Dividend stocks can be dual-threat vehicles, offering investors the best of both worlds. Specifically, these equities can act as reliable passive income generators while simultaneously possessing the potential to increase your net worth through share-price appreciation.

If you’re interested in buying a handful of dividend stocks as part of a passive income strategy, consider investing $51,000 across these three attractive options: AT&T (NYSE: T), Gilead Sciences (NASDAQ: GILD), and the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI). Read on to find out why these three are superb passive income plays, each offering unique benefits to income-focused investors.

The case for AT&T

AT&T, a telecommunications giant with roots stretching back to 1885, offers a mouthwatering 5.9% dividend yield, making it one of the highest-yielding stocks in the S&P 500. With a payout ratio of 59.6% and a forward price-to-earnings (P/E) ratio of 8.4, AT&T presents an attractive option for value-oriented income investors.

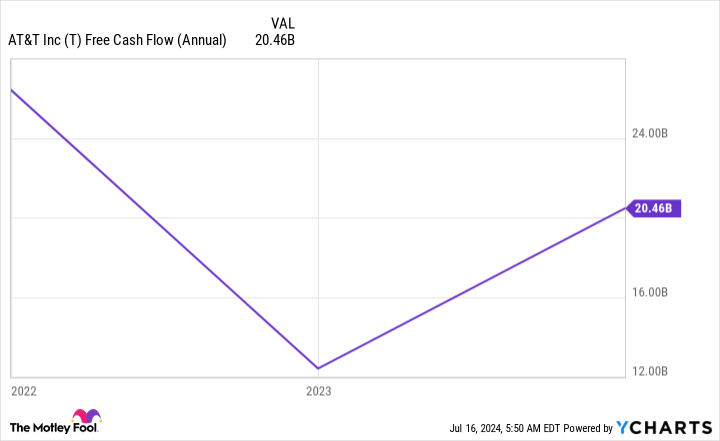

The payout ratio, while on the higher side, isn’t outlandish for a telecom company, especially considering its substantial cash flows (see graph below). AT&T’s meager P/E ratio also puts it in bargain territory compared to the broader market. To wit, the S&P 500 trades at over 22 times forward earnings right now.

More importantly, AT&T’s near-term outlook is promising given its plans to aggressively expand its 5G network and fiber-optic services. The telecom industry is also starting to come to a pricing equilibrium, a dynamic that should help boost profit margins over the next two years.

While AT&T faces fierce competition in the wireless market, its strong brand recognition, extensive infrastructure, and renewed focus on its core competencies provide a solid foundation for long-term success.

The case for Gilead Sciences

Gilead Sciences, a leading biotechnoloy company, offers investors a hefty 4.35% dividend yield. While this yield is lower than AT&T’s, it’s supercharged for a growth-oriented biotech company and significantly higher than the average S&P 500 yield of 1.32%.

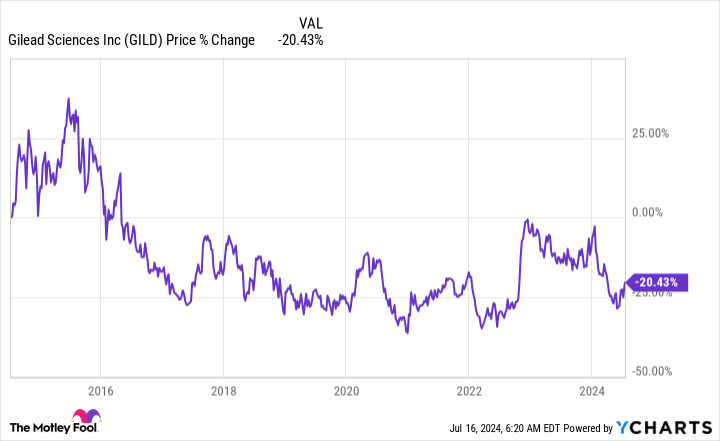

Known for its innovative medicines in HIV, hepatitis C, and oncology, Gilead continues to invest heavily in its pipeline to address areas of unmet medical need and create value for shareholders. That said, the biotech has experienced a number of setbacks in the clinic over the last 10 years, which has created a drag on its share-price performance (see graph below).

Moreover, Gilead’s shares are trading at only 18 times forward earnings, which is cheap for a large-cap growth stock. While the biotech will need to develop additional revenue drivers before its HIV portfolio faces serious generic competition in the next decade, Gilead arguably deserves the benefit of the doubt in light of its long history as a top innovator.

The case for JPMorgan Equity Premium Income ETF

The JPMorgan Equity Premium Income ETF, a relatively new player in the market, offers an impressive dividend yield of nearly 8%. Launched in 2020, this actively managed derivative income fund has quickly gained popularity among income-seeking investors due to its unique strategy and attractive payouts.

The exchange-traded fund (ETF) aims to provide steady income while maintaining lower volatility than the broader equity market, a combination that’s particularly appealing in today’s uncertain economic environment.

The JPMorgan Equity Premium Income ETF employs a distinctive approach to income generation, combining investments in U.S. large-cap stocks with equity-linked notes to generate income and manage risk. This strategy allows the fund to potentially benefit from market upswings while also providing downside protection.

One of its key strengths is its active management approach, which allows for adaptability in various market conditions. The fund’s managers can adjust the portfolio based on market trends, potentially offering stability during volatile periods and participation in broad-based gains during upswings.

Key takeaway

By investing $17,000 in each of these three high-yield options, investors can potentially generate around $3,000 in annual passive income. Together, these dividend-paying equities could form a diversified income-generating portfolio, capable of providing steady cash flow while also offering opportunities for long-term capital appreciation.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,026!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

George Budwell has positions in AT&T. The Motley Fool has positions in and recommends Gilead Sciences. The Motley Fool has a disclosure policy.

Want $3,000 In Passive Income? Invest $51,000 in These 3 High-Yield Dividend Plays was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel