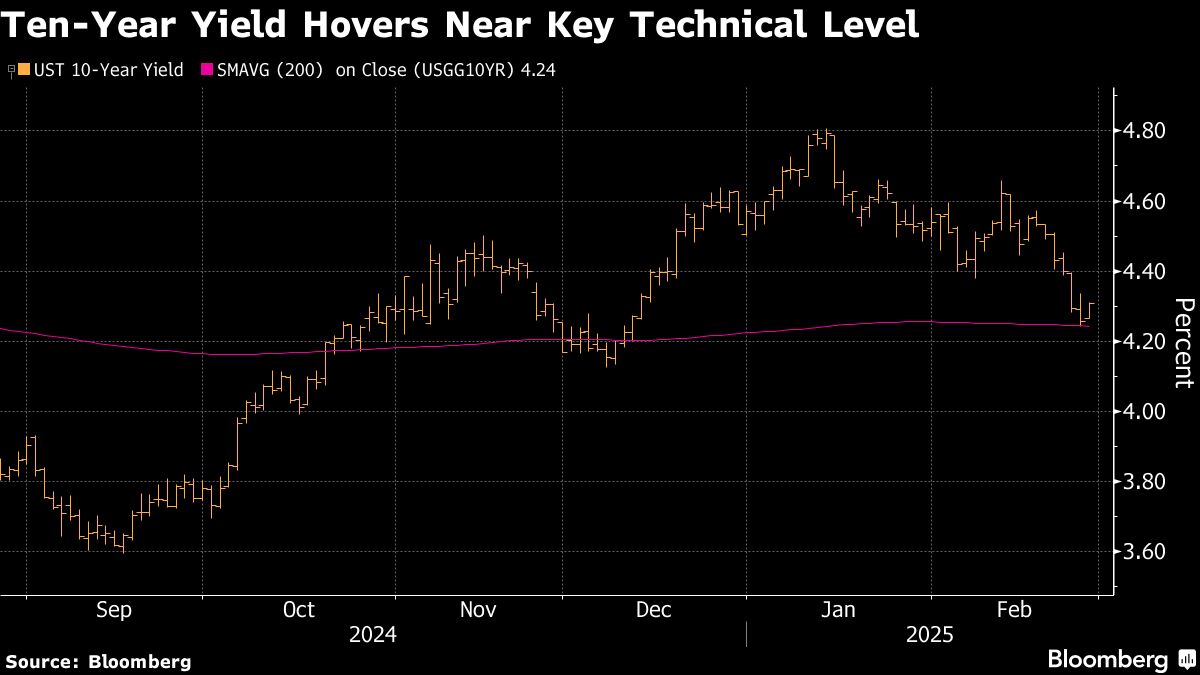

The bond market has rallied for six straight sessions, fueled by weaker-than-expected economic data and speculation that tariffs and US government retrenchment will make things worse, at least in the short term. Higher by about three basis points across maturities Thursday, Treasury yields remain some 30 basis points below their February peaks and on course for steep monthly declines.

“The market has been taken off guard in the last week with some US macro weakness,” said Evelyne Gomez-Liechti, strategist at Mizuno International.

The ICE BofA MOVE Index, which measures implied volatility for a basket of fixed-income assets, has risen to a six-week high.

In Thursday’s economic data releases, inflation gauges in fourth-quarter gross domestic product were revised higher, while initial jobless claims climbed to 242,000, the biggest weekly tally this year.

Mounting worries and confusion over the impact Trump’s threatened trade tariffs have spurred bets the Federal Reserve will need to shift its focus away from inflation to tackling economic weakness with lower interest rates.

That’s putting more attention on economic growth indicators, and traders have resumed fully pricing in two quarter-point cuts by the Fed this year.

“It’s probably early to call this a growth scare, but I think we’re potentially at the very early stages of a growth scare,” said Brian Quigley, senior portfolio manager at Vanguard.

The rally drove the 10-year Treasury yield down from a 2025 peak of 4.8% in mid-January to 4.25%, a key long-term average level that may slow its descent without fresh evidence of economic weakness. It’s on course for its seventh straight weekly decline, the longest since 2019.

Vanguard had “been viewing 10-year Treasuries in a 4.25% to 4.75% range, and we now see that range having shifted down a bit, maybe into 4% to 4.5%,” Quigley said. “That range likely holds absent another catalyst to drive growth concerns.”

The first major data sets for February — including the employment report — are set to be released next week.

“If growth does slow more meaningfully — if the unemployment rate begins to go up — I do think the Fed will begin to put more weight on growth risks,” Apollo Global Management’s Torsten Slok said on Bloomberg Television. Otherwise, upward pressure on inflation in goods and labor markets will keep interest rates higher for longer, he said in a note this week.

Specific drivers of lower yields in February included reports on consumer sentiment, retail sales and consumer confidence.

Markets face a “tug of war between potential inflation risks from the new US administration policies versus the potential consequences on the growth backdrop of that,” Laura Cooper, Head of Macro Credit and Global Investment Strategist at Nuveen, said.

There’s “quite choppy price action as markets digest the incoming data against what we’re seeing from the policy front as well,” she said.

–With assistance from James Hirai, Alice Gledhill and Alice Atkins.

(Adds economic data, comment and updates yield levels.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel