Bubbles have a lot in common, and not just the obvious, that asset prices rise well ahead of what fundamentals would suggest.

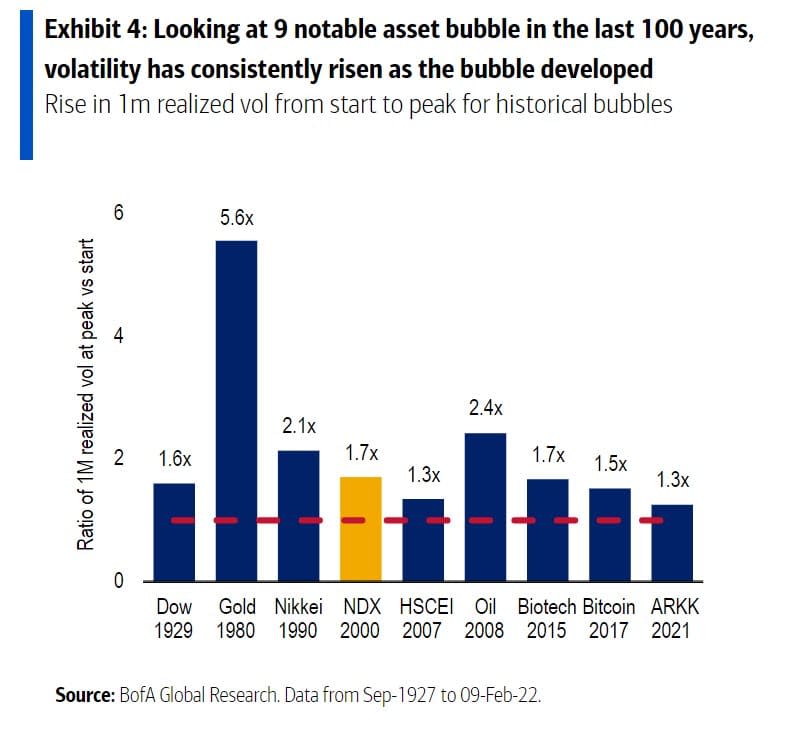

Analysts at Bank of America looked at nine asset bubbles over the last 100 years — from the Dow DJIA on the eve of the Great Depression to the rally in the ARK Innovation ARKK fund in 2021. What they all had in common was that volatility rose as the bubble developed.

Most Read from MarketWatch

If that history still holds, investors shouldn’t be worried about a bubble just yet. The popular CBOE volatility index VIX is at a low reading of 12.95.

“Based on volatility, valuation and returns, it looks closer to 1995 today than 1999,” said Bank of America derivatives analysts led by Benjamin Bowler.

That said, some unusual things are happening. Nasdaq 100 NDX stocks are exhibiting greater “panic” in rallies than sell-offs, which they say is historically unusual behavior. Equity momentum earlier in the year reached near 100-year records.

What they call fragility events — dividing a stock’s one-day return by its 21-day trailing volatility — are on pace for their highest frequency from tech stocks over the past 30 years.

That’s especially so for megacap tech stocks like Nvidia NVDA, Alphabet GOOGL and Meta Platforms META, which they say highlights the uncertainty in estimating the value of technological disruption.

“[Bubbles] may be hard to avoid given the likely significant but unclear way in which AI will impact the global economy, not dissimilar to the internet in the ’90s or railroads in 1840s Britain. The dominance of price momentum, investors remaining believers in buying equity dips, and meme stock popularity only add to the potential for irrationality,” they say.

GameStop GME this week surged after the investor most associated with its rally, Keith Gill, posted a screenshot of his holdings.

Read more: One theory on how Roaring Kitty amassed such a giant GameStop position

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel