(Bloomberg) — A banner year for US stocks is ending badly as a retreat in technology stocks extended a stretch of losses that began when the Federal Reserve cooled expectations for interest-rate cuts two weeks ago.

Most Read from Bloomberg

The S&P 500 pared declines after falling as much as 1.7% earlier. Apple Inc., Tesla Inc. and Microsoft Corp. weighed on the index. The Nasdaq 100 fell 0.8%.

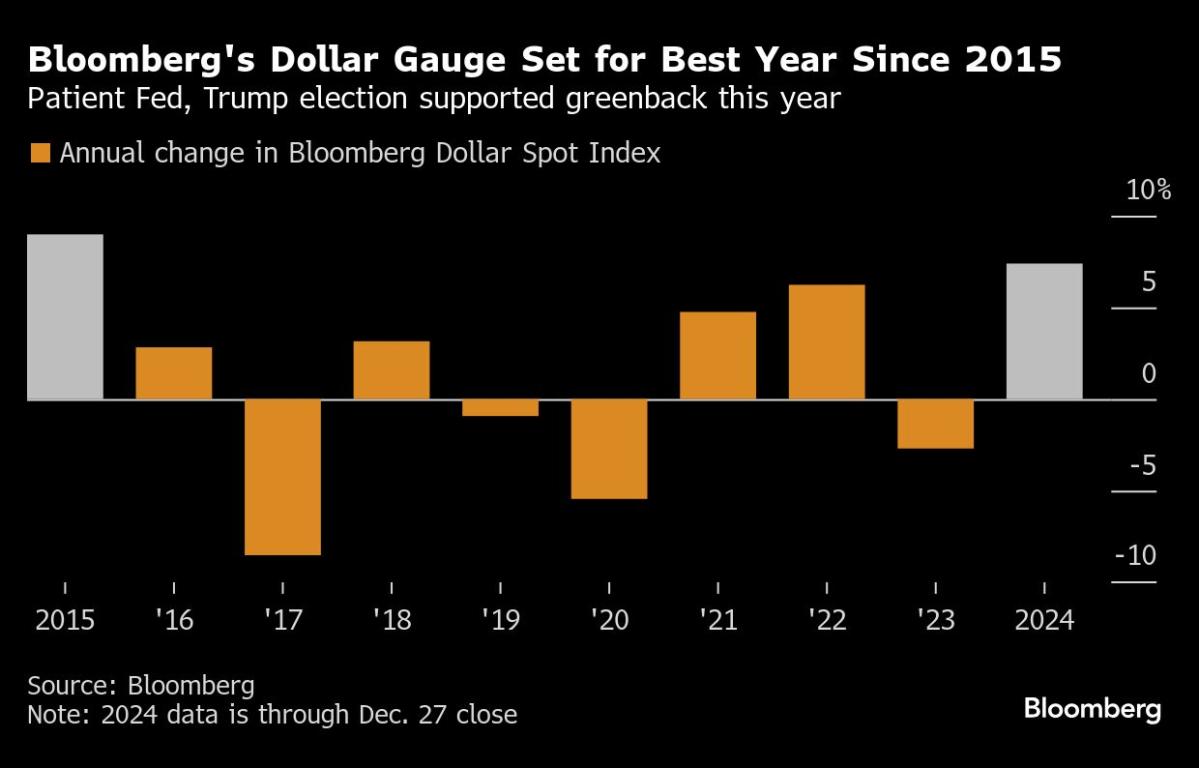

Treasuries rallied, with the 10-year yield hovering around 4.55%. Yields had dropped further after Chicago Purchasing Managers’ Index data showed an unexpected decline. Data on Monday also showed pending sales of US homes increasing for a fourth month in November to the highest level since early 2023. The Bloomberg Dollar Spot Index rose to its highest since November 2022.

This year, the so-called Magnificent Seven cohort of US tech giants has driven a 25% advance in the S&P 500, while prompting some to worry that the gains are too concentrated in a small group of names. Still, few are calling for the rally to end and none of the 19 strategists tracked by Bloomberg expects the S&P 500 to decline next year.

“In these moments, it’s best to stay put,” said Nicolas Domont, a fund manager at Optigestion in Paris. “The US remains the place to be. Growth stocks continue to outperform and earnings forecasts are good, so there are good reasons to remain optimistic.”

Elsewhere, Europe’s Stoxx 600 index retreated, while Asian stocks snapped five days of gains. Trading volumes were thinner because of the holiday season.

“There’s a little bit of trepidation heading into year-end, owing in part to uncertainty over how the international trade picture may take shape in 2025,” said Tim Waterer, chief market analyst at Kohle Capital Markets Pty. “Some traders are taking risk off the table heading into year-end.”

It’s the final session of 2024 for some markets including Germany, where the DAX benchmark saw an 19% annual advance.

Deadly Crash

In Asia, shares in Jeju Air fell 8.7% in Seoul to a record low after a Boeing Co. 737-800 aircraft operated by the carrier crashed on Sunday, causing the death of all but two of the 181 occupants. Boeing shares dropped as much as 5.9% in US trading before paring declines.

Oil edged higher as traders focused on 2025 risks. Crude is heading for a loss this year, with trading confined to a narrow range since mid-October. Gold is set for one of its best years.

Jimmy Carter, the 39th president of the US, died Sunday at his home in Plains, Georgia. The US stock market has traditionally closed on the day of presidential funerals. The New York Stock Exchange, Nasdaq Inc.’s US equities exchanges and Cboe Global Markets Inc. will close Jan. 9, in observance of a national day of mourning for Carter.

Key events this week:

-

China manufacturing PMI, non-manufacturing PMI, Tuesday

-

New Year’s Day holiday, Wednesday

-

US construction spending, jobless claims, manufacturing PMI, Thursday

-

US ISM manufacturing, light vehicle sales, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.7% as of 1:03 p.m. New York time

-

The Nasdaq 100 fell 0.8%

-

The Dow Jones Industrial Average fell 0.7%

-

The MSCI World Index fell 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.3% to $1.0395

-

The British pound fell 0.3% to $1.2546

-

The Japanese yen rose 0.5% to 157.12 per dollar

Cryptocurrencies

-

Bitcoin rose 0.4% to $93,594.01

-

Ether rose 1.2% to $3,385.5

Bonds

-

The yield on 10-year Treasuries declined seven basis points to 4.55%

-

Germany’s 10-year yield declined three basis points to 2.37%

-

Britain’s 10-year yield declined two basis points to 4.61%

Commodities

-

West Texas Intermediate crude rose 1% to $71.30 a barrel

-

Spot gold fell 0.6% to $2,604.67 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Aya Wagatsuma and Julien Ponthus.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel