(Bloomberg) — JD.com Inc. reported a 7% rise in revenue after it slashed prices and ramped up shopper perks to counter fierce market competition and a Chinese downturn.

Most Read from Bloomberg

The Beijing-based retailer said its sales increased to about 260.1 billion yuan ($36 billion) in the March quarter, compared to the average analyst projection for about 258.4 billion yuan. That topline growth accelerated from 3.6% in the previous quarter. Net income rose 13.9% to 7.1 billion yuan.

JD.com’s results are seen as one of the key bellwethers of Chinese consumption, which has struggled to recover since the country lifted nearly three years of Covid curbs. While Chief Executive Officer Sandy Xu predicted that Beijing’s policies would shore up consumer confidence, growth in retail sales slumped in March and industrial output fell short of forecasts, in warning signs for the economy’s recovery this year.

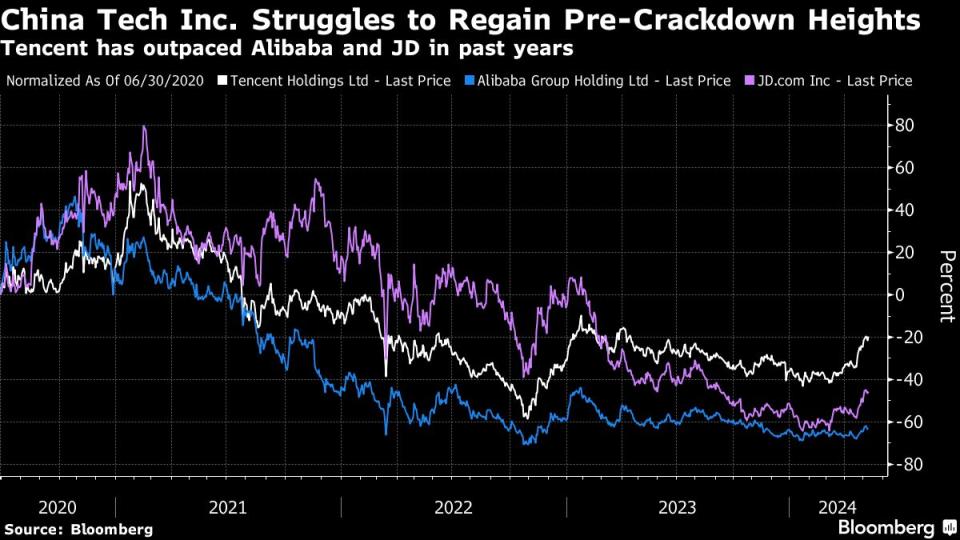

The company in recent months has turned to a discount spree and other perks to fend off stiff competition in China from Alibaba Group Holding Ltd. as well as up-and-comers like PDD Holdings Inc. and ByteDance Ltd. JD nearly doubled salaries to some front-line staff and offered 1 billion yuan in subsidies and rewards to video content creators on its platform. It even trotted out a digital avatar of its billionaire co-founder Richard Liu, hoping his name would juice sales ahead of the June 18 festival, China’s second largest online shopping event.

JD also intensified efforts to expand internationally as domestic consumer sentiment has remained sluggish — including weighing and then scrapping an offer to buy British electronics retailer Currys Plc. It touted its efforts in artificial intelligence with its own proprietary large language model, while following Alibaba with aggressive price reductions for cloud computing services.

What Bloomberg Intelligence Says

JD.com’s 1Q retail-operating margin probably fell year on year for the second straight quarter. Revenue gain may have trailed cost hikes from new perks to merchants and users, such as free delivery services, as well as higher staff salaries amid intense rivalry from Alibaba, Douyin and other retailers. The firm likely incurred more expenses after offering free delivery services to a wider spectrum of third-party merchants and lowering the minimum value of on-demand orders which are entitled to this incentive. JD.com’s new free-returns service in 1Q may have also raised costs.

– Catherine Lim, analyst

As with other Chinese tech firms, JD has stepped up its share repurchase program, It plans to buy back up to $3 billion worth of shares through March 2027. The company’s repurchases jumped sixfold in the first quarter, raising the likelihood of further buybacks this year, Bloomberg Intelligence estimates.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel