From its spinoff from eBay in 2015 to April of this year, I was a boring buy-and-hold investor of PayPal Holdings (NASDAQ: PYPL) — I acquired my position in 2015 and then I never bought or sold a single share for nearly 10 years. However, I finally sold my PayPal position because I believed that there were better opportunities elsewhere.

It took roughly one month for me to start second-guessing my decision to sell PayPal. On one hand, I expected to feel some regret — PayPal and I go way back, after all. But on the other hand, I didn’t anticipate that the company would finally make a move that gives me more hope for the business than I’ve had in some time.

PayPal just made a move that could catalyze its profits in coming years. And that could be a big deal for investors, considering the stock is as cheap as it’s ever been.

Here’s PayPal’s smooth move

On May 28 — after I sold — PayPal announced that it had hired Mark Grether from Uber Technologies to build an advertising business. And this revelation is immediately making waves in the investing community, for good reason.

PayPal CFO Jamie Miller had this to say about hiring Grether: “He’s got deep experience in the ad space more than 20 years. Really built out Uber’s ad business over the last couple of years. And this is his mission, to build this out for us.”

For perspective, PayPal may be viewed as an over-the-hill financial technology (fintech) company, but it still has one of the largest user bases in the world with 220 million monthly actives. Users access PayPal’s platform more than once a week on average, which provides opportunities for ads.

Not only that — PayPal has tens of millions of merchant customers. So this is really an ideal situation to take the transaction data it has and offer it to merchants for advertising purposes. And this is a high-margin revenue opportunity.

PayPal had roughly $4.6 billion in free cash flow in 2023, and it expects to grow that to around $5 billion in free cash flow in 2024. But if the company could quickly scale an advertising business based on the existing size of its platform today, then its free cash flow could make a much bigger jump in 2025 and beyond.

The stock is priced for a big move higher

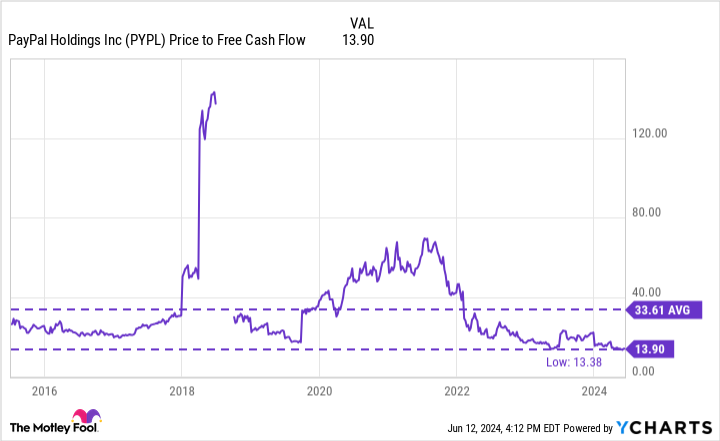

This is all intriguing because PayPal stock trades close to its lowest valuation ever from a free-cash-flow perspective. As the chart below shows, it trades at less than 14 times its free cash flow — a price it’s only dropped to within the past year.

It seems unrealistic to bet that PayPal stock will get much cheaper from here considering it’s already the cheapest it’s ever been. And the low valuation reflects doubts that it can grow its free cash flow meaningfully. But the advertising business could be something that the market isn’t yet factoring into a PayPal investment thesis.

This suggests that PayPal could surprise investors if its free cash flow greatly improves. And if that happens, I’d fully expect the stock to take off as investors start taking note.

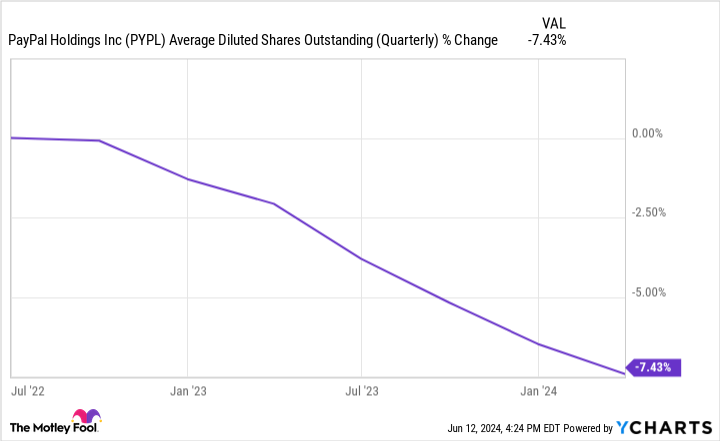

To be clear, I’m saying that if PayPal’s advertising business is successful, then the stock is significantly undervalued today. And PayPal’s management might agree with me that its stock is undervalued. Going into 2024, management planned to spend at least $5 billion to buy back stock. But it’s since clarified further that it now plans to spend more than $5 billion this year. It’s a subtle wording change that could suggest a more aggressive stance.

This buyback would reduce PayPal’s share count and boost shareholder value. And over the last two years, this process has started making a bigger dent than it has in the past because shares have been cheap — the money it uses to buy back stock stretches further. As the chart shows, it’s reduced its share count by 7% in two years, which is meaningful.

The aggressive pace at which PayPal’s management is buying back stock could suggest that it believes its stock is undervalued right now and it wants to take advantage of the cheap share price before it increases.

I’ve already invested the money I received from selling PayPal stock, so I don’t plan to jump right back in after selling less than two months ago. However, I am second-guessing if I made a good choice. I wouldn’t be surprised if PayPal’s ad business was quickly successful and catalyzed a big jump in its stock price.

Should you invest $1,000 in PayPal right now?

Before you buy stock in PayPal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends PayPal and Uber Technologies. The Motley Fool recommends eBay and recommends the following options: short July 2024 $52.50 calls on eBay and short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

I Sold My PayPal Stock in April. I’m Already Second-Guessing That Decision; Here’s Why. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel