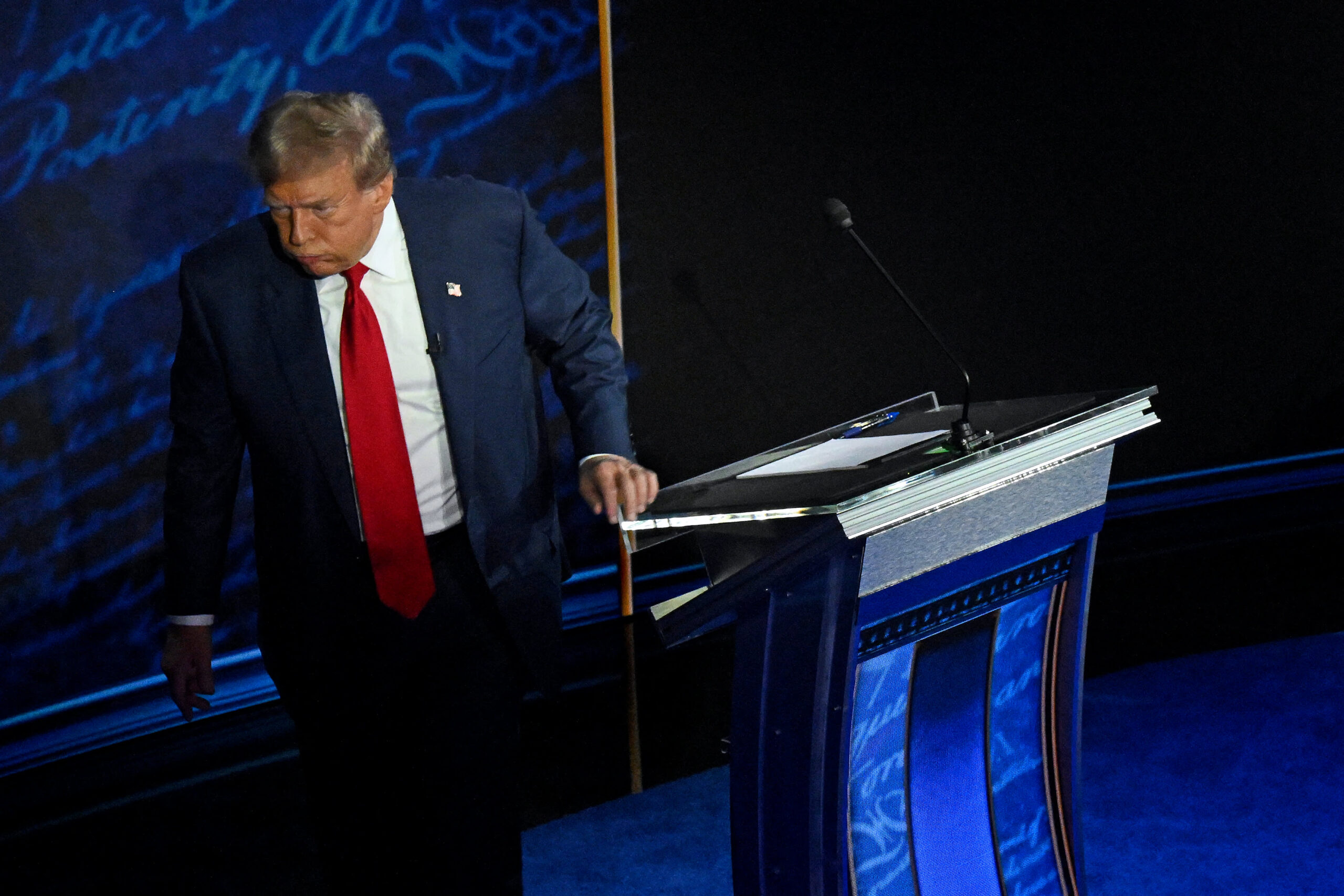

Former US President and Republican presidential candidate Donald Trump walks away during a commercial break as US Vice President and Democratic presidential candidate Kamala Harris take notes during a presidential debate at the National Constitution Center in Philadelphia, Pennsylvania, on September 10, 2024.

Saul Loeb | Afp | Getty Images

The share price of Trump Media plunged more than 14% before the opening bell Wednesday, a day after its majority shareholder Donald Trump delivered a widely panned presidential debate performance against Vice President Kamala Harris.

Investing in the Truth Social maker’s stock has come to be seen as a way to bet on the political fortunes of Trump, the Republican presidential nominee.

The company has acknowledged that its success at least partly depends on Trump’s popularity, and analysts say its value will rise or fall based on his electoral prospects.

The steep stock decline on the heels of the debate could signal that some of Trump’s supporters weren’t pleased with what they saw on Tuesday night.

Both liberal and conservative political commentators said Harris appeared more prepared, articulate and even-keeled on the Philadelphia stage than Trump, who repeatedly bit on bait she tossed to throw him off topic.

Harris’ team, projecting confidence, immediately challenged Trump to another debate after the first one ended.

Trump said he may not agree to another one.

Trump Media, which trades as DJT on the Nasdaq, had surged as much as 10% in intraday trading Tuesday, possibly indicating optimism about how Trump would fare in the debate.

The company’s gains on Monday and Tuesday offered a respite from a weekslong rout that has seen shares sink as much as 75% from their intraday high in late March, when Trump Media merged with a blank-check firm.

The slump coincided with President Joe Biden dropping out of the presidential race and endorsing Harris to replace him at the top of the Democratic ticket.

It also came in the run-up to the date when Trump and other company insiders can start selling their shares.

Trump owns nearly 59% of the company’s stock, a stake that at Wednesday’s pre-market price was worth nearly $2 billion.

It is unclear if Trump plans to start selling off his stake when a lock-up agreement lifts on Sept. 19.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel