AMD CEO Lisa Su delivering a keynote speech at Computex 2024, in Taipei, Taiwan, on June 3, 2024.” src=”https://s.yimg.com/ny/api/res/1.2/OYW6.RBXGVQhg3S9kwFacQ–/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA–/https://media.zenfs.com/en/investopedia_245/a46d7cb044123e0c08250eb20cdde858″ data-src=”https://s.yimg.com/ny/api/res/1.2/OYW6.RBXGVQhg3S9kwFacQ–/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA–/https://media.zenfs.com/en/investopedia_245/a46d7cb044123e0c08250eb20cdde858″>

What You Need To Know Ahead of AMD’s Earnings Report

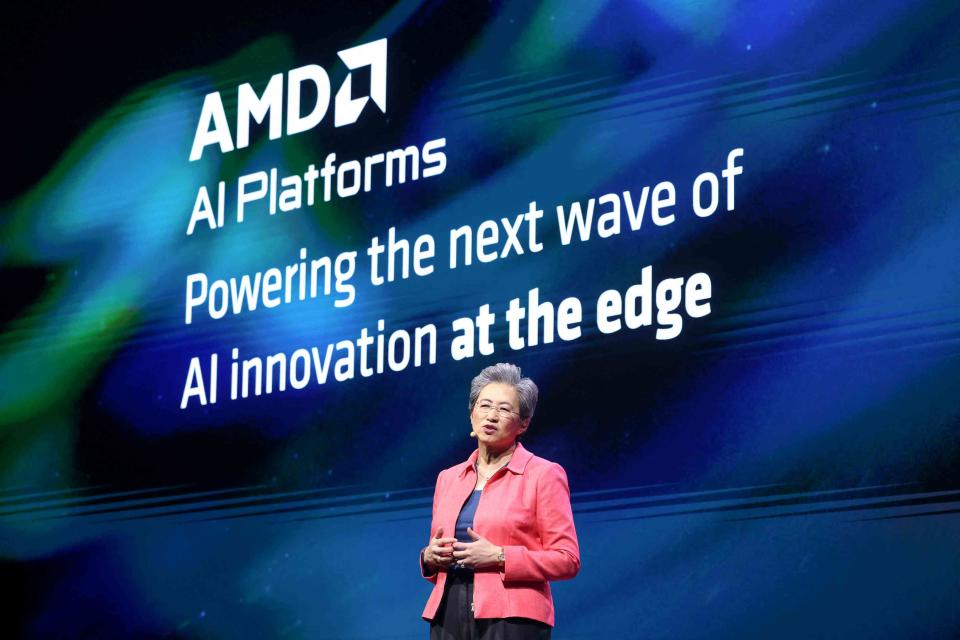

I-Hwa CHENG / AFP / Getty Images

AMD CEO Lisa Su delivering a keynote speech at Computex 2024, in Taipei, Taiwan, on June 3, 2024.

Key Takeaways

-

Advanced Micro Devices reports second-quarter earnings after the bell Tuesday.

-

Analysts expect revenue and earnings to rise from the year-ago period.

-

The chipmaker will report data center revenue, with analysts expecting a fresh record high for the quarter.

-

The company will also provide guidance for the third quarter and could give an updated outlook for full-year data center GPU revenue, which could help boost investor sentiment around the stock.

Advanced Micro Devices (AMD) is set to report second-quarter earnings after the bell Tuesday, with investors likely watching for record data center growth and strong guidance amid the artificial intelligence (AI) boom.

The chipmaker is projected to report revenue of $5.74 billion, according to estimates compiled by Visible Alpha, which would represent 7% growth from the year-ago period. Net income is expected to come in at $342.76 million, or 21 cents per share, an increase from the second quarter of 2023.

|

Analyst Estimates for Q2 2024 |

Q1 2024 |

Q2 2023 |

|

|

Revenue |

$5.74 billion |

$5.47 billion |

$5.36 billion |

|

Diluted Earnings Per Share |

21 cents |

7 cents |

2 cents |

|

Net Income |

$342.76 million |

$123 million |

$27 million |

Key Metric: Data Center Growth

AMD will report revenue for its data center segment, with investors watching for continued growth on AI demand.

In the first quarter, AMD’s data center business reached a record-high revenue of $2.3 billion, up 80% from the year-ago period, driven by sales of MI300 chips used for AI data centers.

Analysts expect data center revenue to be $2.79 billion, according to consensus estimates from Visible Alpha, which would be a quarterly record high for the segment.

Business Spotlight: Outlook and Investor Sentiment Amid AI Boom

AMD will provide its expectations for revenue for the third quarter, with investors likely watching closely as sentiment surrounding the stock has been less favorable than for many of its AI chipmaker peers.

Investors consider Nvidia (NVDA) and Broadcom (AVGO) as favorite stocks within the semiconductor industry, while AMD was among the “most unpopular,” according to Citi analysts who recently met with investors to gauge their views on chipmaker stocks.

AMD’s third-quarter revenue forecast is expected to be $6.66 billion, according to consensus estimates compiled by Visible Alpha. If AMD’s outlook were to surpass estimates, it could act as a positive catalyst for the stock.

Goldman Sachs analysts anticipate AMD will provide third-quarter guidance in line with consensus estimates. The analysts said they expect the chipmaker to update its data center GPU revenue forecast to $4.5 billion from $4 billion, which could also improve investor sentiment.

Shares of AMD have lost about 2% of their value so far this year, at $144.63 as of Wednesday’s close.

Read the original article on Investopedia.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel