Semiconductors are a core pillar in the emerging artificial intelligence (AI) revolution. Yet the chip space is largely dominated by just two players: Nvidia and Advanced Micro Devices.

However, other companies are beginning to make inroads in the industry as well. Qualcomm (NASDAQ: QCOM) has spent the last several months instituting new cost reduction policies while simultaneously combatting its larger cohorts in the chip space.

The company just reported earnings for its second fiscal quarter — ended March 24. While Qualcomm is still in turnaround mode, the earnings report was encouraging and could shed light on where the company is headed.

Let’s dig into Qualcomm’s business and assess if the stock looks like a good buy right now.

Qualcomm has had a bumpy ride

Over the last year, demand for semiconductor chips has risen sharply.

Nvidia has been the biggest beneficiary of this trend, as the company witnessed over 120% revenue growth in 2023. What’s even more impressive is Nvidia’s compute and networking segment grew by more than 200% last year. The upswings are largely driven by unprecedented demand for Nvidia’s A100 and H100 graphics processing units (GPUs).

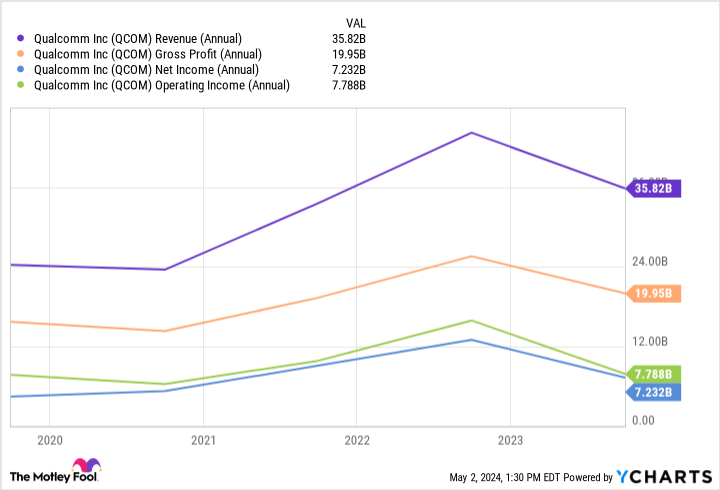

Unfortunately, this same growth narrative doesn’t apply to Qualcomm. The chart below illustrates some of the financial and operating trends for Qualcomm during 2023.

Clearly, the company’s revenue and operating margin profiles have taken a step back compared to prior periods.

Last year, sales from Qualcomm’s handsets and Internet of Things (IoT) businesses declined 22% and 19%, respectively. Management attributed these declines to a challenging macroeconomic environment.

However, since the company’s fiscal year-end in September, Qualcomm has quietly been turning its operation around. Let’s unpack the last couple of quarters and assess the moves the company is making.

The turnaround story could finally be unfolding

The last couple of quarters have shown some encouraging progress for Qualcomm investors. The table below illustrates that the company has handily beaten its revenue and earnings guidance for two consecutive quarters.

Metric | Q1 2024 Actual | Q1 2024 Forecast | Q2 2024 Actual | Q2 2024 Forecast |

|---|---|---|---|---|

Revenue | $9.9 billion | $9.1 billion to $9.9 billion | $9.4 billion | $8.9 billion to $9.7 billion |

Earnings per share (EPS) | $2.46 | $1.82 and $2.02 | $2.06 | $1.73 and $1.93 |

Data source: Qualcomm.

A combination of disciplined cost reductions and strong demand in the company’s handsets business has contributed to the accelerating revenue and profitability.

While this is all nice to see, is it enough to buy Qualcomm stock over its peers in the chip space?

Should you buy Qualcomm stock right now?

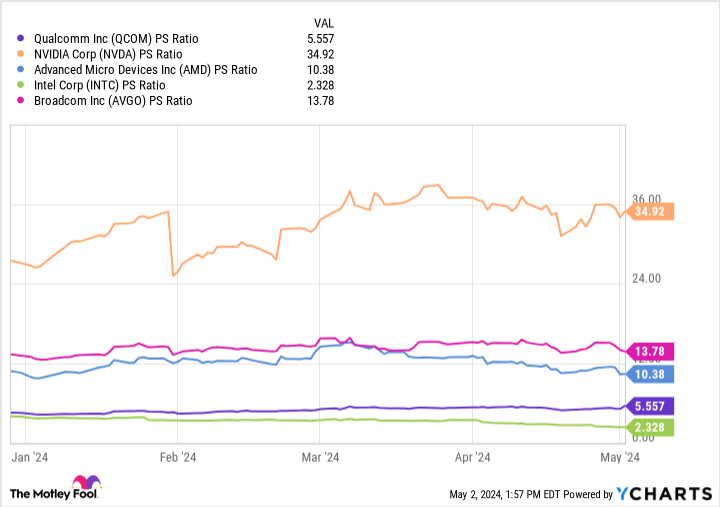

The chart below benchmarks Qualcomm against a peer set of other semiconductor stocks by the price-to-sales (P/S) ratio. At a P/S of just 5.5, Qualcomm is the second-lowest-valued stock in this cohort based on this valuation metric.

QCOM PS Ratio data by YCharts

Considering that shares in Qualcomm have soared 50% in just the last six months, it’s hard to digest the disparity between its valuation multiples compared to the competition.

At a higher level, however, investors should realize that semiconductor stocks in general have enjoyed quite a ride on the backdrop of an evolving AI narrative. For example, shares in the VanEck Semiconductor ETF have risen 48% over the last six months, and are up 77% in the last year.

I see a lot of momentum fueling semiconductor stocks right now. Moreover, I do not see Qualcomm as immune to this activity.

With that said, the company is making good on its outlook and it appears to have found its footing in its turnaround efforts. Prudent investors should continue monitoring the company’s progress, as well as macro factors fueling the chip space in general.

But considering Qualcomm stock is far less pricey compared to peers — even after a big run — I’d say that it is a reasonable buy right now. If anything, it could serve as a hedge to other chip names or AI stocks that you may own and provide an additional layer of diversification to your portfolio.

Should you invest $1,000 in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Qualcomm. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Forget Nvidia: Here’s 1 Other Semiconductor Stock to Buy Instead was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel