(Bloomberg) — US stock futures indicated a weaker open on Wall Street as traders awaited data on job openings to guide their outlook on the economy. Nvidia Corp. dropped 1.6% in pre-market trading.

Most Read from Bloomberg

Contracts on the S&P 500 dipped 0.4%, a sign that the decline may moderate after yesterday’s 2.1% selloff. Losses in Europe and Asia were deeper, with traders still rattled by the speed and severity of the US retreat. The VIX Index climbed above 22, while a gauge of the dollar weakened for the first time in six days.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

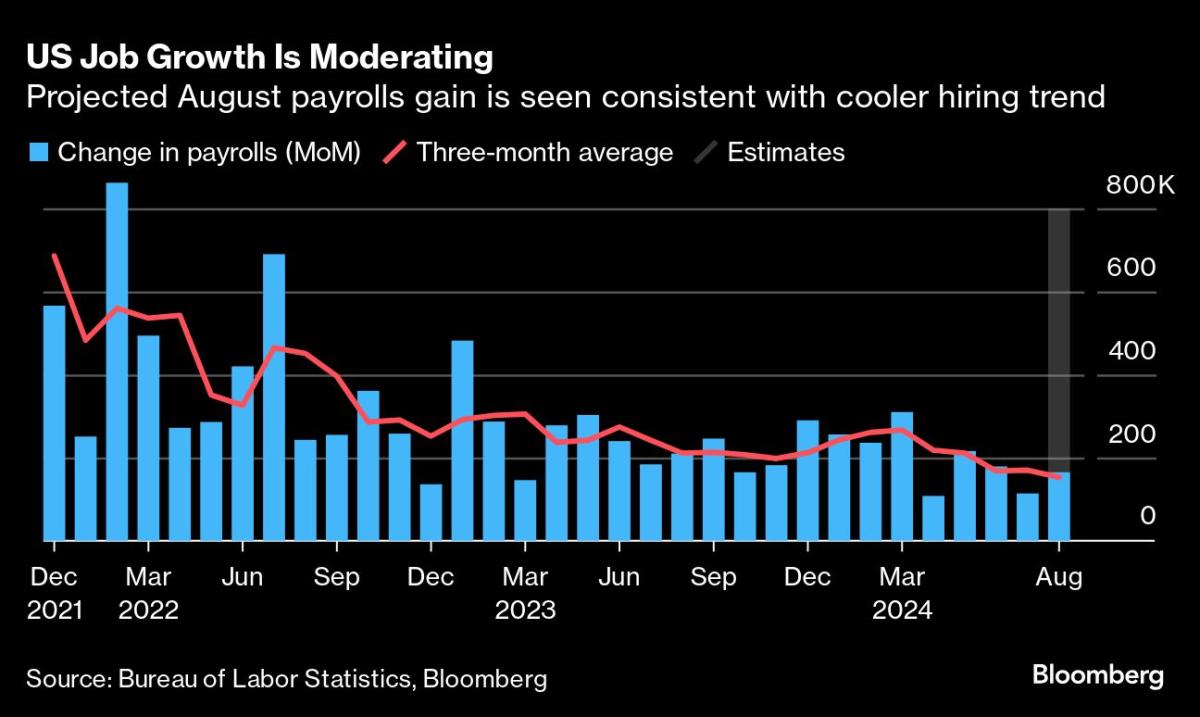

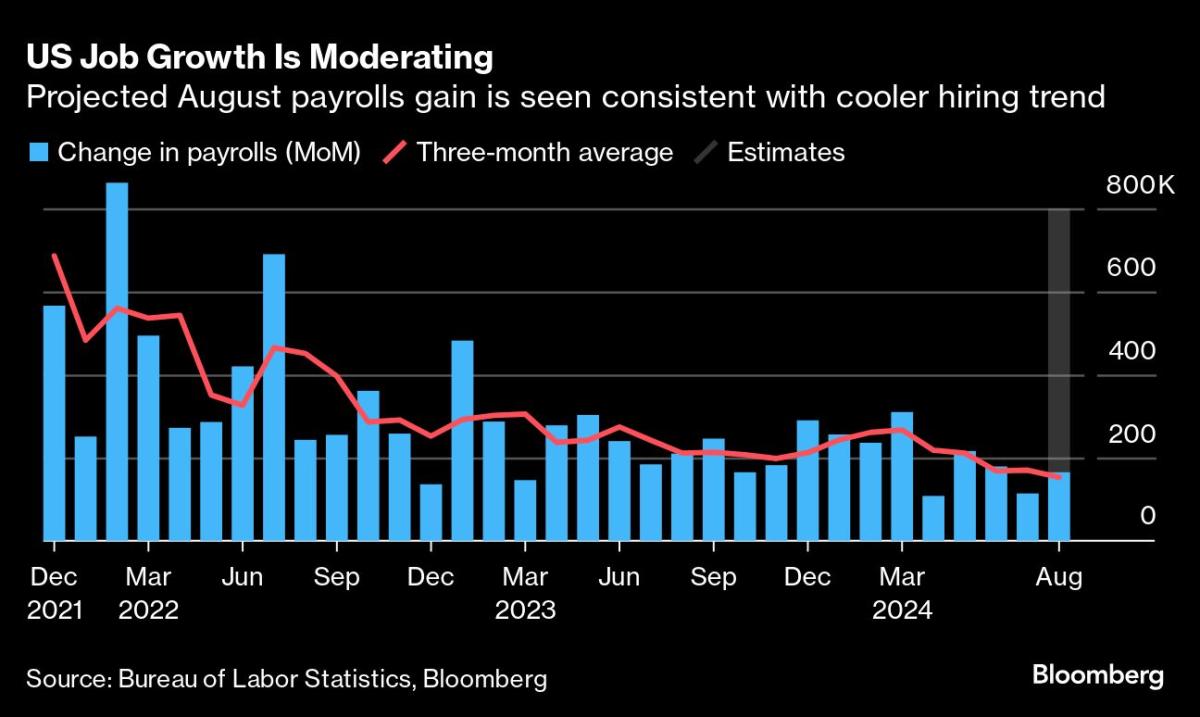

A US job openings report due on Wednesday is expected to show further cooling in the labor market, following yesterday’s data showing a fifth consecutive month of contraction in manufacturing activity. As the market’s focus shifts from inflation to concerns over economic growth, negative macro data is increasingly translating into pain for stocks and other risk assets.

For now, traders are anticipating the Federal Reserve will start easing policy in September and reduce rates by more than two full percentage points over the next 12 months — the steepest drop outside of a downturn since the 1980s. Payrolls data due on Friday is considered crucial in shaping the magnitude of the initial rate cut.

“A disappointing number will spook markets a little bit,” said Neil Birrell, chief investment officer at Premier Miton Investors. “There’s just a lack of certainty around. I’m not brave enough to say buy the dip on Wednesday when the numbers are out on Friday.”

Treasuries gained for a second day as traders added to bets on a jumbo cut from the Fed, with the yield on two-year notes down to 3.84%. The chance of a half-point reduction later this month has increased to about 30% from 20% last week, according to swaps.

Oil sank even further after crashing to the lowest level this year. Brent futures fell to around $73 a barrel on growing concerns that fragile demand and restored supplies from OPEC+ will create a new glut. West Texas Intermediate dropped under $70 for the first time since early January.

Key events this week:

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Canada rate decision, Wednesday

-

US job openings, factory orders, Beige Book, Wednesday

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 6:33 a.m. New York time

-

Nasdaq 100 futures fell 0.5%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The Stoxx Europe 600 fell 1%

-

The MSCI World Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1054

-

The British pound was little changed at $1.3118

-

The Japanese yen rose 0.2% to 145.12 per dollar

Cryptocurrencies

-

Bitcoin fell 2.7% to $56,631.62

-

Ether fell 2.7% to $2,397.4

Bonds

-

The yield on 10-year Treasuries declined two basis points to 3.82%

-

Germany’s 10-year yield declined four basis points to 2.23%

-

Britain’s 10-year yield declined three basis points to 3.96%

Commodities

-

West Texas Intermediate crude rose 0.3% to $70.46 a barrel

-

Spot gold fell 0.3% to $2,486.19 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Aline Oyamada.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel