Super Micro Computer (NASDAQ: SMCI) had a remarkable year, as the stock nearly tripled. However, it’s down around 35% from its highs, which some investors may see as a buying opportunity.

So, should you scoop up the stock now? Or is it down so much for a good reason?

Super Micro Computer is often compared to a key supplier

Super Micro Computer (often called Supermicro) is a key supplier in the data center industry and is thriving thanks to increased demand for artificial intelligence (AI). This association caused the stock to increase quickly, but also contributed to its volatility.

Supermicro’s business is booming because it specializes in highly customizable servers that can be tailored to workload type and size. As companies rush out to increase their computing power to train AI models, Supermicro is who they turn to.

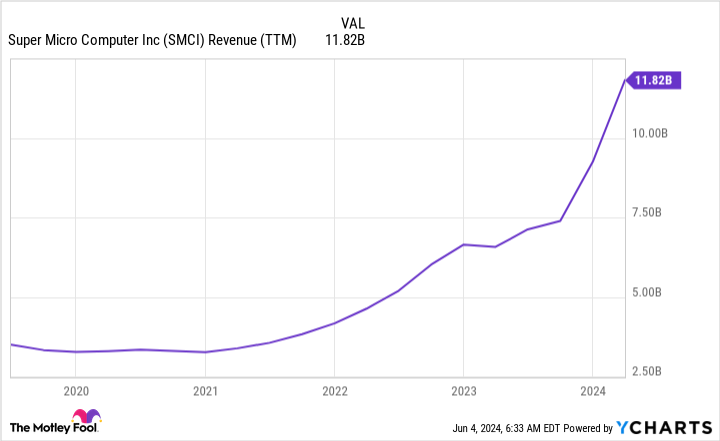

This has shown up in Supermicro’s financials, as its revenue growth has been astounding. In the third quarter of fiscal 2024 (ending March 31), revenue rose 200% year over year to $3.85 billion. However, this figure only increased 5% from Q2’s total. Quarterly comparisons are useful when companies aren’t exposed to seasonal trends, and investors want to see a much larger jump from Q2 results.

Part of this is because Supermicro is being compared to Nvidia, as the two should see similar benefits. Because Nvidia GPUs are placed in Supermicro servers, it would make sense if the growth was roughly equal, but it’s not. In Q1 of fiscal 2025 (ending April 28, a similar time frame to Supermciro’s Q3, but not exact), Nvidia’s revenue rose 18% quarter over quarter.

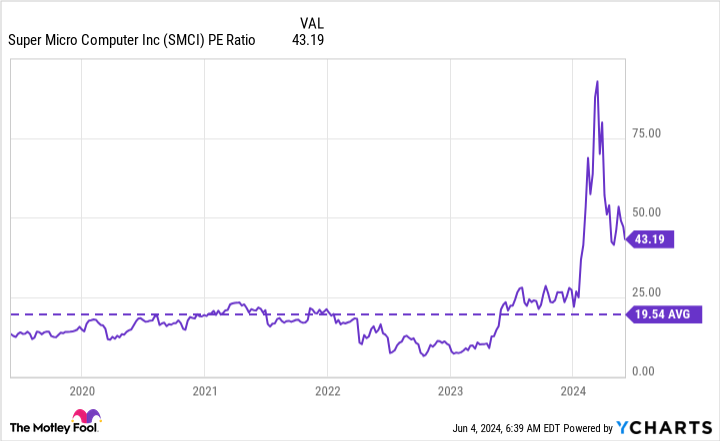

When a company is constantly being compared to Nvidia, living up to those expectations is hard. However, this can be compensated for by the stock’s lower valuation, which has occurred thanks to the significant decline. So, is Super Micro Computer a buy now?

The stock’s valuation doesn’t match management’s projections

There’s no doubt that Supermicro is a successful business and is cashing in on the AI boom. The question becomes whether the stock’s price is worth paying. To determine this, let’s compare management’s long-term goals to current valuation levels.

Management’s long-term goal for Supermicro is to reach $25 billion in recurring annual revenue across all product lines. Currently, its trailing 12-month revenue total is $11.8 billion.

While management doesn’t give a time frame for its goal of $25 billion in revenue, let’s arbitrarily set it at five years. This would require a 16% compound annual growth rate, which seems achievable.

Assuming that Supermicro’s profit margin remains at 10%, it will produce around $2.5 billion in profits once it achieves its revenue goal.

This projection sets the stage for determining whether the price you pay today is reasonable. If you utilize today’s market capitalization (how much the company is worth) and divide it by its projected profits, you get the forward price-to-earnings (P/E) ratio. However, this is a slight modification of the standard P/E, as it uses profits five years into the future.

At a $45 billion market cap, Supermicro currently trades at 18 times projected earnings. Historically, Supermicro has traded around 20 times earnings.

When you have to go five years into the future to get the required earnings just to pay almost the same price tag that the stock has historically traded at, it’s a tell-tale sign of an overvalued stock.

While Supermicro will succeed and grow as a business, the expectations built into the stock are far too high. As a result, I think investors should avoid buying the stock, even if the company will succeed due to the rise of AI.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $750,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Is Super Micro Computer a Top Artificial Intelligence (AI) Stock to Buy Right Now? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel