Our call of the day from Beth Kindig, the lead tech analyst at the I/O Fund, who says investors are overlooking a hidden gem among the AI kingmakers.

Kindig and her firm have a history of prescient calls. She predicted in August 2021 that Nvidia’s NVDA valuation would surpass Apple’s by 2025. That briefly happened a week ago, and Nvidia continues to nip at the heels of the iPhone maker.

Most Read from MarketWatch

In a chat with Real Vision that published Wednesday, the analyst touched on another of her predictions, that Nvidia is headed for a $10 trillion market cap by 2030. That would mean a return of over 250% by 2030, she said.

“In my world, that’s not as impressive as what I’m potentially seeing in other stocks,” said Kindig, adding that while the potential of Nvidia is clearly very strong, rival AMD AMD is looking at far higher returns.

As for how this plays out, Kindig expects “nice movement by 2027” on AMD, of which Wall Street has some differing opinions. Morgan Stanley recently downgraded AMD, saying investor expectations are running way too high for what it can deliver on AI, while others have argued the tech company deserves more attention.

Up 152% so far this year, Nvidia stock is crushing AMD’s 8.7% gain.

Kindig flags a big hurdle for AMD — that Nvidia has 98% of the GPU market (a graphics processing unit is a chip that has been around awhile, and now vital for machine learning) because of its highly advanced CUDA programming platform that developers prefer.

She says it’s here that they think AMD can find its “niche,” explaining that where an AMD GPU costs around $10,000 to $15,000, Nvidia’s costs $30,000 to $40,000. And that may appeal to some big tech companies looking to save a bit of money, though enterprise and smaller companies probably have no choice but to go with Nvidia, she adds.

What she wants to see is “AMD finding that niche … potentially giving that lower total cost of ownership to big tech companies with these massive capex budgets to where they’ll have their own engineers work with AMD GPUs no matter what. Because they can design that custom silicon already, they can definitely work with AMD GPUs,” she said.

The analyst touched on other AI-related stocks, such as Dell DELL, whose shares took a hit recently after earnings showed soaring AI demand, but raised concerns it isn’t making enough on its AI servers.

Kindig said Dell is a “great company to keep an eye on.”

She explains that rival Super Micro SMCI, which also makes AI servers, is nearly at production capacity.

“Dell is very, very large company, even though they have thin margins, operating at such large scale means that you just have more cash, you have more earnings power… so Super Micro now needs to go out and raise more cash,” she said.

And markets are getting sensitive to companies that need to raise cash right now because of the wariness around anyone or any big company needing to borrow money.

While Super Micro is an “awesome” company, Kindig said she owned it last year and has closed that position and moved onto Dell. “Where will Nvidia or AMD go after Super Micro hits production capacity? Our guess is Dell.”

Best of the web

I spent a week on China’s versions of E-Trade. Here’s what I found.

Microsoft’s Nadella is building an AI empire. OpenAI was just the first step.

Deadly and wildly profitable, uranium fever breaks out

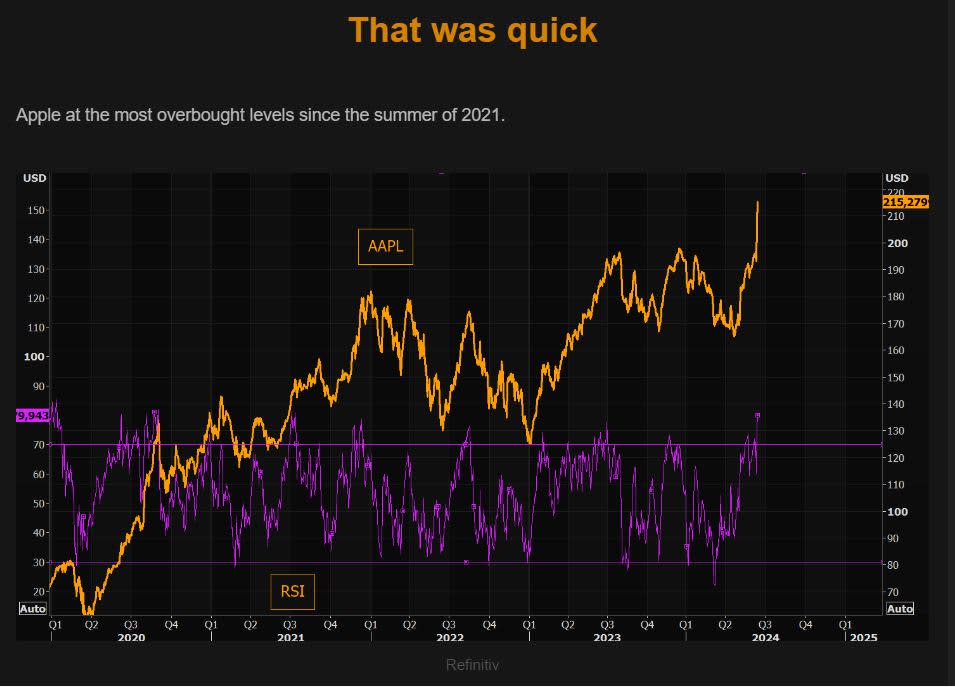

The chart

Apple stock AAPLis at its most overbought since 2021, says this Refinitiv chart provided by The Market Ear Blog, which also highlighted Goldman Sachs data showing mutual funds had been running large Apple underweights. That means they likely missed the jump in shares following Apple’s AI strategy revealed at a WWDC keynote address, though that run has lost some steam.

Random reads

The original NBA logo model? Mystery solved.

The vengeful, car-eating bear.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel