The world’s largest e-commerce company, Amazon (NASDAQ: AMZN), kicked off summer by announcing that it’s kicking plastic to the curb. By the end of this year, the company hopes to replace 95% of the plastic pillows in its packages with paper fillers. The company’s press release says this move “[w]ill avoid nearly 15 billion plastic air pillows annually.”

Many people likely processed this announcement simply by thinking about the environmental implications. But as an investor, my thoughts immediately went to something else: That’s a lot of plastic pillows to replace with paper. And I wondered if there was a company that could profit from this decision from Amazon.

In fact, there is. Ranpak Holdings (NYSE: PACK) is a company that few investors have ever heard of. But it could find itself as a sudden beneficiary of Amazon’s abrupt move.

Ranpak is a surprisingly strong business

Ranpak sells machines for filling, wrapping, and cushioning packages. It also sells consumable paper products for these machines. As of the first quarter of 2024, the company had 141,000 machines placed with various businesses. And as these businesses use their machines, they eventually go back to Ranpak when they need more paper.

According to certain investor presentations, Amazon is already a customer of Ranpak, although it’s unclear how big a customer it is. Craig-Hallum analyst Greg Palm says that Amazon is Ranpak’s largest direct customer, according to The Fly. But this isn’t explicitly stated in Ranpak’s annual filings.

That said, 30% of Ranpak’s revenue in 2023 came from e-commerce companies. This is important to keep in mind. The company also says that 11% of revenue comes from direct customer purchases, whereas the rest comes through its distributor business model. So this is the ballpark of how big Amazon could be for Ranpak.

Ranpak won’t necessarily blow you away with growth or profit margins. But there is a certain strength to its model. Once businesses buy its machines, they have incentive to keep using them. And as they consume the paper products, they need to replenish supplies from Ranpak. This is a form of recurring revenue, which is good. The company doesn’t break out these financials, but it does say that its consumables are “high margin.”

What could happen after Amazon’s big move?

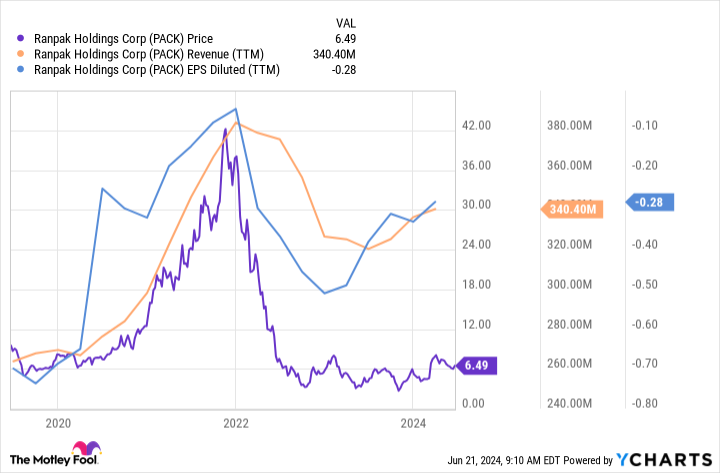

Ranpak went public with a special purpose acquisition company (SPAC) — the deal was complete in 2019. Therefore, it’s traded under its current ticker symbol for almost five years. As the chart below shows, revenue growth and earnings per share (EPS) progress have been better than the stock’s performance.

Ranpak’s revenue and profits could be on the cusp of getting a bigger boost as Amazon moves to replace 15 billion plastic pillows with paper. Ranpak won’t necessarily be Amazon’s only supplier, but the boost to its business could be meaningful. Moreover, the boost to profitability could be even more pronounced, since management says that consumable paper products are higher-margin.

Additionally, Craig-Hallum’s Palm theorizes that Amazon’s decision could send ripples throughout the e-commerce space. More businesses could similarly move away from plastic in the coming months, following the leader in the industry. Since 30% of its revenue comes from e-commerce companies, this secondary ripple effect could be an ever-bigger deal for Ranpak.

I’ve avoided giving concrete numbers when it comes to the potential benefit to Ranpak, because investors simply don’t have enough information to be that precise. There are plenty of unanswered questions.

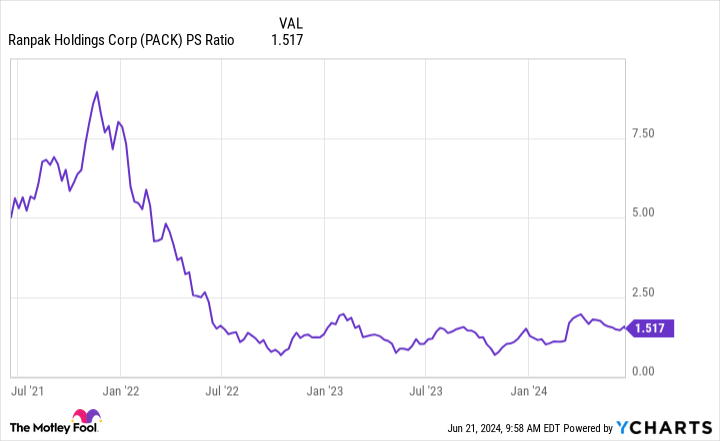

However, here are some encouraging things for investors to keep in mind with Ranpak today. First, the stock is reasonably priced. As of this writing, it has a price-to-sales (P/S) ratio of about 1.5 — that’s typical for a low-growth business.

Investors don’t have to pay up for Ranpak stock — the valuation is reasonable.

The other important thing to keep in mind is that Ranpak is a low-risk investment, in my opinion. Since there is a recurring-revenue element to its business, financial results are consistent. It’s unreasonable to be worried about something suddenly changing and putting the business in jeopardy.

In other words, if Amazon’s move toward paper doesn’t provide a benefit, Ranpak’s business should continue along as it is now. The stock won’t necessarily rise. But I wouldn’t expect things to go south.

However, if Amazon’s move toward paper does provide a benefit, the positive effect for Ranpak could be large. Moreover, if other e-commerce companies follow Amazon’s lead, Ranpak’s financial results could really soar.

I don’t believe the market is pricing in this potential upside with Ranpak stock today, which is why this is an interesting opportunity. It won’t make many headlines. But this could be an under-the-radar way to profit from Amazon’s packaging announcement.

Should you invest $1,000 in Ranpak right now?

Before you buy stock in Ranpak, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ranpak wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

Amazon Is Ditching Plastic and Moving to Paper Fillers. Here’s the Hidden Small-Cap Stock That Could Soar as a Result. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel