(Bloomberg) — Distressed investors see one of the best opportunities in a generation to buy troubled US real estate assets as the commercial property crash continues to roil the market.

Most Read from Bloomberg

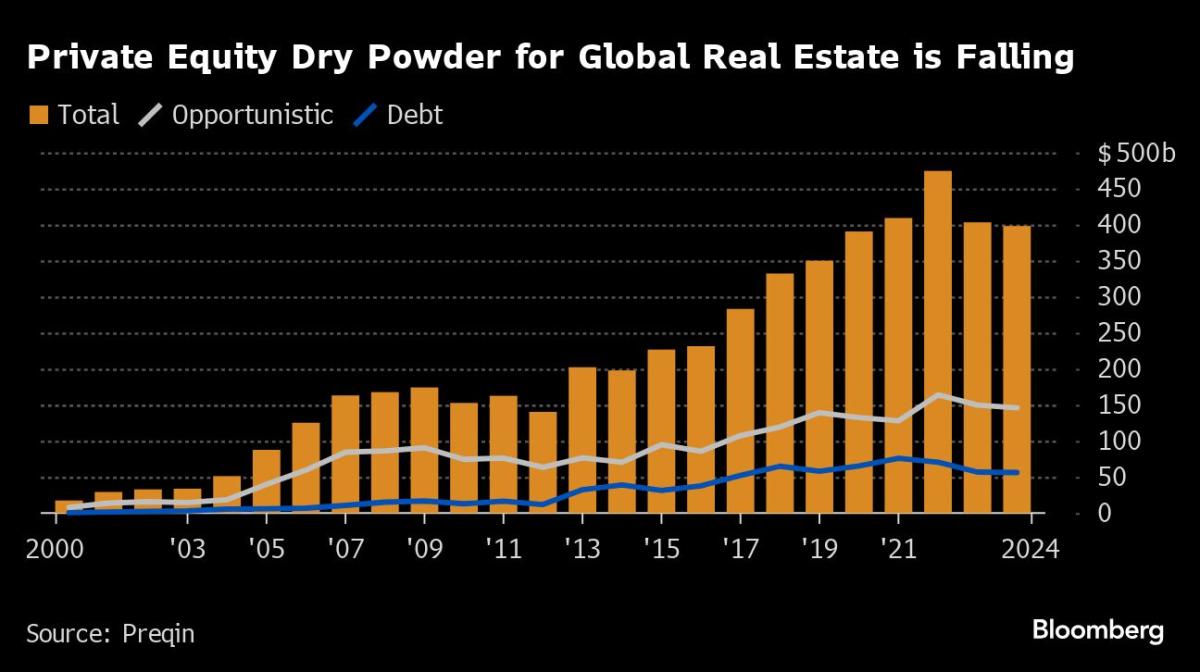

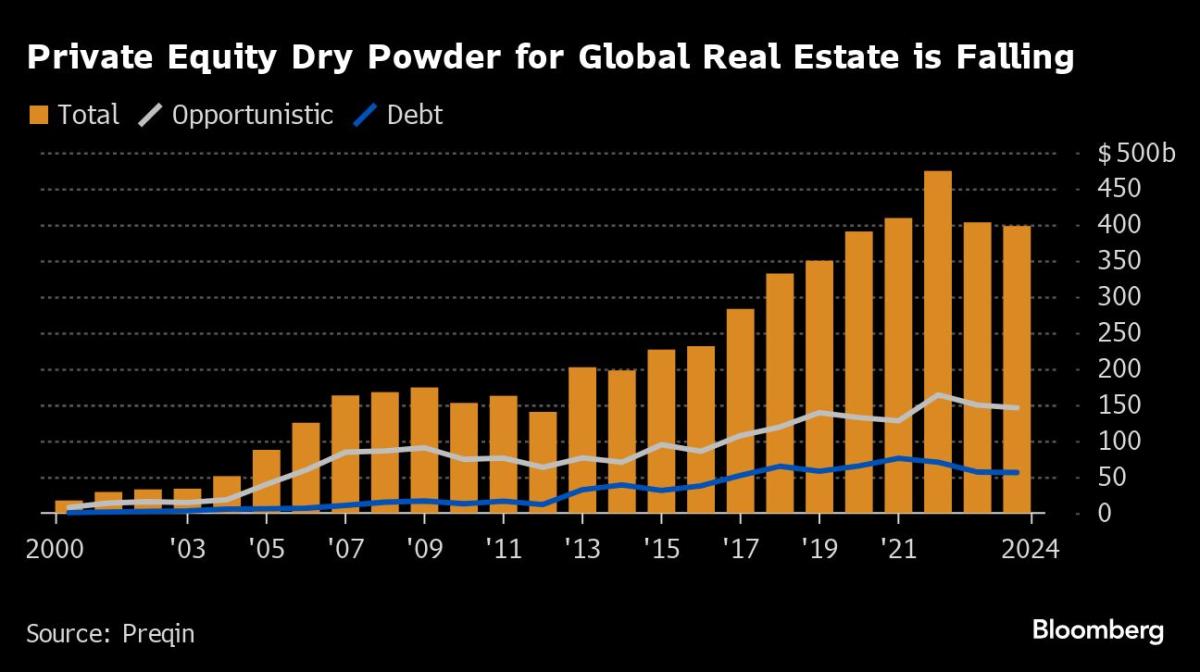

Private equity firms are already positioning to take advantage. About 64% of the $400 billion of dry powder that the industry has set aside for property investment is targeted at North America, the highest share in two decades, according to data compiled by Preqin.

The fear elsewhere is that a strong US bias will mean other parts of the world won’t draw the same demand, delaying the work out of troubled loans and properties there.

PE firms want to take advantage of deep American discounts after office values fell by almost a quarter last year, more than in Europe, following the pandemic work from home shift. Almost $1 trillion of debt linked to commercial real estate will mature this year in the US, according to the Mortgage Bankers Association, and rising defaults as borrowers fail to repay will create more options for buyers of distressed assets.

“Compared with the Savings & Loans crisis and 2008, we’re still in the first or second innings” when it comes to troubled assets, said Rebel Cole, a finance professor at Florida Atlantic University who also advises Oaktree Capital Management. “There’s a tsunami coming and the waters are pulling out from the beach.”

John Brady, global head of real estate at Oaktree, is similarly blunt about what’s ahead: “We could be on the precipice of one of the most significant real estate distressed investment cycles of the last 40 years,” he wrote in a recent note on the US. “Few asset classes are as unloved as commercial real estate and thus we believe there are few better places to find exceptional bargains.”

That focus means other regions could be left with bottom feeders — so called because of the low offers they typically make — as the main bidders. That risks dragging values in Europe and Asia down further, or leaving some markets stuck in stasis as sellers and lenders refuse to cave to super-lowball bids.

The strong North American economy, deeper markets and currency strength may contribute to “a delayed market recovery” outside the region, said Omar Eltorai, research director at data provider Altus Group.

The opportunity in the US is being driven by lenders pulling away from commercial real estate after borrowing costs rose and values plunged. Asset manager PGIM estimates a gap of almost $150 billion between the volume of loans coming due and new credit availability this year.

“When you start to get into the cycle, the big market is where people find the opportunities,” John Graham, chief executive officer at Canada Pension Plan Investment Board, said in an interview. For everything from private equity to private credit and commercial real estate “the US is the biggest and the deepest market.”

Smaller lenders look particularly vulnerable because of their real estate exposure, and there’s already been turmoil in the sector. New York Community Bancorp had to take a capital injection of more than $1 billion earlier this year after its financial challenges mounted. More regional bank failures are likely because of their property debt, according to Pimco.

Based on Oaktree analysis, the number of US banks at risk would exceed levels seen in the 2008 financial crisis levels if CRE values fell by only 20% from their peak. Office values there fell 23% last year, according to the IMF.

Barry Sternlicht, chairman of real estate investor Starwood Capital Group, has also indicated that he sees more problems ahead for lenders.

With regional banks, “you wonder what’s going on, like how could they not be experiencing larger losses, certainly in their office portfolios,” he said on an earnings call in May.

Starwood also hasn’t been immune to the troubles. Its real estate income trust tightened limits on investors’ ability to pull money from the vehicle to preserve liquidity and stave off asset sales.

Shrinking Pool

While the US looks attractive to private equity buyers, the overall pool of PE capital for CRE has shrunk. That will throw up some problems for credit investors, for example.

The amount of money set aside for real estate debt strategies globally by the firms shrank by 26% to $56.1 billion through May from the end of 2021, Preqin data show. That could, for example, limit buyer interest in non-performing CRE loans from Korea to China as loans sour.

“Dry powder is declining,” said Charles McGrath, an associate vice president at Preqin. Higher borrowing costs mean private equity players are “seeing a sharp decline in fund raising and transactions.”

One of the key deterrents for investors in Europe are doubts about the robustness of valuations of real estate and loans. They “may not always provide an accurate reflection of the true worth of the assets, especially in the light of changing market conditions,” the European Insurance and Occupational Pensions Authority wrote in a June report.

Banks in Germany, for example, update valuations of buildings they have financed less regularly than peers in the US, meaning it takes longer for problems to come to the surface. The lag in writedowns comes even as the amount of CRE debt with a loan to value ratio of more than 100% nears €160 billion ($173 billion), according to the region’s banking supervisor.

That suggests there’s a huge wave of defaults and soured asset sales to come through on balance sheets, though the structure of the debt means it could take years for the full scale of the trouble to appear.

The situation is likely to get worse, with a further increase in non-performing loans, European Banking Authority Chair Jose Manuel Campa told Bloomberg Television. “This is a trend that’s not going to be short term.”

–With assistance from Anna Edwards.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel