Agree Realty (NYSE: ADC) is a large net lease real estate investment trust (REIT) with a 4.9% dividend yield. For reference, that’s well above the 1.3% you would get from the S&P 500 index and the 4.1% of the average REIT, using the Vanguard Real Estate Index ETF (NYSEMKT: VNQ) as an industry proxy. There is a good reason for Agree’s high yield, but there’s also a long-term growth story here with plenty of room to run.

Agree Realty likes simple black boxes

Agree Realty is focused on single-tenant retail properties located in the United States. These assets are generally fairly similar to each other, which makes it relatively easy to buy and sell them. It also makes it relatively easy to replace a tenant if there is a vacancy. And there is a large market for retail properties in the United States, so the property type is fairly liquid, as well. While it’s true that any single location is high-risk because it’s occupied by just one tenant, Agree owns over 2,100 properties. That’s enough diversification to offset the risk posed by individual properties.

Adding the net lease structure to the picture makes Agree’s business model even more attractive. That’s because the REIT’s tenants are responsible for most property level operating costs. Although this is a vast simplification, Agree essentially just has to sit back and collect rent while focusing the majority of its effort on finding new properties to buy. Agree isn’t the only company that uses this model, of course, but it has been growing relatively quickly over the past decade or so.

To put a number on that, Agree’s dividend has been increased annually for roughly a decade. That said, it was cut in 2011, coming out of the Great Recession, due to the bankruptcy of a key tenant. But, at that point in time, Agree owned less than 100 properties, and it was a much different company because of that fact. More important on the dividend front is the growth that Agree has achieved, with the annualized dividend increase over the past decade coming in at nearly 6%. That may not sound like a huge number, but for a net lease REIT, it is pretty attractive.

Why are investors downbeat on Agree Realty?

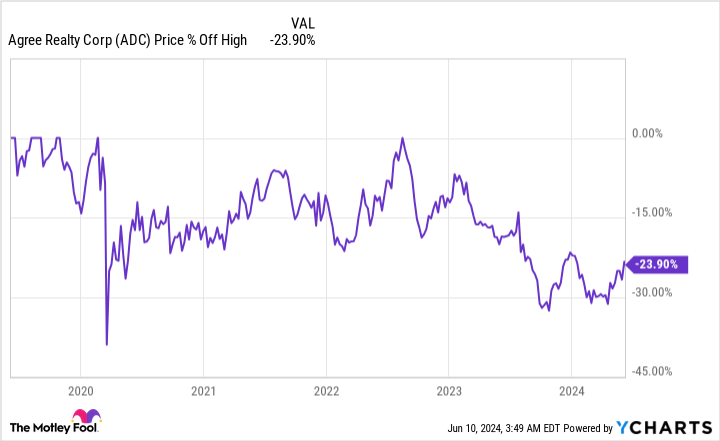

The backstory with Agree is a fairly good one. Then why is the REIT’s share price down around 20% or so from its 2022 highs? Before getting to an explanation, it’s worth highlighting that the price drop has pushed Agree’s dividend yield up to 4.9%, which is the high side of its yield range over the past decade. It looks like the stock is on sale.

The good news here is that the problem really isn’t with Agree. The problem is that interest rates have risen dramatically. That increases costs for REITs, which tend to make heavy use of debt to fund property acquisitions. Don’t follow the crowd on Wall Street and get upset — property markets adjust to interest rate changes. It just takes time. If you think in decades and not in days or weeks, Agree should probably be on your wish list if dividend growth is your focus.

Agree is not dead money

Although Agree is facing a more difficult operating environment, it still bought 31 properties in the first quarter of 2024 and completed two development projects. It also has 14 development projects in the works. In other words, Agree is still finding ways to grow. So not only are you buying a REIT that appears to be on sale, you get to collect an attractive dividend yield from a still up-and-coming net lease company.

When the property market balances out, Wall Street will probably start to appreciate what is likely to be a very long runway for growth here. Note that the largest company in the sector owns more than 15,000 properties.

Should you invest $1,000 in Agree Realty right now?

Before you buy stock in Agree Realty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Agree Realty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 20% to Buy and Hold Forever was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel