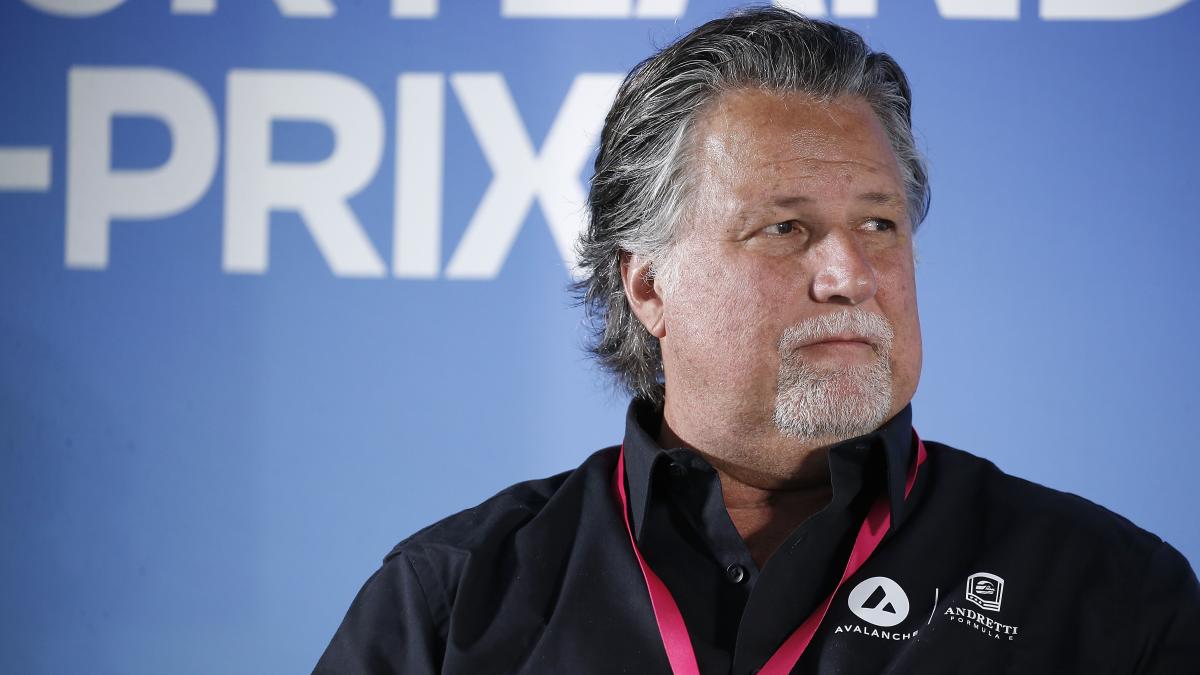

(Bloomberg) — Artificial intelligence startup Zapata Computing Holdings Inc. plunged 58% in its debut after a merger with former IndyCar driver Michael Andretti’s blank-check firm brought the company public, despite the vast majority of public investors bailing on the deal.

Most Read from Bloomberg

Shares of Zapata AI, as the Boston-based company is known, slumped to $5.70 each on Monday on the Nasdaq in its first trading day after completing the deal with Andretti Acquisition Corp. The stock’s decline continues a recent trend of volatility for firms that went public via special-purpose acquisition company as the majority of investors pulled their cash from the deal.

The vast majority of the SPAC shares were redeemed, meaning the infusion for Zapata was far more modest than the $230 million that the blank-check vehicle raised in its 2022 IPO, filings show. A growing portion of investors choosing to take their original investment back is among the issues plaguing the SPAC market, with completed deals over the past year seeing a median 96% of shares redeemed, SPAC Research data analyzed by Bloomberg News show.

The company makes generative AI and optimization software for industry, such as its Sensor Intelligence Platform which is designed to invest and process live streaming sensor data, according to a press release. Its clients have included Sumitomo Mitsui Trust Bank, Banco Bilbao Vizcaya Argentaria SA and BP Plc, the release shows.

Zapata’s debut had lingered for more than six weeks since shareholders approved the deal in February, which finally closed last week, giving it a pro-forma enterprise value of $331 million at the $10 per share level where Andretti Acquisition went public. Between the day of the investor vote and Thursday’s close, the stock swung as low as $7.60 and as high as $18.50.

In preparation for the hefty redemptions, Zapata struck pacts including a deal with Lincoln Park Capital Fund LLC to bolster its balance sheet as needed and to increase the stock’s liquidity, according to Christopher Savoie, chief executive officer of Zapata. The company also unveiled a forward purchase agreement with Sandia Investment Management LP to buy shares.

Being public also enables Zapata to use a range of options to raise needed cash as it grows and competes in what Savoie called a “global talent war.”

“There are different mechanisms for raising capital available to us that wouldn’t be available to a private company,” Savoie said in an interview. “For a private company you either get your VC round or you don’t. Fortunately, in the public markets there are a lot of other things because you have liquid currency.”

Andretti entered a crowded SPAC world in 2022 when the go-go days had already begun to fade. The completed deal was among a handful to close last month, with newly public companies often spiraling as investors balk at the agreed-upon valuations. The main outlier is Donald Trump’s media company, which has surged this year.

(Updates throughout with closing price.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email [email protected] Follow our WhatsApp verified Channel