If you believe its hype, artificial intelligence (AI) is one of the most profound advances in technology ever. This may be hyperbole — time will tell — but it’s clear already that the technology has commercial power. Its impact in the market has been enormous, with its champion, Nvidia (NASDAQ: NVDA), joining Apple and Microsoft as among the biggest companies in the world.

Nvidia’s rise led to the company splitting its stock 10-for-1, opening the door to more investors who were priced out. Now another company working in AI is splitting its stock, too. Broadcom (NASDAQ: AVGO), which designs, manufactures, and sells hardware and network infrastructure that allows AI programs to run, will split its stock later this summer.

So let’s consider: Could Broadcom deliver the sort of returns Nvidia has?

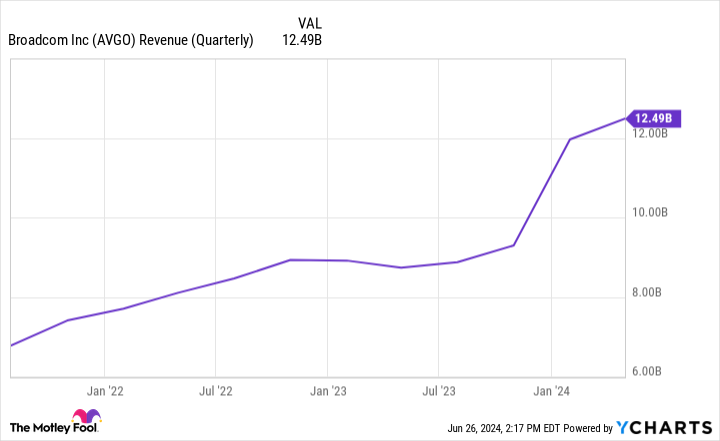

Revenue growth has been impressive, but it’s inflated by a major acquisition

Broadcom is in growth mode, having raised Q1 revenue by 34% from the year before Q2 revenue by 43% from Q2 2023.

Notice the massive recent increase? That late-2023 inflection point is important. This growth isn’t really organic — much of it is coming from an acquisition. The company bought VMware, a highly successful cloud software company, in November 2023 for $69 billion, adding its revenue to Broadcom’s.

Excluding this additional income from VMware, the company grew Q2 revenue by 12% on a year-over-year basis, not quite as eye-watering as the headline-catching 43%.

Looking at future earnings, the company looks reasonably valued

Still, 12% organic growth is nothing to shake a stick at and reflects Broadcom’s growing AI-focused business. Communication within the AI server farms that power platforms like ChatGPT is a crucial aspect and is where Broadcom shines. Its PCIe and Ethernet technology is some of the best on the market. This made its products popular.

Hock Tan, Broadcom president and CEO, stated in the company’s latest earnings release that “revenue from our AI products was a record $3.1 billion during the quarter.” The combo of a growing AI business and a solid acquisition means that the company expects to continue delivering record revenues. It raised its guidance for this year to $51 billion in revenue, up 42% from 2023.

So what does this mean for how fairly valued the company is? If we look at its forward P/E, the company looks pretty solid at about 34. That’s in line with much of big tech and is significantly lower than Nvidia’s 48.

Broadcom is a solid company, but it’ll have trouble rivaling Nvidia

Broadcom’s growth prospects, while promising, just aren’t comparable to Nvidia’s, in my opinion. Nvidia is growing revenue at a pace that far outstrips Broadcom and doing it organically, not relying on costly acquisitions. Consensus estimates have Nvidia delivering more than twice the revenue growth of Broadcom by the end of this fiscal year and again next year.

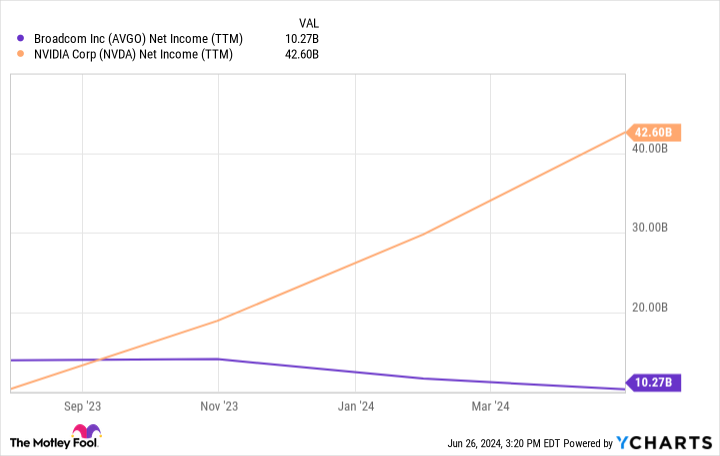

And this disparity will be even greater in looking at net income. Look at the difference over the last year.

It’s not just the acquisition affecting this. Nvidia expects to operate with roughly 20% better margins this year than Broadcom.

Aside from the numbers, Nvidia demonstrated immense vision as a pioneer in AI. While difficult to quantify, I think visionary leadership is an factor that can’t be underestimated. As the industry matures and competition heats up, Nvidia’s leadership may help it maintain its top position.

At the end of the day, however, Broadcom is still a good investment with a solid track record and optimistic prospects. Is it the next Nvidia? I don’t think so, but it doesn’t need to be.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Another Artificial Intelligence (AI) Stock Split Is Coming. Could Broadcom Be the Next Nvidia? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel