(Bloomberg) — Wall Street was poised for a stronger open after two days of wobbles, as confidence mounted that the Federal Reserve and other central banks will cut interest rates in the coming months.

Most Read from Bloomberg

Contracts on the Nasdaq 100 Index added 0.7%, while those on the S&P 500 rose 0.4%, as traders waited to see if PCE inflation — a gauge closely followed by the Fed — will confirm the picture of moderating prices. Europe’s main stock index rallied to a record high as euro-area inflation eased to a three-year low, cementing the case for the European Central Bank to cut rates in September.

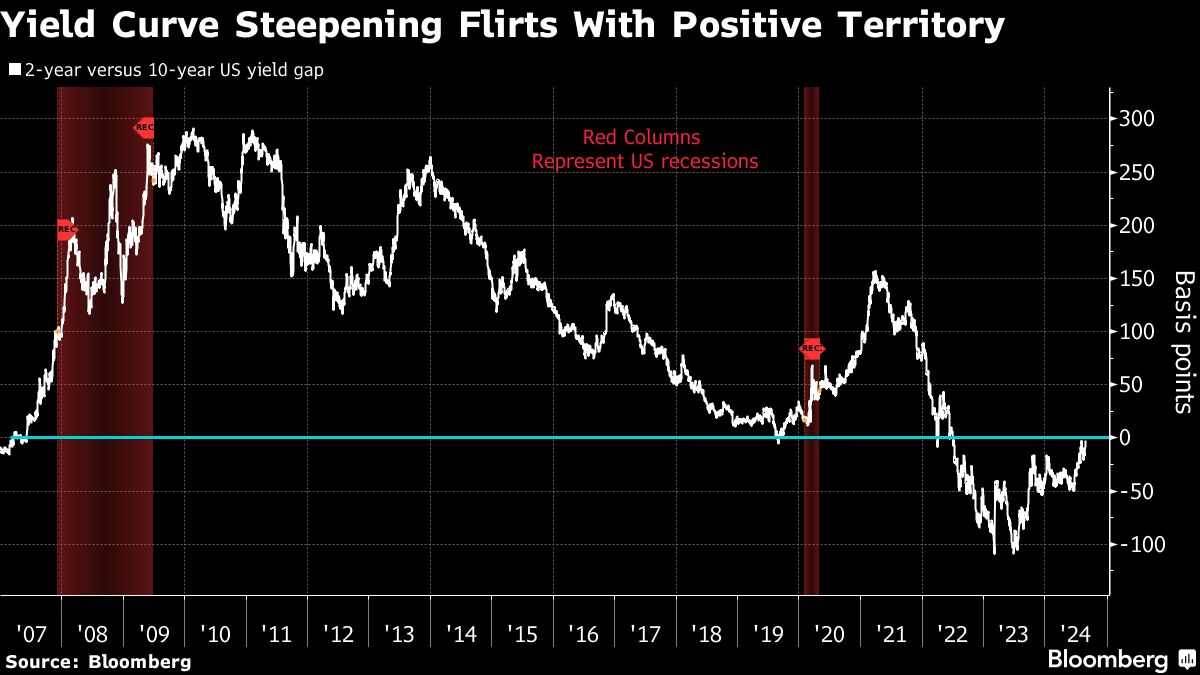

Global stocks are on track for a fourth month of gains, with most data indicating the Fed has tamed inflation without tipping the economy into recession. While economists expect a slight pick-up in the year-on-year PCE reading later on Friday, that’s not expected to derail prospects for a September rate cut.

“When rates ease, it lifts all boats,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management in Geneva. “Inflation is looking better and economic growth remains decent and that’s the environment we are in.”

Markets expect the Fed to cut rates next month by as much as 50 basis points, and by another half-point by year-end. Ielpo said that for traders watching for monetary-policy clues, the US monthly payrolls report due next week would be even more significant than today’s PCE reading.

“Inflation is a done deal so markets are more likely to pay attention to what’s happening to employment and growth,” he added.

Expectations for monetary easing saw investors pump $20.7 billion into global bond funds this past week, with Treasuries recording the largest inflow since last October, Bank of America said, citing EPFR Global data. Treasuries were on course for their longest monthly winning streak in three years.

But the wagers have weighed on the dollar, which edged lower against a basket of currencies and was set for its worst monthly performance this year.

Among individual stock movers, Nvidia Corp. edged higher in premarket trading, following the previous day’s 6% drop, while other tech names, including Marvell Technology Inc., Autodesk Inc. and Dell Technologies Inc. were boosted by forecast-beating results.

In commodity markets, oil was steady, though the main crude benchmark is set for its first back-to-back monthly loss this year on fears that slowing economic growth, especially in China, will impact demand. Iron ore futures pulled back slightly after jumping by about 10% in 10 days to breach $100 a ton.

Key events this week:

-

US personal income, spending, PCE; consumer sentiment, Friday

Stocks

-

The Stoxx Europe 600 rose 0.3% as of 12:35 p.m. London time

-

S&P 500 futures rose 0.4%

-

Nasdaq 100 futures rose 0.8%

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The MSCI Asia Pacific Index rose 0.7%

-

The MSCI Emerging Markets Index rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1083

-

The Japanese yen fell 0.2% to 145.28 per dollar

-

The offshore yuan rose 0.2% to 7.0798 per dollar

-

The British pound was little changed at $1.3178

Cryptocurrencies

-

Bitcoin was little changed at $59,528.84

-

Ether fell 1% to $2,516.15

Bonds

-

The yield on 10-year Treasuries declined one basis point to 3.85%

-

Germany’s 10-year yield declined two basis points to 2.26%

-

Britain’s 10-year yield declined four basis points to 3.98%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Zhu and Catherine Bosley.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel