(Bloomberg) — French antitrust enforcers are preparing to charge Nvidia Corp. with allegedly anticompetitive practices, Reuters reported, as the world’s most valuable chipmaker faces mounting regulatory scrutiny.

Most Read from Bloomberg

The French agency would be the world’s first to take such a step, Reuters said, citing unidentified people with direct knowledge of the matter. The charge sheet — or statement of objections — would follow a raid of Nvidia offices last year.

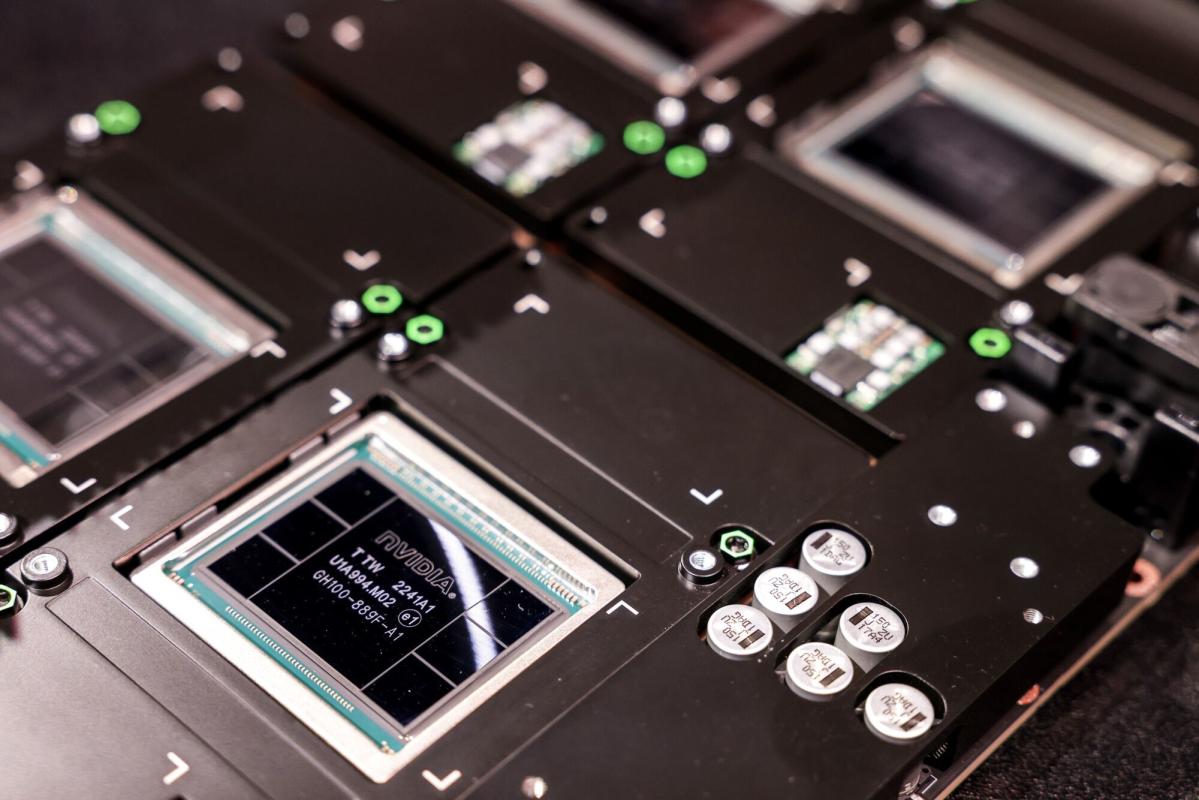

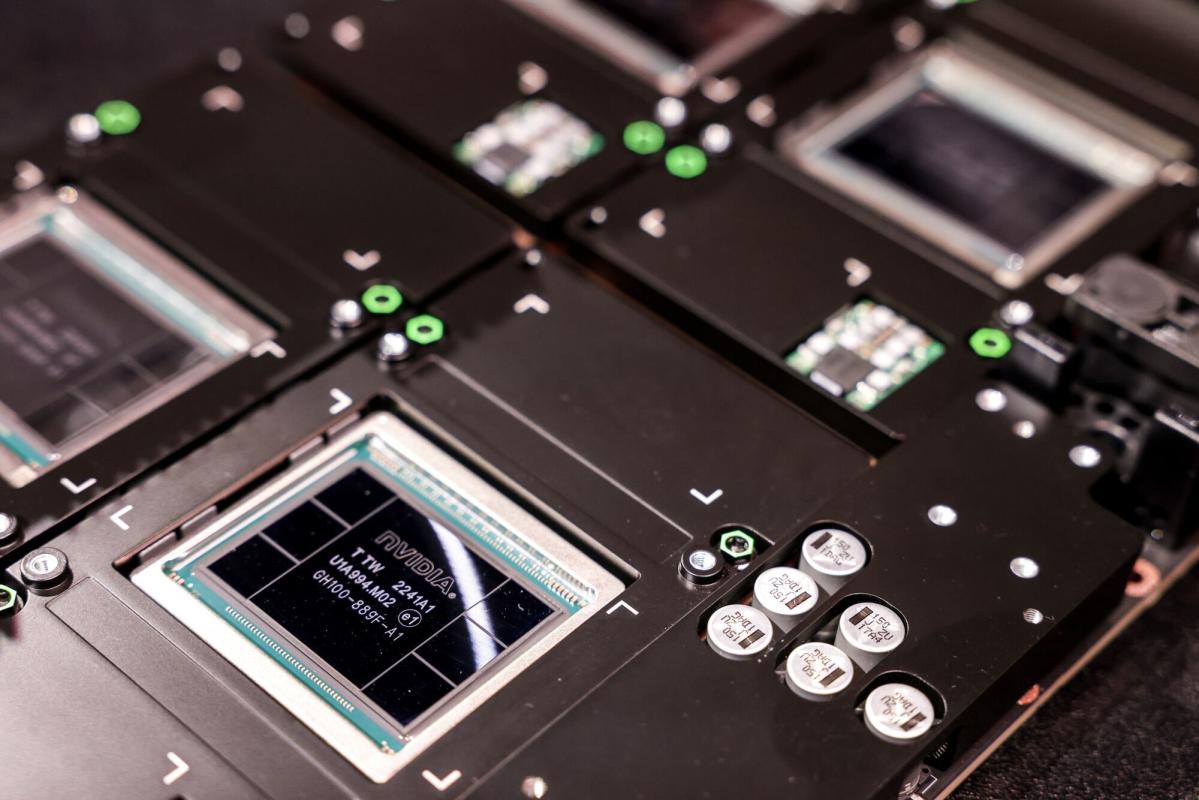

Nvidia has drawn the attention of regulators since becoming the biggest beneficiary of the artificial intelligence spending boom. Its chips — known as graphics processing units, or GPUs — are prized by data center operators for their ability to crunch the massive amount of information required to develop AI models.

The French antitrust agency declined to comment to Bloomberg, as did Santa Clara, California-based Nvidia.

Nvidia shares slipped as much as 3.8% on Monday in New York before mostly recovering. They have more than doubled this year, pushing the company’s valuation above $3 trillion.

In September, French antitrust enforcers raided the offices of a business suspected of engaging in “anticompetitive practices in the graphics cards sector.” They didn’t identify the company as Nvidia at the time, but the chipmaker has since acknowledged that France and other entities are examining its business practices.

Officials in the US, European Union, China and the UK are also scrutinizing its operations, Nvidia said in a filing in February.

“Our position in markets relating to AI has led to increased interest in our business from regulators worldwide,” the chipmaker said at the time.

French antitrust watchdogs have been interviewing market players on Nvidia’s key role in AI processors, its pricing policy, the shortage of chips and the impact on prices. The office raid was aimed at gleaning more information on potential abuses of dominance.

Fines for breaching France’s antitrust law can be as high as 10% of a company’s global annual revenue. The agency lists a €1.24 billion ($1.33 billion) fine from 2020 as its largest since 2011. Of that, €1.1 billion was imposed on Apple Inc., while the rest was levied against two distributors.

In Brussels, the European Commission has been informally gathering views on whether Nvidia may have also run afoul of its own antitrust rules, but it has yet to launch a formal probe into anticompetitive conduct.

In November, French Finance Minister Bruno Le Maire said that Nvidia’s dominance was causing “growing inequalities” between countries and stifling fair competition. He said that 92% of GPUs are from Nvidia.

“If you want to have fair competition, you need to have many private companies and not one single company having the possibility of selling all the devices,” Le Maire said.

–With assistance from Mackenzie Hawkins and Alan Katz.

(Updates with more on raid starting in sixth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel