(Bloomberg) — The yen strengthened while the dollar held on to its weakness as investors prepared for the Federal Reserve’s interest-rate cut later this month following another set of weak US jobs data.

Most Read from Bloomberg

Japan’s Nikkei 225 gauge fell 0.5% as the yen advanced for a third day against the greenback, helped along by a surprise increase in real wages that keeps the Bank of Japan on track for another rate hike. Shares in South Korea and Australia opened higher.

Treasuries were steady after the 10-year yield dropped eight basis points in the prior session, as a slowdown in the US labor market bolstered bets on steep rate cuts by the Fed. The move weakened an index of dollar strength by 0.3% on Wednesday, and supported gains in Australian and New Zealand bonds.

Across Wall Street, economists and money managers have been scouring economic data for signs of weakness that would force the Fed to kick off an aggressive rate-cutting cycle. The moves in Treasuries were partly driven by a reading on job openings, known as JOLTS, which trailed estimates and hit the lowest level since 2021. The report comes ahead of Friday’s hotly anticipated payrolls data.

“The markets may not be as nervous as they were a month ago, but they’re still looking for confirmation the economy isn’t cooling off too much,” said Chris Larkin at E*Trade from Morgan Stanley. “So far this week, they haven’t gotten it.”

US futures were little changed in Asian trading after the S&P 500 and Nasdaq 100 ended Wednesday down 0.2%. Nvidia Corp. saw its worst two-day plunge since October 2022 amid a report about the US Department of Justice sending out subpoenas as part of an antitrust probe.

In Japan, shares of Nippon Steel Corp. slipped after US President Joe Biden was said to block the Japanese steelmaker’s $14.1 billion takeover of United States Steel Corp.. Shares of US Steel closed 17% lower in New York, the biggest decline since April 2017.

Elsewhere, China is considering cutting interest rates on as much as $5.3 trillion of mortgages as authorities attempt to shore up the battered property market and economy. JPMorgan Chase & Co. dropped its buy recommendation for the nation’s stocks, citing weak policy support and potential volatility linked to the US presidential election.

Meanwhile, the Bank of Korea said its economy shrank as initially estimated in the second quarter. The data gives policymakers added incentive to shift their focus to supporting growth momentum after inflation slowed in line with projections.

With the Fed set to begin cutting rates in a few weeks, the main question now is how big the first reduction will be. Monthly US employment data due Friday will help determine the answer. The jobs report last month stoked growth fears and Chair Jerome Powell has made it clear the Fed is now more concerned about risks to the labor market than inflation.

“Markets seem to see September as a coin flip between 25 and 50 basis points,” said Neil Dutta at Renaissance Macro Research. “I think going 25 basis points risks the same market dynamic as skipping the July meeting. It’ll be fine until the next data point makes investors second guess the decision, fueling bets the Fed is behind the curve. Go 50 when you can, not when you must.”

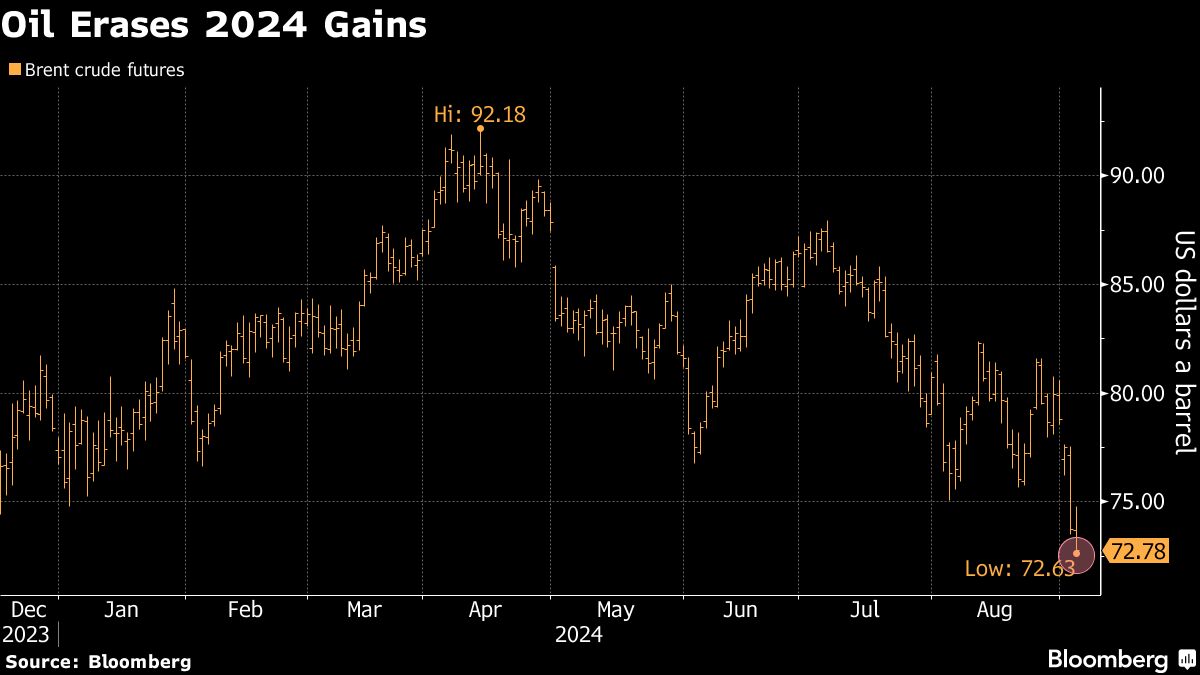

In commodities, oil steadied after declining to the lowest in more than a year Wednesday as persistent concerns about weakening demand overshadowed the potential for OPEC+ to delay supply increases. Meanwhile, gold traded at around $2,495 after finding support following the US job openings data.

Key events this week:

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 9:20 a.m. Tokyo time

-

Hang Seng futures rose 0.1%

-

Japan’s Topix fell 0.3%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Euro Stoxx 50 futures fell 1.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1080

-

The Japanese yen rose 0.1% to 143.55 per dollar

-

The offshore yuan was little changed at 7.1097 per dollar

Cryptocurrencies

-

Bitcoin rose 0.2% to $58,156.71

-

Ether was little changed at $2,456.45

Bonds

-

The yield on 10-year Treasuries was little changed at 3.75%

-

Japan’s 10-year yield declined two basis points to 0.865%

-

Australia’s 10-year yield declined five basis points to 3.90%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel