(Bloomberg) — The world’s biggest steel producer sounded the alarm about an industry crisis in China that carries the potential to ripple around the globe and plunge the sector into a deeper downturn.

Most Read from Bloomberg

Conditions in China’s steel sector are like a “harsh winter” that will be “longer, colder and more difficult to endure than we expected,” China Baowu Steel Group Corp. chairman Hu Wangming told staff at the company’s half-year meeting, warning of a worse challenge than major traumas in 2008 and 2015.

Global investors are lasered onto China’s struggling economy, even as they also contemplate the possibility of a recession in the US, with the Federal Reserve moving toward interest rate cuts. For commodities including steel, the warning from Baowu underscores risks to demand and prices, as well as what ArcelorMittal SA, the industry No. 2, called an “aggressive” surge of exports from China.

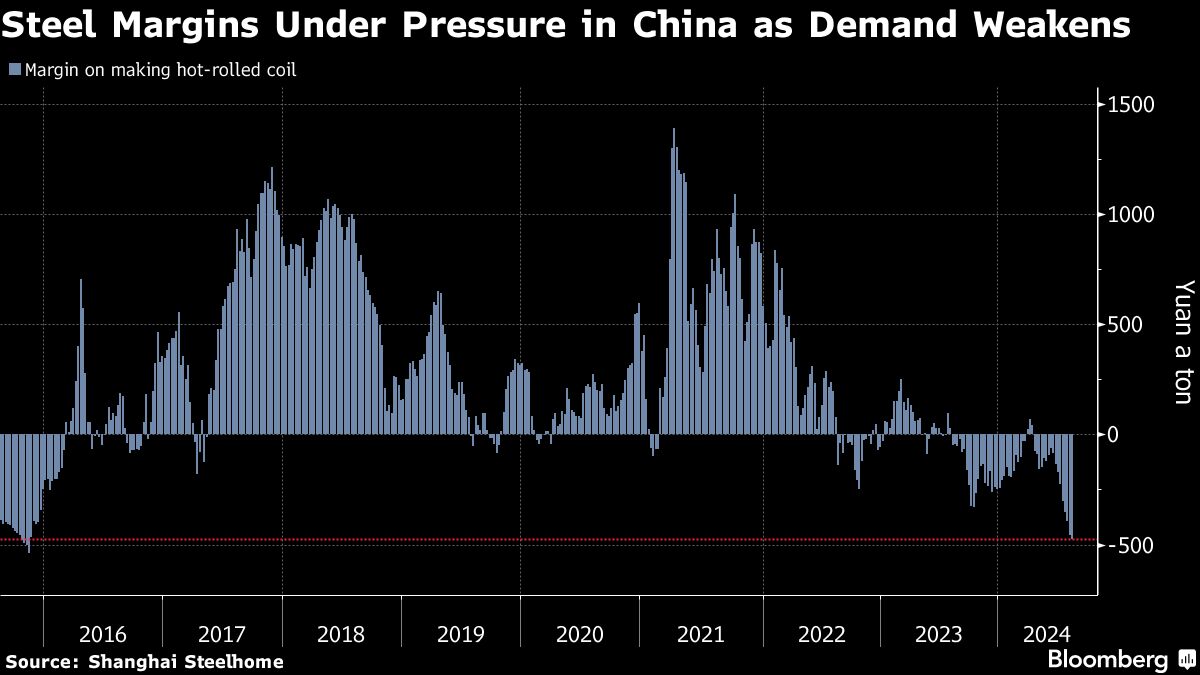

China’s steel market — by far the world’s largest — is flashing multiple warning signs as the protracted property downturn shows no signs of ending, while factory activity remains subdued. Baowu alone produces about 7% of the world’s steel, and its commentary is closely tracked to gauge the market mood in the Asian nation.

Hu’s stark message will likely be a worry for rivals across Asia, Europe and North America as they grapple with a fresh wave of Chinese exports, often by pushing for trade measures. Shipments from China are on track to reach about 100 million tons this year, the highest since 2016, as producers there scramble to offset a domestic slowdown.

German steel giant ThyssenKrupp AG on Wednesday highlighted the industry’s challenges by reporting a big slump in earnings. Earlier this month, ArcelorMittal said China’s rising exports had put the global market in an “unsustainable” condition.

Iron ore futures in Singapore fell as much as 3.4% to $95.20 a ton, the lowest level since May last year. The rout in steel markets was even more marked, with rebar futures in Shanghai plunging more than 4% to the cheapest since 2017. BHP, which gets much of its revenue selling iron ore to China, fell nearly 3%.

China’s country’s steel industry suffered devastating slumps during the Global Financial Crisis of 2008-2009, and again in 2015-2016. In both cases, the crises were ultimately resolved by massive stimulus — a prospect that looks more remote in 2024 as President Xi Jinping bids to reshape the economy.

Baowu didn’t offer much on the causes of the current downturn, focusing on how employees should respond: by preserving cash and minimizing risks.

“Financial departments at all levels should pay more attention to the security of the company’s funding,” a Baowu statement said, with a need to strengthen controls, including for overdue payments and detecting fake trades. “In the process of crossing the long and harsh winter, cash is more important than profit.”

(Updates with ThyssenKrupp earnings in sixth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel