Enterprise Products Partners (NYSE: EPD) is the kind of income stock that even the most conservative investors will fall in love with. The list of positives includes a conservative business model in a highly volatile sector, a large yield, and a strong financial foundation.

If that sounds good to you, here’s a closer look at each point as it relates to this vitally important midstream energy company.

1. Enterprise Products Partners is boring

Oil and natural gas prices can become pretty exciting at times, as both are frequently subject to massive and rapid swings. Given the impact of the commodities’ prices on the financial performance of energy producers, the energy sector as a whole is generally viewed as volatile.

But there’s one niche that operates in a very different manner: the midstream sector. This is where Enterprise Products Partners operates.

Midstream players like Enterprise own pipelines, along with storage and transportation infrastructure. These are vital assets that connect the upstream sector (drilling) to the downstream (refining and chemicals) and to the rest of the world.

Midstream companies generally charge fees for the use of their assets, making them toll-taker businesses. That means that energy demand is more important than energy prices to financial performance at Enterprise. And energy demand tends to be robust even when energy prices are low.

Enterprise isn’t exciting — it just helps move oil and natural gas around — and that’s going to be a huge plus for investors who like consistency.

2. Enterprise has a big, reliable yield

As a master limited partnership (MLP), Enterprise is specifically designed to pass income on to unitholders. So a high yield shouldn’t be shocking, per se. But its 7.2% yield will still be very compelling for income-focused investors.

Compare that figure to the yield from the S&P 500 index, which is a scant 1.3%. Or to the broader energy sector, which is yielding around 3.1% using Energy Select Sector SPDR Fund as an industry proxy. It is hard to beat Enterprise Products Partners if you are looking for passive income in the energy sector.

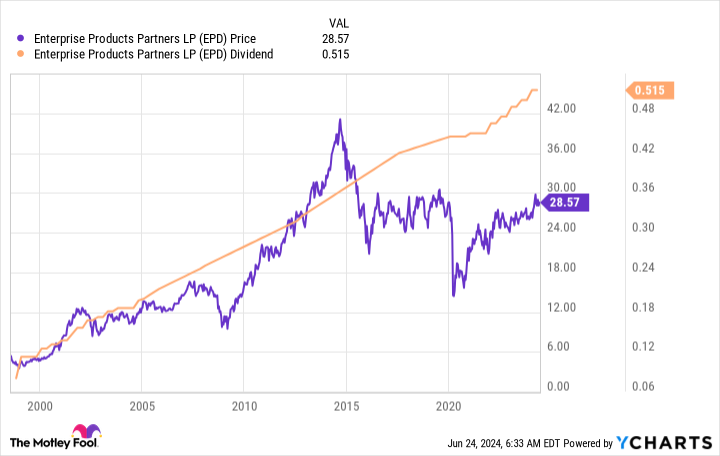

And there’s another very attractive fact here: The company has increased its distribution each year for 25 consecutive years. The annualized growth of the distribution has averaged 7%, which is pretty impressive.

To be clear, more-recent increases haven’t lived up to that figure, so investors should go in only expecting mid-single-digit hikes. But the real story is the lofty yield, not lofty distribution growth. Yield will, in the end, make up the lion’s share of an investor’s return.

3. Enterprise has a rock-solid financial foundation

Of course, the yield is only as good as the distribution is strong. And luckily, Enterprise scores very well on financial strength. The long streak of annual distribution increases speaks to that strength, but there are more direct ways to assess the financial foundation here.

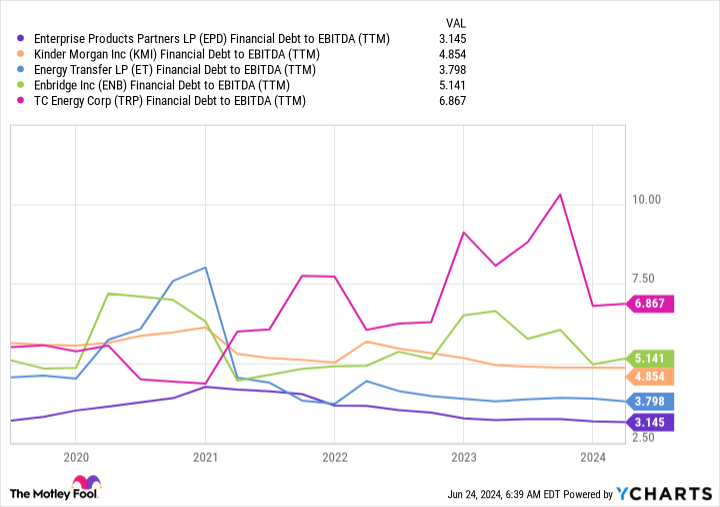

For starters, the balance sheet is rated investment grade. It maintained its leverage at the low end of its peers. Its debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio, a key leverage metric in the midstream space, has been an industry best for some time.

And, more to the point, the company’s distributable cash flow covers its distribution 1.7 times over. There is a lot of room for adversity here before that distribution would be at risk of being cut.

A great option for income investors

There are always trade-offs when it comes to investing. With Enterprise, the biggest one is going to be low growth.

But if your goal is generating a reliable passive income stream, then you will probably look at Enterprise and want to buy it like there’s no tomorrow. Of course, you shouldn’t own only Enterprise, and it should be viewed as one part of a larger, diversified portfolio. But it is, really, every bit as good as it seems if you are trying to find reliable income stocks.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 Reasons to Buy Enterprise Products Partners Like There’s No Tomorrow was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel