Over the last year, serial entrepreneur Elon Musk and semiconductor company Nvidia (NASDAQ: NVDA) have become staples in financial headlines. Rarely, however, have the two names been mentioned together — until now.

Just days ago, Musk’s artificial intelligence (AI) start-up, called xAI, closed on a $6 billion financing round. xAI is building a large language model (LLM) called Grok that aims to compete with OpenAI’s ChatGPT.

Following the announcement, several media outlets reported that a portion of the funding would be used to purchase 100,000 Nvidia H100 graphics processing units (GPUs) to build a supercomputer.

Let’s dig into this story a bit more and uncover why it’s such great news for Nvidia investors.

What is xAI doing?

There are a number of LLMs on the market right now. Besides ChatGPT, some of the more well-known models include Llama from Meta Platforms, Claude from Amazon, and Gemini from Alphabet.

These generative AI models are capable of answering questions based on a prompt, analyzing images, and even assessing pertinent information from documents. Moreover, big tech is making a conscious effort to infuse generative AI into its various products, including social media, e-commerce, cloud computing, cybersecurity, and more.

In a way, LLMs are already becoming a little commoditized. It’s hard to find major differences among the competition, and the introduction of yet another LLM model only floods the landscape.

xAI’s company mission statement is “to understand the true nature of the universe.” On the surface, this looks like an overly philosophical and ambitious goal. However, as is often the case with Musk, there’s a tongue-in-cheek reference to xAI’s mission: Namely, it’s a nod to the acclaimed science fiction novel The Hitchhiker’s Guide to the Galaxy.

How big of an opportunity is this for Nvidia?

Musk has great respect for Nvidia. Tesla, one of his other companies, currently uses supercomputers with Nvidia H100 chips to train autonomous driving software for its cars.

It is important to understand that demand for Nvidia’s chips is so high that the company has faced some supply constraints over the last year. The disparity between limited supply and strong demand has led to a pricing surge for Nvidia’s chips.

While exact prices vary, it is estimated that Nvidia H100 GPUs can fetch upwards of $40,000 per chip. Using this as a proxy, xAI’s planned purchase of 100,000 chips would equate to $4 billion.

I wouldn’t get too bogged down in the finer details. The main idea here is that Musk continues to choose Nvidia to power the most important products for his businesses. I see this as a major source of validation. Furthermore, Nvidia’s deployment in Musk’s high-profile start-up only adds to its existing and expanding footprint over the competition.

Should investors buy Nvidia stock right now?

The development around xAI does not inherently make Nvidia stock a buy. As is the case with breaking news and its influence, shares of Nvidia popped nearly 8% in the day following the xAI story.

Instead of focusing on just one new positive narrative, I’d encourage investors to zoom out and look at the bigger picture. Over the last year, Nvidia’s revenue has soared, but more importantly, the company has grown in a profitable way.

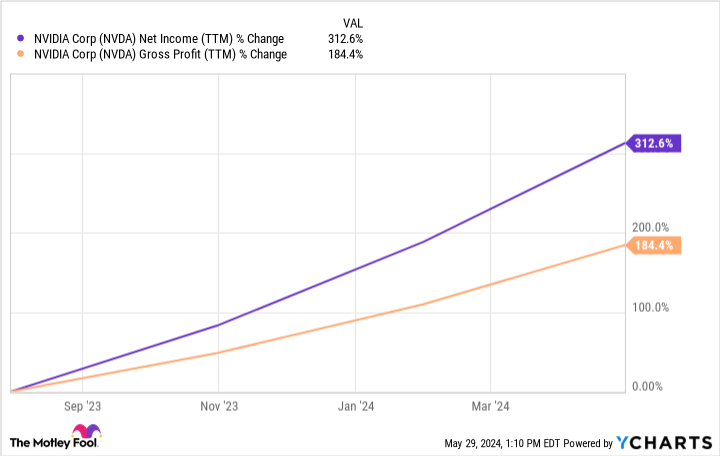

The chart above shows that Nvidia’s gross profit has increased just below 200% over the last 12 months. Moreover, during this same period, the company’s net income has tripled. You might think Nvidia’s stock price has followed these growth rates in lockstep, but that is not the case.

Over the last year, shares of Nvidia have risen 189% as of this article’s publication. As depicted in the chart below, Nvidia’s current price-to-earnings (P/E) multiple is actually considerably lower than a year ago.

In other words, Nvidia’s earnings are accelerating faster than the stock price. While a P/E of 66 isn’t exactly dirt cheap, the trends from the chart above suggest that Nvidia is more reasonably valued today than it was even just one year ago.

I see the relationship with xAI as a piece of a large puzzle. Namely, the secular tailwinds fueling AI are very much real, and for now, Nvidia is leading the pack compared to other chipmakers.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $677,040!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Elon Musk Just Gave Nvidia Investors 100,000 Reasons to Cheer was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel