(Bloomberg) — Treasuries slipped as traders awaited economic data from the US for further signs that growth is flagging.

Most Read from Bloomberg

The two-year yield rose four basis points to 4.11%, climbing from a 3 1/2-month low ahead of the revised fourth-quarter gross domestic product print on Thursday. The rate is down about 30 basis points from a peak earlier this month, on track for its biggest monthly drop since September. The ICE BofA MOVE Index, which measures implied volatility on a basket of fixed-income assets has risen to a six-week high.

Mounting worries and confusion over the impact of President Donald Trump’s threatened trade tariffs have spurred bets the Federal Reserve will need to shift its focus away from inflation to tackling economic weakness with lower interest rates.

“The market has been taken offguard in the last week with some US macro weakness,” said Evelyne Gomez-Liechti, strategist at Mizuno International. “The risk now is whether the GDP data keeps adding to that ‘weaker-than-expected US macro’ narrative or not.”

That’s putting more attention than normal on the second reading for growth figures, said Michael Brown, senior research strategist at Pepperstone Ltd. Traders have resumed fully pricing in two quarter-point cuts by the Fed this year.

“If growth does slow more meaningfully — if the unemployment rate begins to go up — I do think the Fed will begin to put more weight on growth risks,” Apollo Global Management’s Torsten Slok said on Bloomberg Television.

Slok in a note this week warned upward pressure on inflation in goods and labor markets will keep interest rates higher for longer. Still, he added in the interview the Fed may pivot its attention to growth, and away from inflation, if the economy begins to slow more rapidly.

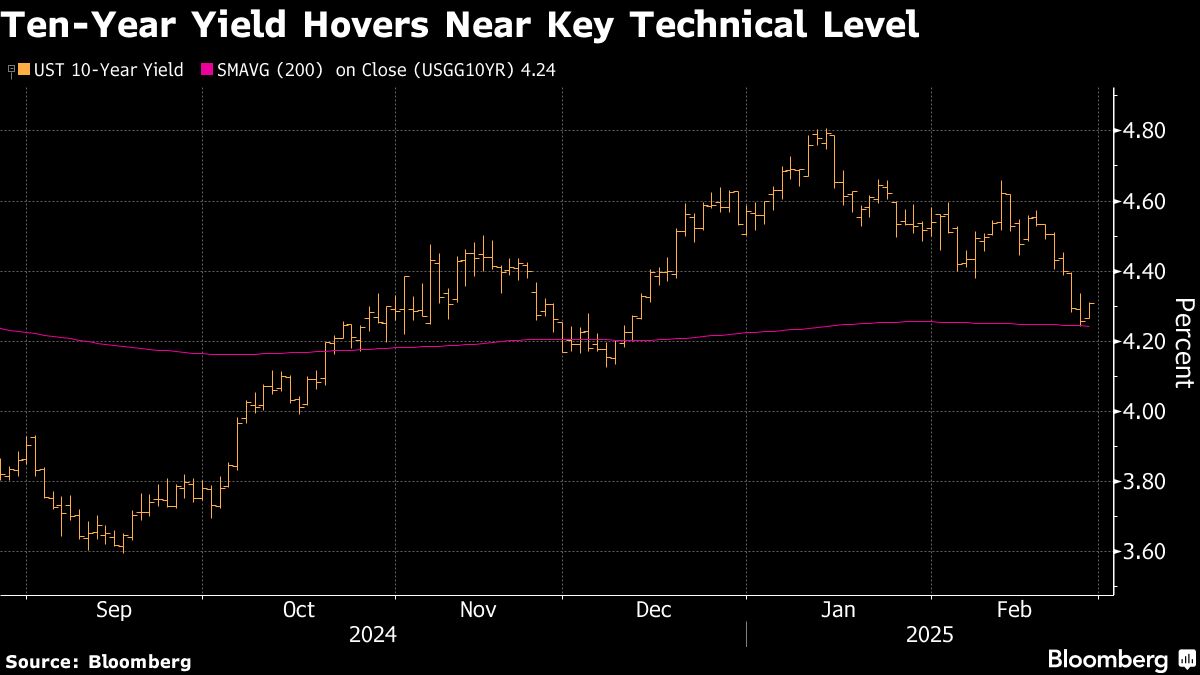

Soft readings for services PMI and home sales have added to signs that the economy is starting to slow, helping put 10-year yields on track for their seventh weekly decline, the longest streak since 2019.

Markets face a “tug of war between potential inflation risks from the new US administration policies versus the potential consequences on the growth backdrop of that,” Laura Cooper, Head of Macro Credit and Global Investment Strategist at Nuveen, said.

There’s “quite choppy price action as markets digest the incoming data against what we’re seeing from the policy front as well,” she said.

–With assistance from James Hirai, Alice Gledhill and Alice Atkins.

(Updates with prices, Slok comments and MOVE Index.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel